English: Click here to read this article in English.

ফান্ডামেন্টাল অ্যানালাইসিস হল একপ্রকার বিশেষ স্টাডি যার মাধ্যমে নির্দিষ্ট বিষয়বস্তুর ওপর ফোকাস করে স্টকের প্রকৃত মান নির্ধারণ করতে পারা সম্ভব | যা কোনও সংস্থার ব্যবসা এবং তার ভবিষ্যতের বৃদ্ধির সম্ভাবনাগুলিকে প্রভাবিত করতে পারে।

ফান্ডামেন্টাল অ্যানালাইসিস আমাদের শিখায় – যে কীভাবে কোনও সংস্থার আর্থিক বিবরণের ( ফিনান্সিয়াল স্টেটমেন্ট ) এর উপর ভিত্তি করে মূল্যায়ন করতে হয় এবং এর থেকে কী ব্যাখ্যা করা যেতে পারে ।

ফিনান্সিয়াল স্টেটমেন্টস গুলি কোনও সংস্থার দীর্ঘায়ু এবং এটির প্রভাবিতকারী উপাদানগুলি পরীক্ষা করার পথ খুঁজে পেতে সহায়তা করে।

এর মধ্যে অর্থনীতি, শিল্প এবং কোম্পানিকে প্রভাবিত করে এমন বিভিন্ন বিষয়ের অধ্যয়ন জড়িত।

ফান্ডামেন্টাল অ্যানালাইসিসের পদক্ষেপ :

- ফান্ডামেন্টাল অ্যানালাইসিসের প্রথম পদক্ষেপে কোনও সংস্থা সম্পর্কে বোঝার জন্য টপ-ডাউন এবং একটি বটম -আপ পদ্ধতি অন্যতম |

টপ-ডাউন পদ্ধতিতে প্রথমে অর্থনীতি বিশ্লেষণ করে তারপরে শিল্প এবং সর্বশেষে কোম্পানির বিশ্লেষণ করা হয়ে থাকে | ওপর দিকে বটম – আপ পদ্ধতিতে প্রথমে কোম্পানি তার পর শিল্প সেক্টর ও সর্বশেষে অর্থনীতিকে বিশ্লেষণ করা হয়

যে ক্ষেত্রে এই তিনটি মূল বিষয়ের পসিটিভ সংযোগ থাকবে সেই ক্ষেত্রে বিনিয়োগের সিদ্ধান্ত নেওয়া যেতে পারে |

- দ্বিতীয় পদক্ষেপটিতে ফিনান্সিয়াল স্টেটমেন্ট এবং ফিনান্সিয়াল রেশিও (অনুপাত) কে ডিকোডিং করা হয়ে থাকে – এই কাজটি কোয়ানটিটিটিভ অ্যাসেসমেন্ট হিসাবেও পরিচিত।

যদি ফিনান্সিয়াল স্টেটমেন্ট – কোম্পানির ভাল প্রবৃদ্ধির দিকে ইঙ্গিত বহন করে এবং ফিনান্সিয়াল রেশিও দক্ষতা – মুনাফা অর্জনে ভাল বৃদ্ধি নির্দেশ করে এবং যদি কোম্পানির স্বচ্ছলতাও মজবুত থাকে তবে আমরা বিনিয়োগের সিদ্ধান্ত নিতে পারি।

| প্রস্তাবিত পড়ার লিংক : How to Analyse Financial Ratios (কীভাবে আর্থিক অনুপাত বিশ্লেষণ করবেন)

- ফান্ডামেন্টাল বিশ্লেষণের সাথে জড়িত তৃতীয় এবং শেষ পদক্ষেপটি ম্যানেজমেন্ট কোয়ালিটির বিশ্লেষণ যা কোয়ালিটিটিভ অ্যাসেসমেন্ট নামে পরিচিত |

সুতরাং এটি আমরা নির্ধারণ করতে পারি – সংস্থার ব্যালেন্স শীট যার ব্যবস্থাপনা আলোচনা রয়েছে এবং অ্যানালাইসিস রিপোর্ট, সংস্থার বিনিয়োগকারীদের উপস্থাপনা,সংস্থা কর্তৃক করা কন কলগুলি, এবং ম্যানেজমেন্টের সাক্ষাৎকার ইত্যাদি যা সংস্থা সম্পর্কে ভবিষ্যতের সম্ভাবনা তৈরি করার জন্য এই সমস্ত অনুবাদ করতে সহায়তা করে।

ফান্ডামেন্টাল অ্যানালাইসিসের লক্ষ্য :

- কোম্পানির আয় এবং মুনাফা বৃদ্ধি পাচ্ছে কিনা এবং তা বৃদ্ধি এবং অবিরত থাকবে কিনা তা নজরদারি করা ।

- ম্যানেজমেন্ট ভুল তথ্য / ডাটা সরবরাহ করে বিভ্ৰান্ত করছে কিনা |

- অভ্যন্তরীণ ব্যববসায়িক সিদ্ধান্তগ্রহণকারী মানাজেমেন্টের মূল্যায়ন করতে |

- এটি কি ভবিষ্যতে তার প্রতিযোগীদের পরাজিত করার পক্ষে দৃঢ় -় পর্যায়ে রয়েছে?

- কোম্পানি / ম্যানেজমেন্ট কি ঋণ পরিশোধ করতে সক্ষম |

- একটি স্টকের অভ্যন্তরীণ মান ( ইন্ট্রিন্সিক ভ্যালু )সন্ধান করতে।

ফান্ডামেন্টাল অ্যানালাইসিস – কেস স্টাডি

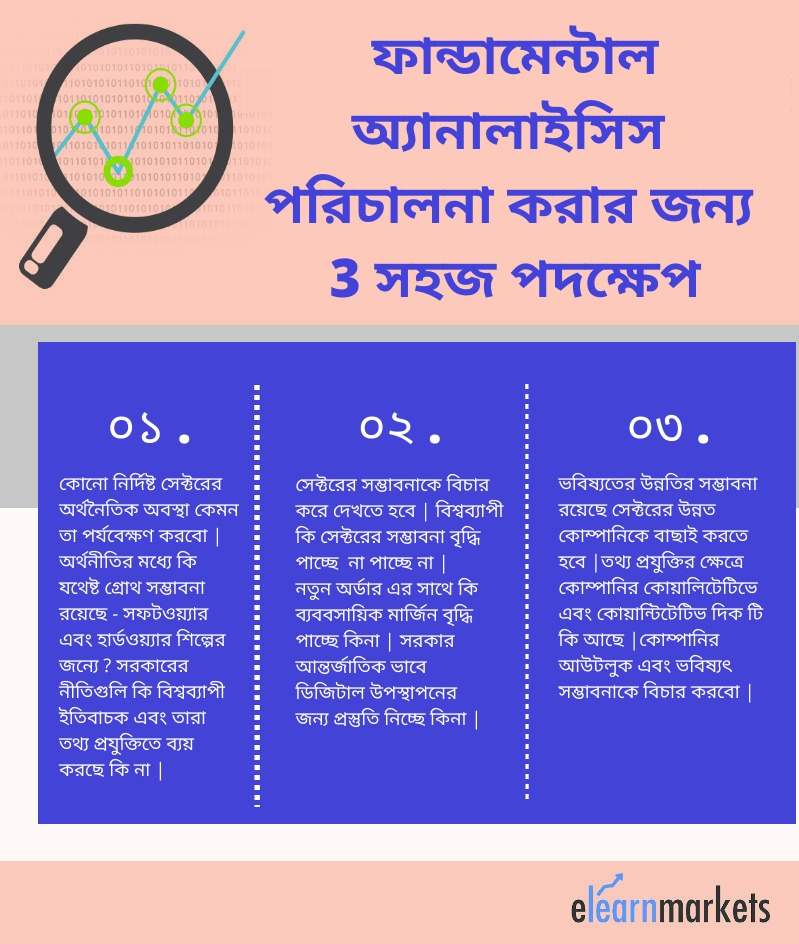

সুতরাং আশাকরি বুঝতে পেরেছেন আমরা একটি তথ্য প্রযুক্তি সংস্থাকে উদাহরণ হিসাবে নিয়েছি :

১. এইভাবে প্রথমে আমরা খাতটির অর্থনৈতিক অবস্থা কেমন তা যাচাই করব।

সফ্টওয়্যার এবং হার্ডওয়্যার শিল্পের জন্য অর্থনীতিতে কী ভাল বিকাশের সম্ভাবনা রয়েছে?

সরকারের নীতিগুলি কি বিশ্বব্যাপী ইতিবাচক এবং তারা তথ্য প্রযুক্তিতে ব্যয় করছে কি না।

সমগ্র বিশ্বে ভারতবর্ষ শীর্ষস্থানীয় I.T ( তথ্য প্রযুক্তি ), সোর্সিং গন্তব্য , I.T পরিষেবাগুলির জন্য বাজারের প্রায় ৫৫ শতাংশ মার্কেট শেয়ার ভারতের দখলে রয়েছে |

২. এর পরে, আমরা সেক্টর সম্ভাব্যতা যাচাই করব:

বিশ্বজুড়ে সেক্টর সম্ভাবনা বৃদ্ধি হচ্ছে কি না। সেক্টর কি অর্ডার এবং ক্রমবর্ধমান ব্যবসায়িক মার্জিনে ভাল বৃদ্ধি পাচ্ছে?

সরকারগুলি কি বিশ্বব্যাপী ডিজিটাল অনুপ্রবেশ বাড়াতে কাজ করছে?

ডিজিটাল বিভাগ থেকে উপার্জন পূর্বাভাসিত বিশ্বব্যাপী আয়ের 38 শতাংশ হবে বলে আশা করা হচ্ছে।

৩. সবশেষে, আমরা সেই সংস্থাটি যাচাই করবো যা শিল্পে ভাল এবং যার ভবিষ্যতের সম্ভাবনা আশাব্যঞ্জক বলে মনে হচ্ছে

এর পরে, আমরা তথ্য প্রযুক্তি সংস্থার গুণমান এবং গুণগত দিকটি যাচাই করব।

আমরা সংস্থার দৃষ্টিভঙ্গি এবং ভবিষ্যতের সম্ভাবনা বিশ্লেষণ করব।

আমরা আর্থিক প্যারামিটারগুলি লক্ষ্য করব এবং পুরো খাতের মধ্যে কোন সংস্থাটির বৃদ্ধি এবং দক্ষতা উভয় রয়েছে তা পরীক্ষা করে দেখার জন্য এর সমকক্ষদের মধ্যে তুলনা করব।

সুতরাং এই সমস্ত গবেষণা এবং বিশ্লেষণের পরে, আমরা একটি সেরা I.T কোম্পানিতে বিনিয়োগ করতে প্রস্তুত।

সারমর্ম :

- টপ-ডাউন বা বটম আপ পদ্ধতি দ্বারা বিশ্লেষণ করুন।

- কোয়ালিটেটিভে এবং কোয়ান্টিটেটিভ মানদণ্ড পরীক্ষা করে দেখুন

- উপরের দুটি বিষয়বস্তু মূল্যায়ন করার পরে ঝুঁকি এবং রিটার্নগুলি বিশ্লেষণ করুন

- শুধুমাত্র সেই কোম্পানিতেই বিনিয়োগ করুন যা তার সমকক্ষীয়দের মধ্যে সেরা।