A bank is a financial institution which creates credit by lending money to a borrower thus creating a corresponding deposit on the bank’s balance sheet. This blog talks about the key benefits of a bank account.

No doubt, Bank plays a very important role in the economy of any country and are highly regulated.

Banks are subjected to minimum capital requirement norms based on an international set of capital standards, known as the Basel Accords.

| Table of Contents |

|---|

| Why save in a Bank? |

| Advantages of Bank account |

| Bottomline |

Why save in a Bank?

It offers high liquidity since you can withdraw your money anytime you want to.

Banks offer a number of useful services like debit card facility, cheque facility etc.

You can also choose a nominee who will claim the money after your death.

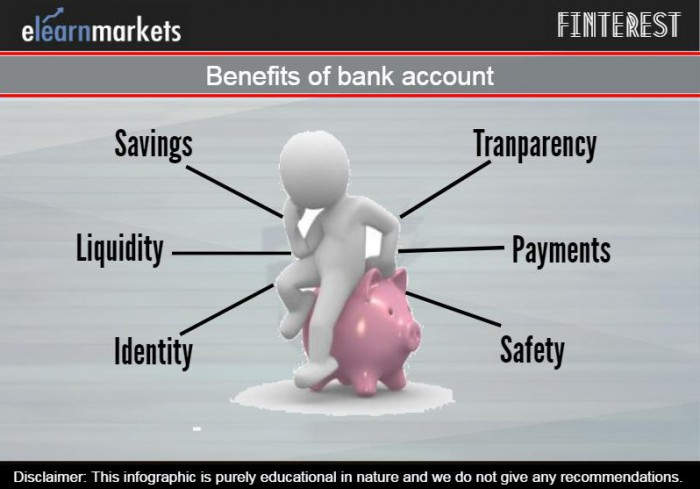

Advantages of Bank account

Savings–

It built a habit of setting aside money. There are various types of bank accounts like fixed deposit, current deposit etc which a customer can choose based on his need.

A savings account can offer the holder a small profit on her deposit for allowing a bank to use your money to make investments. In exchange, the bank will compensate you by paying you a small rate of interest.

In certain kinds of accounts, your money is placed in liquid money market funds, generating higher revenues.

Liquidity

It provides high liquidity especially when a person needs a ready pool of money for the emergency purpose. You can deposit or withdraw your money whenever you need and also send remittances through the bank.

Download E-book to manage your bank account – Banking Awareness for beginners

Identity

It provides an identity which is recognized by various government institutions.

Transparency

The bank transactions are very transparent in nature and you can keep a track of your transactions through your Passbook.

Safety

The money kept in a bank account is safe and is well regulated. Money that is kept safely in your home or on your person can be lost in a disaster, such as a fire or stolen.

By contrast, up to a certain amount placed in a bank account is automatically insured against loss by the government. Even if the bank where you hold the account goes bankrupt or is robbed, your money is still safe.

Also Read: A brief distinction between savings, trading and demat account

Payment of expenses

We can give standing orders to pay some fixed expenses like telephone bill, electricity bill etc and also receive payments directly into the bank account.

Many bank accounts are set up so to make regular bill payments like payment to insurance companies utilities etc. Lenders can extract money directly from the account.

This saves the account holder’s time and cost of mailing a cheque or money order. In addition, many banks offer direct deposit in which a paycheque of an account holder is automatically deposited into his bank account.

Accessibility-

Instead of carrying a big amount of your money with you, having a bank account gives you the option to withdraw that amount of money from a variety of locations using a debit card.

A debit card can generally be used to make purchases or to withdraw money from an ATM. For larger sums, a cheque allows the recipient to withdraw a certain amount of money from her account.

Also Read: How to Open a Bank Account?

Bottomline

Money deposited in a savings account earns interest and also enjoy compounding benefits.

Moreover, if you are highly risk-averse, then saving money in a bank offers a better choice than other risky instruments like equities.

Keep Learning!!

Thanks for helping me understand what the benefits of having a bank account are. My mom has been telling me to create a bank account for my kids so they can start the habit of saving early. I like how this article mentioned that having a bank account gives you the option to just get the right amount you need instead of carrying a huge amount of money in your pocket.

Thanks for the valuable benefits you listed on your blog about having a bank account. I agree that instead of carrying a big amount of cash with me, having a bank account can give me the option to withdraw the money or save it. I like how it offers a number of useful services like debit card facility, cheque facility, and etc. I can say that having a bank account is truly convenient.