What to look for in a before investing in stocks? Do you know what things you should take care before searching stocks for investment? If not, let’s know today what eight things should be kept in mind before investing.

By focusing on these 8 techniques, your loss will be less and trade will be more profitable and these techniques should be considered before investing in stocks.

| Table of Contents |

|---|

| First Technique |

| Second Technique |

| Third Technique |

| Fourth Technique |

| Fifth Technique |

| Sixth Technique |

| Seventh Technique |

| Eight Technique |

Techniques for Investing in Stocks

The following are some techniques for searching before investing in stocks:

First Technique:

If any business increases its sales every year, then that business will give you profits. i.e. the increase in sales will eventually give profits to the investors. The increase in sales will lead to increase in profits and turnover for the company and this can only happen when the demand for the company’s product are favourable.

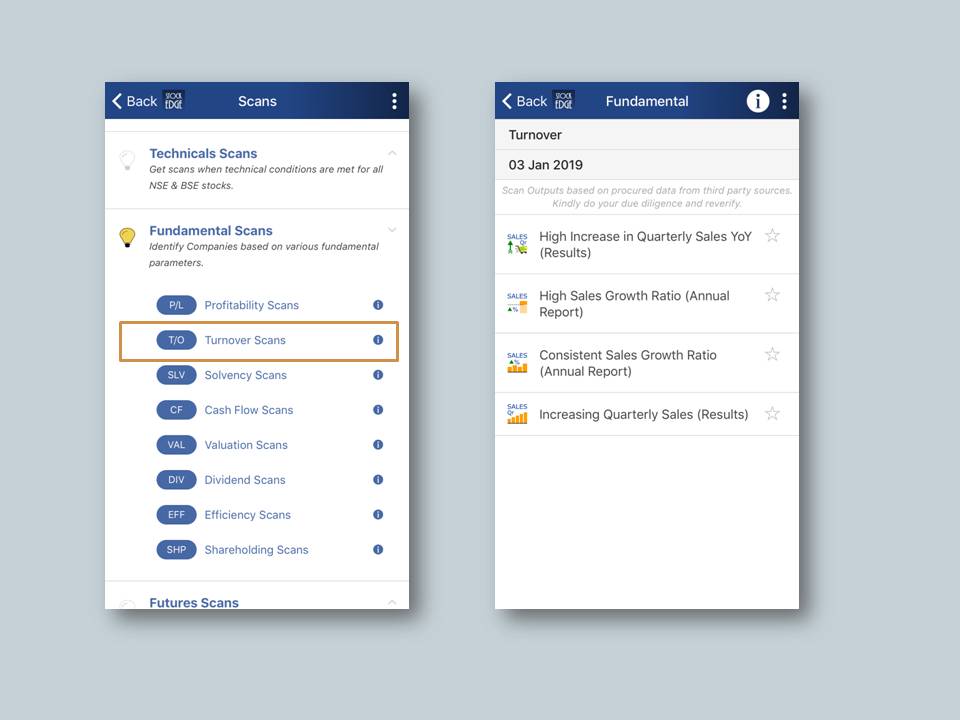

Thus these types of companies will not require much loan to run their company as their product are sold as soon as they are manufactured. Find it in Turnover ratio scan in StockEdge.

Second Technique:

If the company earns profits after paying for its expenditure every year, then the company will give good returns on your investment i.e. the rise in the profits will ultimately culminate into rise in share price of the company.

If the profits continue to increase then these types of companies can look forward for expansion or joint venture as their retained earnings will fund their future growth venture.

Third Technique:

If any company runs its business in low debt or progress without paying little or no interest, then such company will give you profits on your investment i.e. the debt equity ratio should be less than 1.

These companies are ideally investment criteria for people who want to play safe in the markets. Highly leveraged companies would face margin pressures in the event of any adverse micro or macro conditions.

Learn to invest in stocks with Stock Investing Made Easy Course by Market Experts

Fourth Technique:

For any company, the money saved after meeting the expense is their cash, so the companies who can save more money will also be able to run their business in future ie cash flows should be good and they should also be increasing.

Thus these companies takes out its expenses from the Sales be it direct or Indirect expenses. Thus the cash left after meeting all its expenses are termed as the cash flow for the company.

Fifth Technique:

One should also look in how many days the company is receiving its money after sales, so if there is a problem in paying money or getting money, then it is also a big problem for the business. That’s why such a business cannot give you profits.

This means that suppose you buy raw material on day 1 and make a finished product out of it on day 10 then there are some costs involved from sourcing of raw material to making of goods and then selling it on day 15 but getting payment on day 30.

That means you make payment on day 1 and you receive payment on day 30. So that means that you are receiving your investment by 29th day and till then you have to fund from your own money.

Thus if this 29 days get reduced to 19 days then it’s good for the company. Such company’s can give you good returns if payment days reduce or remain static.

Sixth Technique:

If the business is earning profits and payment from sales are also received on time and interest is not high, then it is important to see if the company gives any dividend to its share holders. If the company gives dividends then that company is good.

Dividends are only given if the company generates enough cash from its business. Some part of the profits are kept as retained earnings and dividend is given from it to the shareholders.

Seventh Technique:

Everything said and done we should also take into account the PE ratio. That is the company’s price to equity ratio. If this ratio is less than that of the rest of the business in the same Industry then the company will be profitable for you to invest into thus the company would be worth investing.

As higher PE ratio means that the company is expensive and a lower PE ratio means that the company is a good bargain buy. If the PE ratio of any company is below its Industry PE then it’s a good bargain buy.

Eight Technique:

We should take note of the share holding pattern. This means that we need to see if the promoter is buying or selling its shares in the company if they are investing then there is no harm in investing in such a company.

The Promoters only invest into their company if they see any growth opportunity for their company in the future. The FII’s or DII’s also increase holdings in only those companies which are a good bargain buy and can give good futuristic returns.

Bottomline:

If one follows all these 8 criteria’s sincerely then one can never go wrong in stock selection and will always create profits in the stock markets. These techniques would help every investor to research well before investing their hard earned money into any stock.

Any stock idea which fulfils all these criteria’s are sure to give good returns on investments.

The best technique I feel is going in with two ways of investments.

Hi Rahul,

Thank you for Reading!

Keep Reading!

This is the best platform for finance and stock market students ,but sir can you plaese all blogs provides in Hindi Language

Hi,

We have blogs on Hindi, you check out here:https://www.elearnmarkets.com/blog/tag/hindi/

Thank you for reading our blog!

Keep Reading!