The Bear Put Spread options strategy involves selling one Put Option while simultaneously buying another. In contrast to the Bear Call Spread, you pay the more significant premium and receive the lesser premium in this case. As a result, there is a premium deficit. Your risk is limited to the premium difference, while your reward is limited to the difference in Put Option strike prices less net premiums.

When a trader feels the underlying asset price will fall moderately, this approach is applied. Because a net debit is taken upon joining the trade, this method is also known as the bear put debit spread.

In today’s blog, we will discuss the Bear Put Spread Options Strategy:

What is the Bear Put Spread Options Strategy?

The investor must buy an in-the-money (higher) put option and sell an out-of-the-money (lower) put option on the same company with the same expiration date in order to execute this strategy. The investor incurs a net loss as a result of this technique.

The strategy’s overall effect is to lower the cost of buying a Put and raise the breakeven point (Long Put). Because the investor will only profit if the stock price/index declines, the approach requires a bearish perspective. This method comes with low risk and a low profit.

How does its work?

Let us take the stock example so that we can understand this strategy better-

Stock Example- Hero MotoCorp Ltd-1.6.2022

1. Outlook

After a significant uptrend from the level 2163-2798 levels, the prices made a Doji at the resistance level of 2800 and from then, it started falling. So, if we have a bearish view of the stock then we can implement this strategy:

2. Strategy

The Bear Put Spread Strategy involves:

- Buying Put of Higher Strike Price– According to this example, we can buy 2600 put around 38 of the June Expiry

- Selling Put of Lower Strike Price- we can sell 2500 put around 22 of the June Expiry

3. Maximum Gain

In the example above, the difference between the strike prices is 100 (2600 – 2500 = 100), and the net cost of the spread is 16 (38 – 22= 16). Therefore, the maximum profit is 3.10 (100 – 16 = 84) per share less commissions.

So, 1 lot of Hero MotoCorp Ltd. is 300 shares, thus, total profit= 300*84= Rs. 25,200

This maximum profit is realized if the stock price is at or below the Short put (lower strike) strike price at expiration. Short puts are generally assigned at expiration when the stock price is below the strike price.

You can also read our blog on 12 Common Option Trading Strategies Every Trader Should Know

4. Maximum risk

The maximum risk is equal to the spread cost, including commissions. A loss of this amount is realized if the position is held to expiration and both puts expire worthlessly. For example, both puts will expire worthless if the stock price at expiration is above the long put’s strike price (higher strike).

5. Breakeven stock price at expiration

The strike price of long put (higher strike) minus net premium paid= 2600-16=2584

6. Payoff Diagram

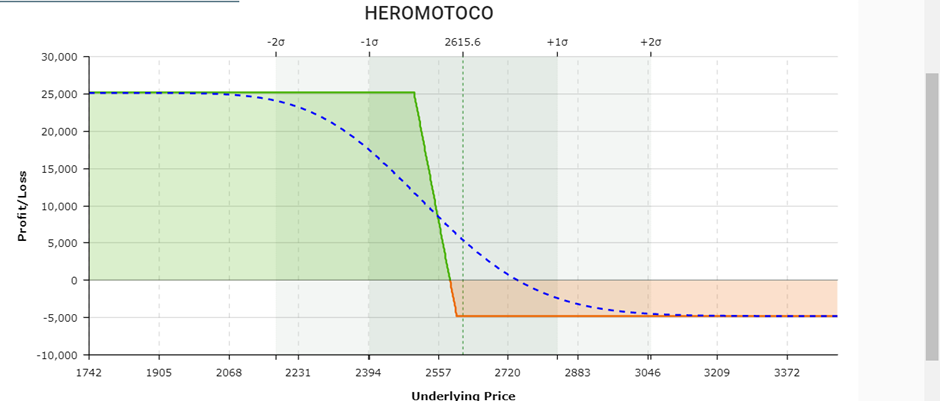

Below is the payoff diagram for the above Bear Put Spread options strategy:

So, from the above diagram, we can see that both maximum profit and maximum loss are limited.

You can also join our course on Advanced Options Strategies

Bottomline

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.