Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

Fundamental Analysis is the study by which we can determine stocks’ actual value by focussing on certain parameters which can affect a company’s business and its future growth prospects.

It teaches us how to evaluate a company based on its financial statements and what can you interpret from the same.

The financial statements help to find the path to examine a company’s longevity and the factors affecting it.

It involves a study of different factors which affect the economy, industry and company.

| Table of Contents |

|---|

| Steps in Fundamental Analysis |

| Goal of the fundamental analysis |

| Fundamental Analysis Case Study |

| Key Takeaways |

Steps in Fundamental Analysis:

A)Fundamental analysis first step involves a Top-down and a bottom-up methodology to understand any company.

Top-down means to first analyze the Economy then Industry and lastly the Company whereas the bottom-up means to first analyze a company, then the Industry, and lastly the Economy.

Once we can envisage that all these 3 parameters are positively synced then we can take an investment decision.

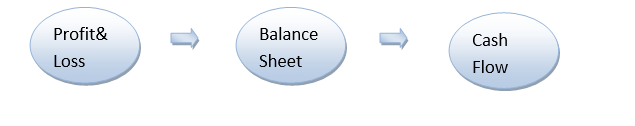

B) Now the second step involves decoding Financial Statements and Financial ratios are also known as Quantitative assessments.

If the financial statements also point to good growth in the company and the financial ratios indicate good growth in efficiency, profitability and if the solvency of the company also remains robust then we can take an investment decision.

Suggested Read: How to Analyse Financial Ratios

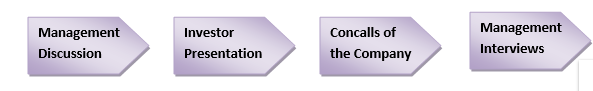

C) The third and the last step involved in Fundamental analysis is to go through Management Quality also known as Qualitative Assessment.

Thus this we can ascertain from the Balance sheet of the company which has management discussion and analysis reports, the Investor presentations of the company, the con calls made by the company, the management interviews, etc which help in translating all this for generating a future prospect about the company.

Goal of the fundamental analysis:

- To see if the company’s revenue and profit is growing or not and will continue to grow or not.

- Whether or not the management is cooking their book that is showing misleading data.

- To evaluate the management which makes internal business decisions?

- Is it in a strong-enough position to beat out its competitors in the future

- Will it be able to repay its debts

- To find intrinsic value of a stock.

Learn from Experts: Online Fundamental Analysis for Equity

Fundamental Analysis Case Study

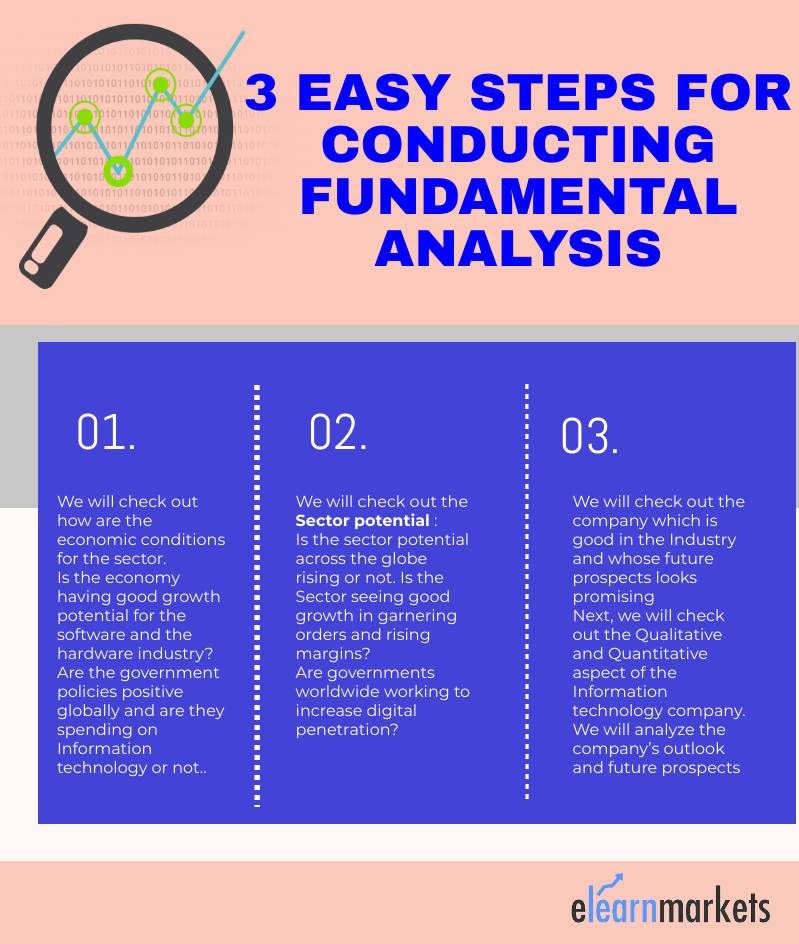

So we take an Information Technology company as an example:

1. Thus first we will check out how are the economic conditions for the sector.

Is the economy having good growth potential for the software and the hardware industry?

Are the government policies positive globally and are they spending on Information technology or not.

India is the leading sourcing destination across the world, accounting for approximately 55 percent market share for its I.T services.

2. Next, we will check out the Sector potential :

Is the sector potential across the globe rising or not. Is the Sector seeing good growth in garnering orders and rising margins?

Are governments worldwide working to increase digital penetration?

Revenue from the digital segment is expected to comprise 38 percent of the forecasted global revenue.

3. Lastly, we will check out the company which is good in the Industry and whose future prospects looks promising

Next, we will check out the Qualitative and Quantitative aspect of the Information technology company.

We will analyze the company’s outlook and future prospects.

Also Read: How Investors evaluate a company?

We will look at the financial parameters and compare among its peers to check out which company among the entire sector has both growth and efficiency.

So after all this research and analysis, we are ready to invest in one of the best I.T Companies.

Key Takeaways:

- Analyze by Top-down or Bottom-up methodology.

- Check out the Quantitative and Qualitative criteria

- Analyze the Risk and Returns after assessing both the above fundas

- Invest in the company which is best among its PEERS.

Visit Stockedge to get the latest Stock Market Information right at your fingertips.

I’ve been surfing online greater than 3 hours lately, but I by no means discovered any fascinating article like yours. It is pretty value enough for me. Personally, if all site owners and bloggers made just right content as you did, the web will be a lot more helpful than ever before.|

Hi, I log on to your new stuff like every week. Your story-telling style is witty, keep doing what you’re doing!|

Peculiar article, exactly what I wanted to find.|

It’s very simple to find out any topic on web as compared to books, as I found this article at this website.|