Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

It will be better to compare growth investing with value investing in order to define it. Value investors look for stocks which are trading for less than intrinsic value today, whereas growth investors focus on the future potential of a company, with much less emphasis on the present price. Growth investors try to increase their wealth mainly through long-term or short-term investments.

Table of Contents

What is Growth Investing?

Growth investing is a style of investment strategy focused on the increase in the price or value of assets. Those who follow this strategy are known as growth investors who focus on the future potential of the company, with less emphasis on the present price. It is often called capital growth strategy because investors seek to maximize their capital gain.

Profits from Price appreciation – not dividend

Growth investors invest in companies whose earnings are expected to grow in comparison to their industry or overall markets. As a result, growth investors focus on companies with huge growth potential. The idea behind growth investing is that growth in earnings or revenue will translate into higher stock prices in future.

Growth investors look for investments in rapidly expanding industries where new technologies and services are being developed and earn profit through stock appreciation and not dividends. Growth investing is highly attractive to many investors because buying stock in growth companies can provide impressive returns if the companies are successful. However, such companies are highly risky.

What to look for in Growth Investing?

There is no hard and fast rule for evaluating this formula; it requires a degree of individual interpretation and judgment. Growth investors use certain guidelines or criteria as a framework for their analysis, but these guidelines must be applied with a company’s particular situation in mind, which means investors must consider the company in relation to industries’ past performance and compare the company’s particular situation in mind.

The application of any guideline or criterion may therefore change from company to company and from industry to industry. Some general guidelines one might include as part of their growth investing strategy would be to look for companies with:

- Increase in quarterly sales (YoY): This means an increase in sales for any quarter compared to the same quarter in the previous year. This gives an idea of how much sales of the company are increasing over time (i.e. its quarterly sales growth).

- Consistent sales growth ratio annually: This parameter will select stocks whose sales growth rate consistently increases yearly. It is a sign of a company’s financial health, where companies offer new products or services, diversify their business with technological changes, fulfil customers’ needs, etc., to maintain their brand image.

- Quarterly EBITDA growth YoY: The company’s EBITDA does not consider Interest, Taxes, depreciation and amortisation. It gives investors a clear view of the company’s operating profitability (i.e., how much cash it generates from its business).

- Quarterly net profit growth YoY: Quarterly growth in net profit indicates that the company is able to generate profit after deducting all the expenses from its revenue. Growth in the same indicated that the company is able to maintain its market and is growing.

- Consistently increasing quarterly EPS means the company’s quarterly EPS is being compared to the previous quarters. It is also called net income per share and measures the net income earned per share of outstanding stock.

- Consistently increasing annual EPS: It means the company’s EPS for the year is being compared to the previous years. It is also called net income per share, and measures the amount of net income earned per share of outstanding stock.

- Increasing Cash flow from operations: It signifies the company’s financial strength due to an increase in earnings. It means that after all the direct costs related to production and distribution of goods are deducted from sales the company generates enough cash from operations.

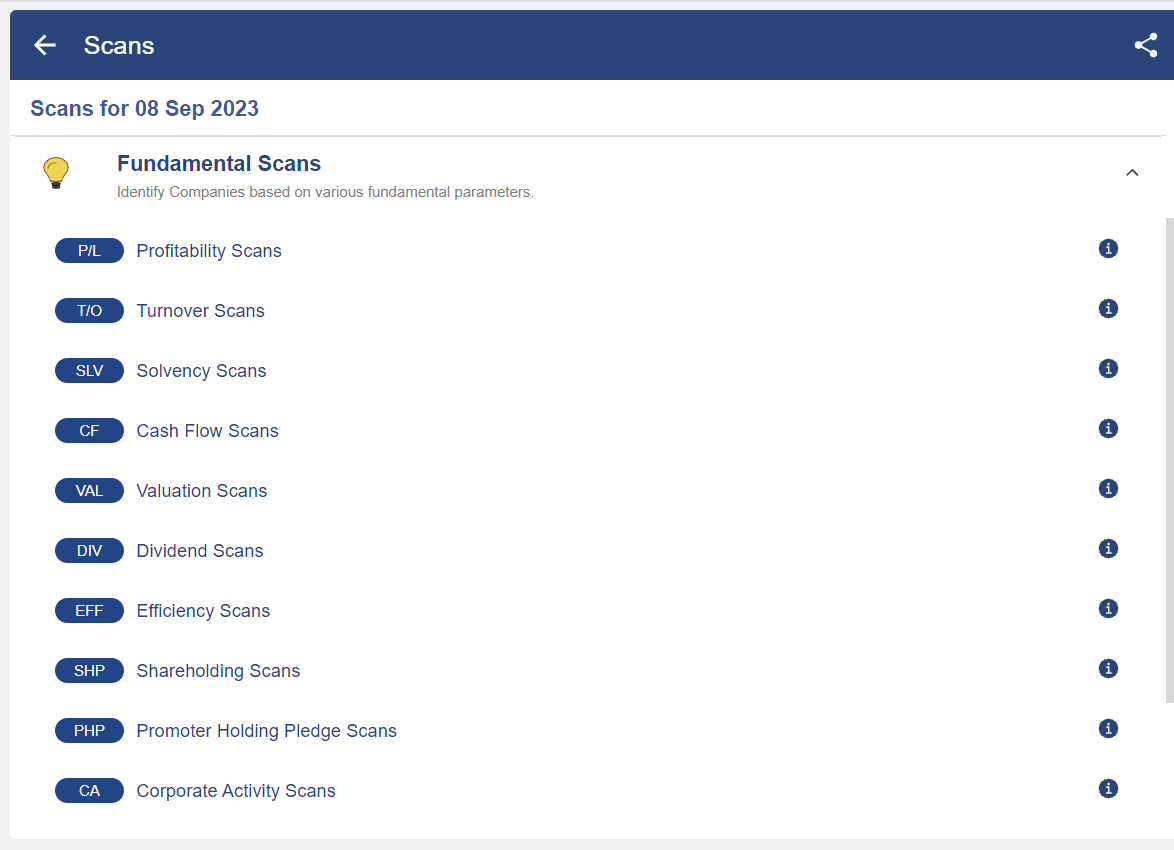

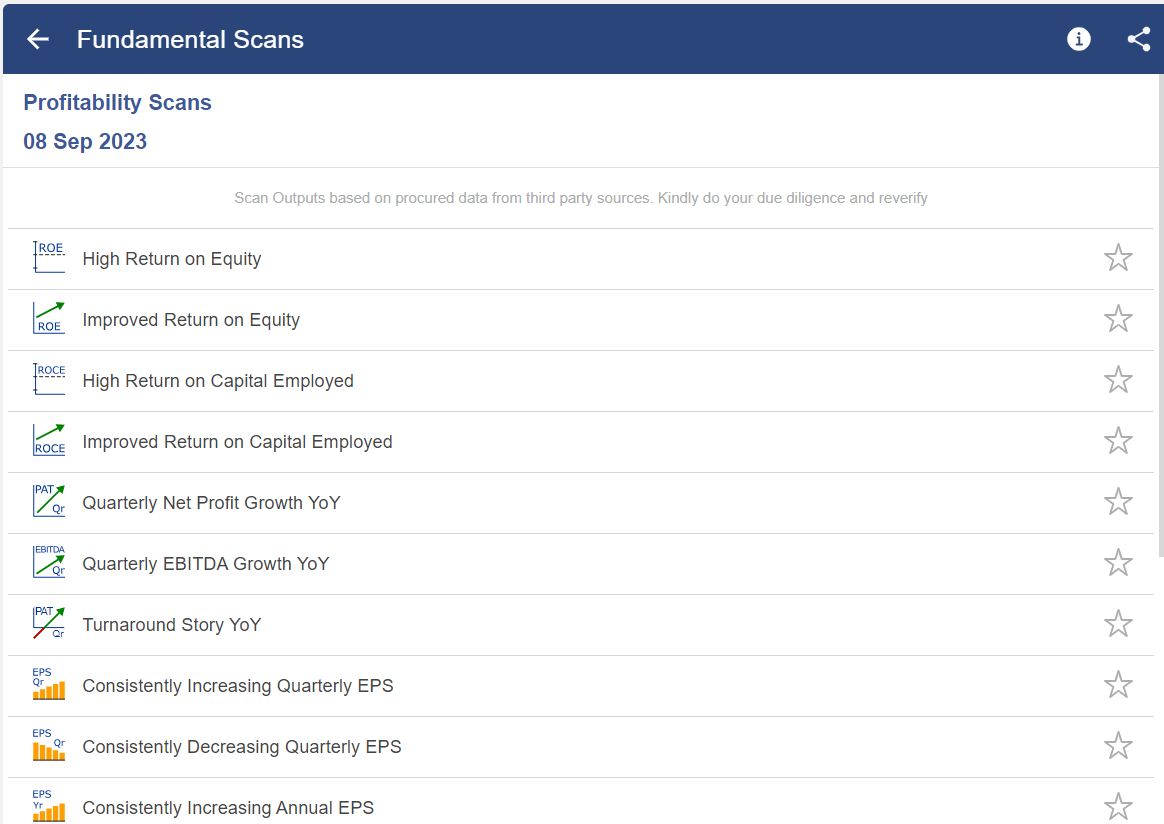

Fundamental Scans Using StockEdge

Below are the fundamental scans that will help you to filter fundamentally strong companies as shown below:

After clicking on any of the fundamental scans one will get a sub-list of scans:

You get a list of stocks that fulfills the criteria:

You can also join our comprehensive course on Online NSE Academy Certified Capital Market Professional (E-NCCMP)

Bottomline

Investors have many options and ways to execute a strategy that focuses on capital appreciation which includes investing in blue chip companies, investing in smaller companies having high growth potential, investing in emerging markets, etc. Warren Buffet has recognised the value of growth investing through his business partner Charlie Munger which is expressed by Buffet’s saying:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price”

Frequently Asked Questions (FAQs)

What is an example of growth investing?

High-risk growth investments like penny stocks, futures and options contracts, foreign currencies, and speculative real estate like undeveloped land are sought after by thrill-seekers and speculators. For risk-takers with large incomes, there are also oil and gas drilling partnerships and private equity.

What are the risks of growth investing?

Growth stock performance can be impacted by variables including interest rate changes, inflation, and geopolitical events, which could result in losses for investors.

Why is growth investing better?

Growth stocks, on the other hand, have the advantage of having the potential to increase their cash flows over time and produce a greater return on assets in a manner that is less indicative of the current book value of their assets. Looking at the net present value formula is another method for classifying the stock of a company by style.