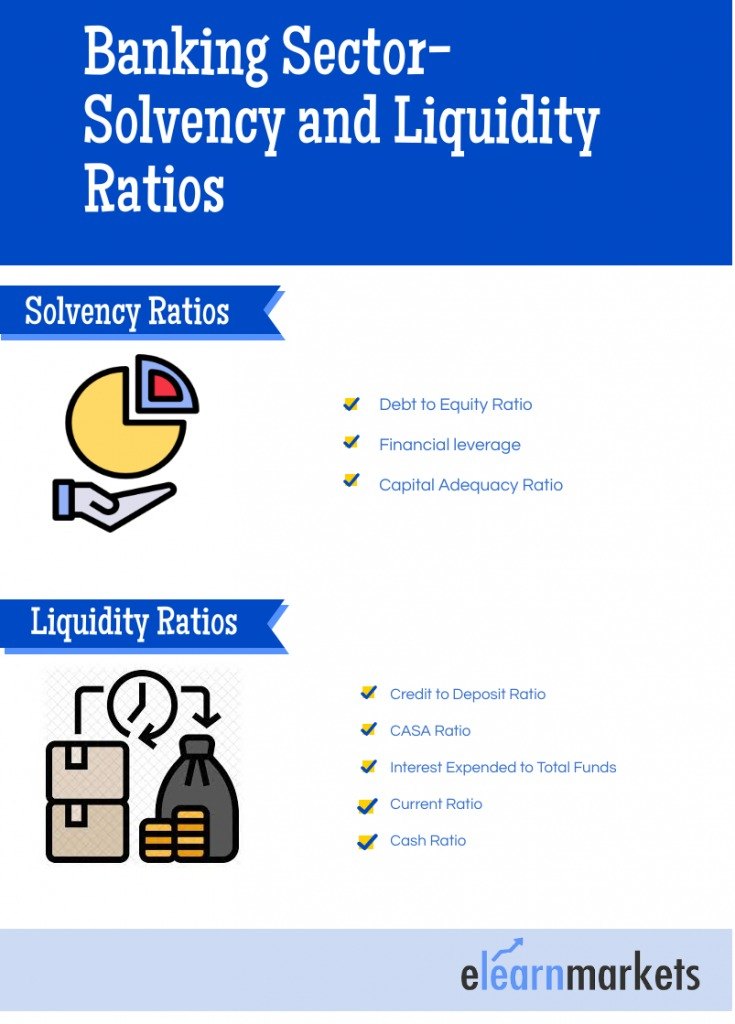

Financial ratios are widely used to analyze a bank’s performance, specifically to gauge and benchmark the bank’s level of solvency and liquidity.

These financial ratios should be used before investing in the banks.

Liquidity and Solvency play an imperative role in the smooth survival of the banking sector.

These are some of the fundamental factors in the maintenance of the bank’s financial viability. This is a vital parameter on which a bank is analyzed.

| Table of Contents |

|---|

| What are Banking Sector Ratios |

| Solvency Ratio |

| Liquidity Ratio |

Liquidity is the ability of a bank to increase the assets and meet obligations as and when they come due, without incurring any losses.

Solvency of the bank refers to the ability of the bank to meet long-term obligations as and when they arise.

What are Banking Sector Ratios ?

In the most lucid way, solvency measures the long-term position of the bank, and liquidity measures the short-term position of the bank.

Both of these parameters are important for the banking sector to function smoothly:

Solvency Ratio

The solvency ratio measures the long-term ability of the bank to meet its obligations. This involves understanding the capacity of the bank to meet its obligations.

1. Debt to Equity Ratio:

The financial business is a leveraged business and hence this will be high.

So for the banking sector, this ratio will be high, and therefore the most prudent manner to analyze the bank on this parameter will be to compare it with its peers.

This will give a clear understanding of the debt in comparison to its peers.

2. Financial leverage:

Financial leverage is the ratio of a bank’s total debt to its total assets. It implies the amount of assets in comparison to its debt.

In the banking sector analysis, it is of utmost importance in understanding the banks Business strength. As lending is one of the most important businesses of the Banks.

Learn theory & principles of Macroeconomics with Macroeconomics Made Easy Course by Market Experts

3. Capital Adequacy Ratio:

This ratio helps understand the amount of losses the bank can absorb before becoming insolvent.

It is a measurement of a bank’s available capital expressed as a percentage of a bank’s risk-weighted credit exposure.

Here are the ratios of HDFC Bank and Kotak Mahindra Bank.

| Particulars | HDFC Bank | Kotak Mahindra Bank |

| Capital Adequacy Ratio | 17.1 | 17.5 |

| Debt to equity | 0.78 | 1.14 |

Also in the banking sector analysis, Provisions is a very important item which needs to be analysed under both short and long term impact on the books.

This basically implies the conservatism with which the bank is performing its operations and its strength to absorb any sudden and also deemed hit on the financials.

Thus a rising provision means that the bank expects some hit on its financials so has increased provisions and vice versa.

Liquidity Ratio

Liquidity measures the short-term ability of the bank to operate and function.

There are a few banking sector ratios that can be computed to analyse the liquidity of the bank while analyzing banking stocks.

1. Credit to Deposit Ratio:

This measures the bank’s total credit in relation to its total deposits in the bank. This helps in analyzing the bank’s liquidity position.

This should be neither too high nor too low, hence a balance must be strike between the % to be maintained.

As a ratio, more than 100 would mean that the bank has lent more than it has received as deposits

2. CASA Ratio:

CASA stands for current account and saving account.

CASA ratio measures the ratio of deposits in current and savings account as a % of total deposits.

The higher the ratio, the lower is the cost of funds for the bank which significantly helps the banks in reducing operating expenses.

3. Interest Expended to Total Funds:

The interest expense is the amount paid on the deposits accepted by the bank. It tells us about the cost of funds with respect to deposits.

Interest expense is a non-operating expense shown in the income statement. It represents interest payable on any borrowings such as bonds, loans, convertible debt, or lines of credit.

Suggested Read – 7 Ratios to check before Investing in Banks

Here is a list of different ratios of two of the leading banks HDFC Bank and Kotak Mahindra Bank as of FY19.

| Particulars | HDFC Bank | Kotak Mahindra Bank |

| Credit to deposits | 88.76 | 91.06 |

| CASA | 42.38 | 52.50 |

| Interest expended to total funds | 4.08 | 4.06 |

4. Current ratio-

This ratio measures the ability of the bank to meet its current liabilities in relation to its current assets.

This implies the day-to-day liquidity which the bank possesses for its functioning. This ratio when greater than 1 is viewed as the liquid to meet its current obligations.

5. Cash ratio-

The cash ratio is the ratio of cash to banks’ total liabilities. This ratio implies the cash which the bank holds.

This ratio determines the credit which can be created from the deposits.

This ratio if high will imply the bank is less profitable and if low will imply the bank is risky.

Hence the right balance is required to make the bank liquid to let its activities function smoothly.

For Instance, the cash balance of the bank gives a sense of the liquidity the bank holds in terms of cash.

You can check these ratios and invest in the banks accordingly from the StockeEdge web version.

Key Takeaways:

- Solvency ratio is analyzed to determine the long term ability of the bank to meet its obligations

- Liquidity ratio is analyzed to determine the short term ability of the bank to meet its obligations

- Banks are a leveraged business and hence their ability in both short term and long term should be carefully analyzed.

- This position of the banking sector should be analyzed both on a standalone bank basis and also in comparison to its peers to have a better understanding of the current situation in the sector as a whole.

Happy Learning!