The Dow Theory was a ground-breaking strategy that permanently altered how stock investors traded. Technical analysis is also built on Charles Dow’s market movement analysis principles. Charles Dow was not only a co-founder of the prestigious Wall Street Journal but also a co-founder of the Dow Jones Industrial Average.

The Dow Theory’s guiding principles are familiar to anyone with even a passing trading knowledge. Even if you’re not aware of it, the Dow Theory is most likely used if you use technical analysis charts.

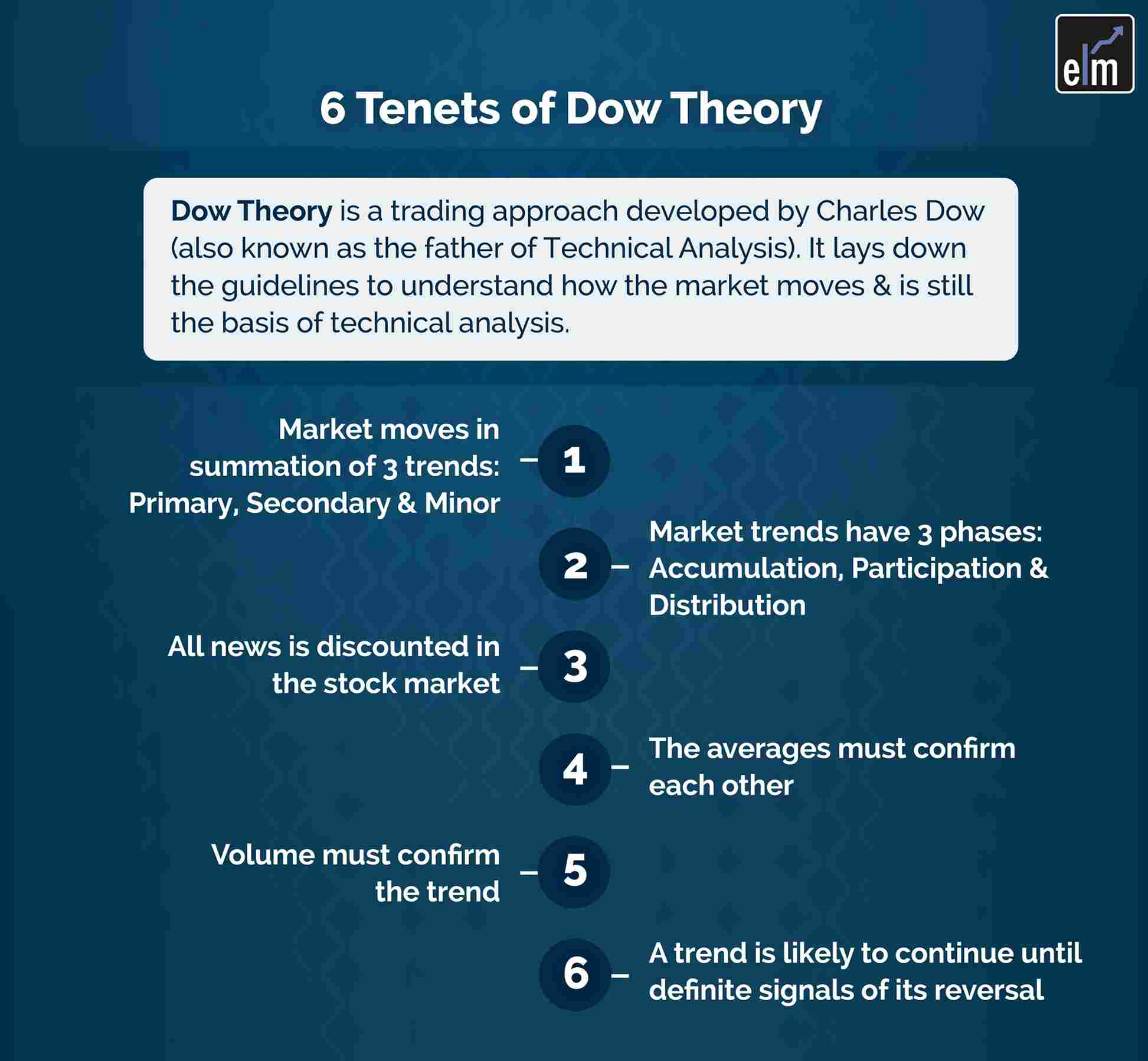

In today’s blog we will discuss 6 Tenets of Dow Theory:

What is Dow Theory?

Dow Theory is a trading approach developed by Charles Dow, who is also known as the father of Technical Analysis. It is still the basis of the technical analysis of financial markets. The basic idea of Dow Theory is that market price action reflects all available information, and the market price movement is comprised of three main trends.

Most modern-day technical analysis theory has an origin in ideas proposed by Dow and his partner Edward Jones back in the 19th century. Those ideas were published in the Wall Street Journal and are still assimilated by most of the technicians. Dow Theory still dominates the far more sophisticated and equipped modern study of technical analysis.

The 6 tenets of Dow Theory :

1. Market moves in summation of three trends

- The PRIMARY TREND: It can be as long as years and is the ‘main movement’ of the market.

- The INTERMEDIATE TREND: lasting between 3 weeks to several months, retraces the last primary move by some 33-66% and is difficult to decipher.

- The MINOR TREND: is least reliable, lasting from several days to a few hours, constitutes noise in the market and may be subject to manipulation.

2. Market trends have three phases

Be it the bull trend or the bear trend, either way, there are three well-defined phases for each. For an uptrend, the phases are Revival of confidence (accumulation), Response (public participation), and Over-confidence (Speculation). The three defined stages of the Primary Bear Trend are Abandonment of hope (Distribution), Selling on decreased earnings (doubting), Panic ( distressed selling )

3. All news is discounted in the stock market

Prices know it all. All possible information and expectations are factored into prices beforehand.

The efficient market hypothesis serves as the foundation for Dow Theory’s first tent. (EMH). According to the EMH theory, the market price has already discounted everything that can be known. Human emotion is the only thing that is not taken into account by the stock price.

From the Dow Theory’s first principle, we can learn the following important lesson:

- A price action analysis is the study of human emotion.

- This idea, which forms the cornerstone of all technical trading, is one that you subscribe to if you support technical analysis strategies.

4. Averages must confirm

Initially, when the US was a growing industrial power, Dow formulated the two averages. One would reflect the state of manufacturing, and the other, the movement of those products in the economy. The logic was that if there is production, then those who move them about should also be benefiting, and hence new peaks in the industrial average needed to be confirmed by the peaks in the transportation average. Today, the roles have changed, but the relations remain among sectors, and so does the necessity of confirmation.

5. Volumes confirm trends

Dow was of the belief that trends in prices could be confirmed by volumes. When the movements in price were accompanied by high volumes, they would depict the ‘true’ movement of the prices.

According to the fifth rule of the Dow Theory, volume should support the trend and move in lockstep with it. A rise in buying activity should be observed if there is a bullish candlestick trend. As a result, a bearish trend should be accompanied by an increase in selling pressure.

Note: A weak trend may be indicated by low volume.

The key concept is that volume must follow the main trend.

You can also do our course on Online NSE Academy Certified Capital Market Professional (E-NCCMP)

6. Trends continue unless definitive reversals come about

Irrespective of the day-to-day erratic movement and market noise that may be witnessed in prices, Dow believed that prices moved in trends. Reversals in trends are hard to predict unless it’s too late due to the nature and difference in magnitude of trends. However, a trend is believed to be in action unless definitive proofs of reversal emerge.

Bottomline

By understanding the Dow Theory, traders are better able to spot hidden trends that more experienced investors may be noticing. This allows them to make more informed decisions regarding their open positions.

We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us spread financial literacy.

Happy Investing!