Intraday trading is still one of the most popular types of trading. However, many people fail at intraday trading because they do not follow a set of intraday strategies and trade based on their mood.

Millions of people now have access to intraday trading thanks to the retail investment revolution. Online brokers now provide professional-grade platforms and cost-effective terms and conditions, allowing small-scale traders to trade markets and strategies previously reserved for institutional-grade firms.

Intraday trading is becoming increasingly popular, owing to the potential for quick profits. The strategy’s principles are based on capitalising on frequent and sometimes minor price movements. Risk management is important because losses must be limited, and identifying the right market conditions is critical.

Let’s look at some of the most popular Intraday Trading strategies for beginners that can help you profit from the stock market.

1. Open High Low- Intraday Trading Strategy

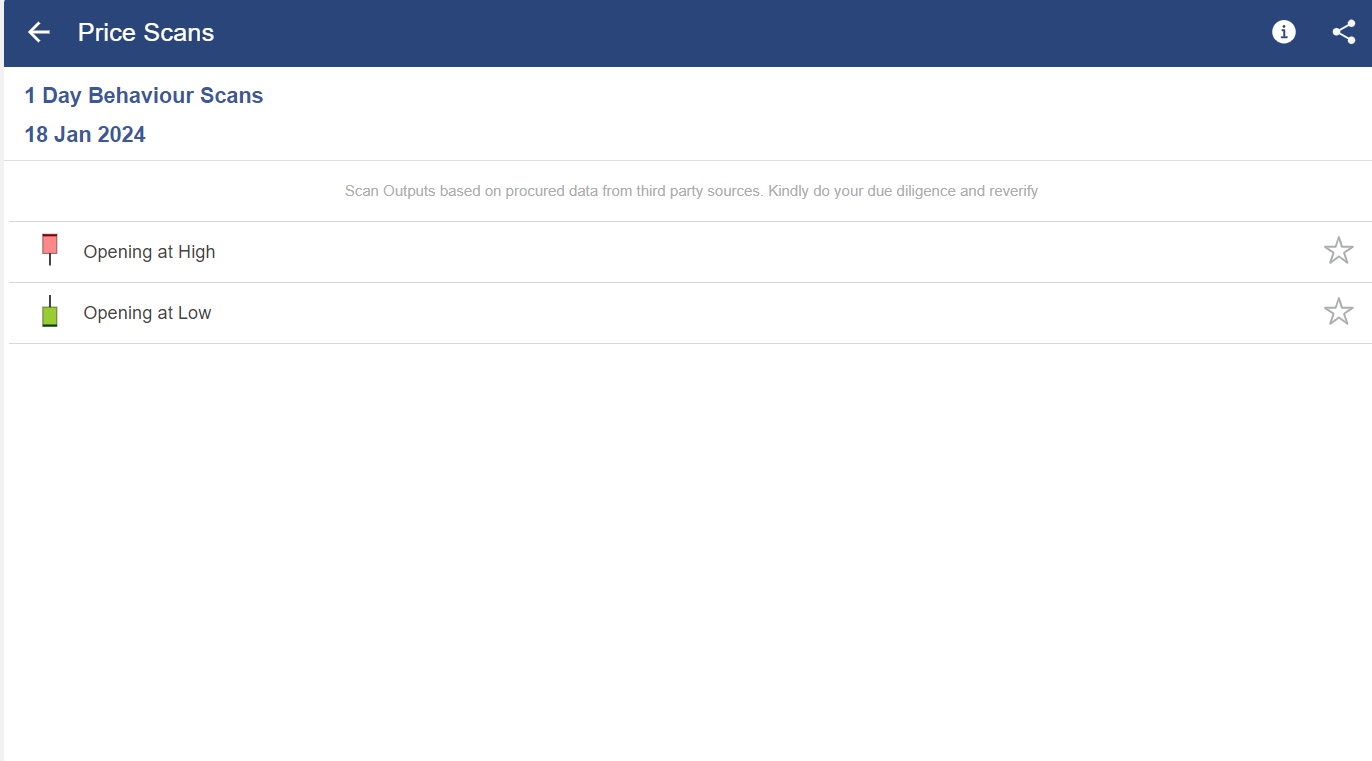

The open high open low strategy is one of the best intraday trading strategies for beginners to learn. Although the accuracy rate varies between 50 and 70%, this strategy can help you succeed in intraday trading if used with proper risk and money management.

We wait 15 minutes after the market opens before looking for stocks where the opening is equal to the high or low for the day, according to the OHL strategy. When open = high for the day after 15 minutes, stocks began falling with heavy selling pressure almost immediately after the market opened.

Also, the stock has not yet crossed the day’s high after 15 minutes, which will naturally act as resistance. Such stocks are candidates for short selling and should be sold short near the VWAP (volume-weighted average price)

Similarly, when Open = low, it means that buyers began buying that stock as soon as it opened, and if Open = low after 15 minutes, it means that the day’s low point has not been breached. Such stocks can be purchased daily while keeping days low to avoid a loss. However, make sure you buy it near VWAP and not too far away.

Many screeners exist for the open high open low strategy, but our favourite is StockEdge’s Open high low scanner, which can be found here.

2. Breakout Trading Strategy

The breakout trading strategy is one of the most popular day trading strategies for selecting good intraday stocks. This strategy focuses on stocks that move above or below specified levels as volumes increase.

These are known as support and resistance levels, and once the price moves above resistance, it continues to rise. Similarly, if the price falls below support levels, you can enter a short position in the stocks, assuming the price will continue to fall.

The range breakout trading strategy is another simple day trading strategy based on the breakout trading strategy. Stocks that are breaking the 30-day range with high volumes, for example, can show good intraday and positional trading movement.

When the stock price begins to trade and sustain above 30 days or 90 days highs and lows with volume additions, volatility expands the stakes and further buying or selling occurs, causing stocks to move up and down.

3. Pullback Trading Strategy

Pullback trading is a trading strategy in which we enter stocks during corrections or pullbacks. When a stock is in an uptrend or a downtrend, it will make small moves in the opposite direction of the major trend.

For example, if a stock is in an uptrend, it may pull back and show some correction before resuming its major trend. Similarly, if a stock is falling, it may experience a brief rebound before resuming its downward trend.

Pull back trading is a trading strategy in which we catch stocks in a correction (in an uptrend) or on a bounce back (in a downtrend).

4. Moving Average Trading Strategy

Another excellent beginner intraday trading strategy is the moving average crossover strategy. When two different moving average lines cross over one another, this is referred to as a moving average crossover.

The moving average crossover strategy is based on the simple fact that smaller moving averages follow price faster than larger moving averages (for example, 5 SMA follows price faster than 20 SMA), and when the crossover occurs, we can have a small trend formation until reverse crossover occurs.

Because moving averages are a lagging indicator, the crossover strategy will not capture exact tops and bottoms. However, it can assist you in identifying the formation of a trend and trading in that direction.

Let us illustrate this with an example. On the 15-minute timeframe of the Nifty, we can see the 5 SMA (red line) and the 20 SMA (blue line). We have a sell signal when the 5MA crosses the 20MA from above (negative cross). Let’s say we start a sell trade with. Stop loss is set at 5%, and the target is set at 1%. Exit is also possible if the 5 MA crosses the 20 MA from below (positive cross).

5. Momentum Trading Strategy

Momentum trading strategy is one of the best intraday trading strategies that beginner intraday trading strategies should follow. This is a great intraday trading strategy with a high chance of success.

Finding stocks that have moved in the last few days or weeks is what momentum trading is all about. Unless there are clear reversal signs, such stocks will continue to move. We can ride the trend and profit from such stocks if we catch them early.

You can also join our course on Trading Mentorship Program

In the preceding example, you can see how the bank nifty gained momentum after breaking through a resistance level. Such trades are known as momentum trades, and they involve catching and riding such moves. A 50-period simple moving average can also be used to ensure that the momentum or trend remains intact.

Join our webinar on 6 Intraday Trading Strategies for Nifty

Bottomline

Intraday trading is a fast-paced and intense activity in which traders who make the right decisions can make significant profits in a short period. There are losers, of course, and one thing to keep in mind is that intraday trading can be exciting. Recognizing this fact is critical because successful strategies remove as much emotion from trading as possible.

Frequently Asked Questions (FAQs)

How do I choose the right intraday trading strategy?

Choose a trading approach that fits your trading style, risk tolerance, and the state of the market. Think about things like liquidity, volatility, and the amount of time you can dedicate to trading.

What technical indicators are useful for intraday trading?

Bollinger Bands, Moving Averages, Relative Strength Index (RSI), and MACD are examples of common indicators. Traders frequently combine different indicators to validate signals.

How important is risk management in intraday trading?

Effective risk management is essential. Use a risk-reward ratio, set stop-loss orders to limit potential losses, and refrain from losing a significant percentage of your cash on a single trade.