Bank of Baroda announced its 3rd quarter results on the 13th of Feb, for FY 15-16. The results were the worst one posted by any bank so far. However, when the trades opened today, Bank of Baroda was seen trading 19% higher from the previous close!

This reaction was the result of the Bank of Baroda’s Management’s comments on the quarterly result in which they stated that (link) :

- The worst was behind, the bad loans have been recognized

- There will not be any dilution of interest in the company by way of capital infusion from the government

- Customer mapping to increase business and reduce capital inclusion

- Non –monetised assets – means there are assets with the bank which have not been included in the balance sheet, which provide the bank’s business with benefits, which will be monetized in the future and help improve the bank’s books.

- Foreign currency gains which are expected to flow in any time soon.

- There are thus, potential mark to market gains which the bank can take in which will act as an accretion to capital.

- Expecting a 20% growth in the capital next year as the bank is committed to improving in its inefficiencies.

- The bank hopes to release 50 bps of capital following the clean up of its balance sheet and unnecessary lines of credit given to customers who won’t be needing it.

- BoB has other banks outside India, and on capital adequacy ratio they expect to pick up another 50bps of capital on a consolidated basis.

The board’s comments came resounding around just one thing: EFFICIENCY.

However, let’s take a thought on this.

What the management has spelled does sound like a new beginning for the bank, however, to build a new something which is already standing, it takes the process of creative destruction.

And destruction as well know, is painful.

So the reaction to the board’s comments is phenomenal, but what next?

Will the traders who have jumped in on the sound of music standby when the board drops the beat?

If you are a market participant and facing difficulty with charts and patterns, you can check for NSE Academy Certified Technical Analysis course on Elearnmarkets.

Now, if we look at the Technical perspective, and analyze the chart, we can find evidence that the reaction is technically justified.

On the daily chart of Bank of Baroda, there was an evident Positive divergence between price and the momentum indicator RSI which suggested that though the price was trending lower, the momentum in the stock was catching up.

This lead to the price to shoot up today when the word of the board came in with a positive note.

However, the concern comes from the fact that the last day the RSI had breached the level of 30, had this reversal come from a level of say 31-35, more credibility would have been awarded to today’s move.

Another concern here is the volume which has been consistently high during the falling witnessed in price.

As we know, high volume during a trend adds to its weightage and importance.

Lastly, let’s take a look at the weekly charts.

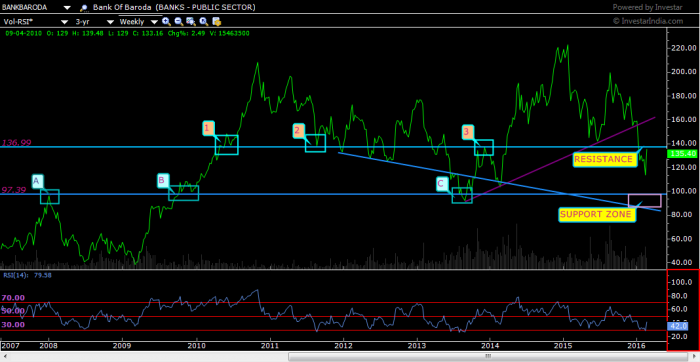

There are two levels defined on the chart, one is the resistance for the current up-move at 137 (for reasons marked 1,2,3) and the other is the support in the zone of 85-100 (for reasons marked A, B,C).

The stock is very close to the August 2013 lows of 85-86.

The technical support combined with flushing of the balance sheet makes Bank of Baroda an important stock in the banking sector and among the Nifty 50s.