Debt Settlement or Debt Consolidation? Which one you should opt for clearing your debts?

Well, don’t worry! Everyone faces the same confusion when they decide to clear off their debts.

Even one of the colleagues had the same confusion, so I explained to him what are these methods of getting rid of their debt–

Debt settlement and debt consolidation both help the consumers to find a way to get out of credit card debt or other debts but both of them follow very different ways for achieving that goal.

Still, Confused? Let us discuss debt settlement and debt consolidation in simpler words-

Debt settlement is a process of negotiating with creditors for settling debt by paying less than what is owed. This method is mainly used for settling debt with a single creditor, but can also be used when dealing with many creditors.

Whereas, Debt consolidation refers to an effort for combining debts from many creditors and then taking out a single loan for paying them all at a lower interest rate and monthly payment. This is usually done by consumers who are trying to pay bills for multiple credit cards and also other unsecured debts.

The pros and cons of debt settlement and debt consolidation may differ especially with regard to the time it will take for eliminating debts as well as the impact it will have on your credit score.

When these methods are used properly, they will help you in getting out of debt sooner and also in saving money.

So, in order to clear your confusion, in today’s blog we will discuss how does the debt settlement or consolidation works and also their pros and cons:

What is Debt Settlement?

Debt Settlement refers to making an offer through negotiation to your creditor for settling the debt for less than it was owed.

For example, if you owed Rs. 20,000, then you might offer the creditor a payment of Rs. 15,000. Now if the creditor accepts this negotiation offer, then you will make the payment to him and that debt will be settled.

But the problem here is if you own too many creditors then you have to go through the process with each one. Thus, if you have many credit cards or bills such as cable, cell phone, medical, etc. then you will have to negotiate a settlement with each one so that all the debts are paid.

Now let us discuss the pros and cons of debt settlement:

Pros of Debt Settlement:

Debt settlement helps in paying back less than what is actually owed. If you owe more than you can actually afford to pay back, then debt settlement will help you in clearing your debts and let you move on.

Cons of Debt Settlement:

Below are the cons of debt settlement:

- The Debt settlement companies usually tell you to stop making payments while they are negotiating with your creditors which often lead to late fees. The late fees and interest will be added to the amount that you already owe them.

- Generally, the normal time frame for a debt settlement is 2–3 years, which means you will have to pay the late fees and penalties for these 2-3 years which will be added to the amount you owe.

- Debt settlement also has a negative impact on your credit score as not paying the full amount is considered to be negative for the credit score.

- Debt settlement companies charge a fee that is calculated as a percentage of the amount owed for negotiating on your behalf.

Read more about Savings and Investment from ELM School

What is Debt Consolidation?

Debt consolidation refers to the method of combining two or more debts into a single one. This method of paying debt is taken by those consumers who have many debts from many creditors.

If you have many bills coming to your home every month, then debt consolidation may be the debt-relief program you need.

According to this method, consumers can combine debts from many creditors and then take out a single loan for paying them all at a lower interest rate and monthly payment.

Now let us discuss the pros and cons of debt consolidation:

Pros of Debt Consolidation:

Below are the pros of debt consolidation:

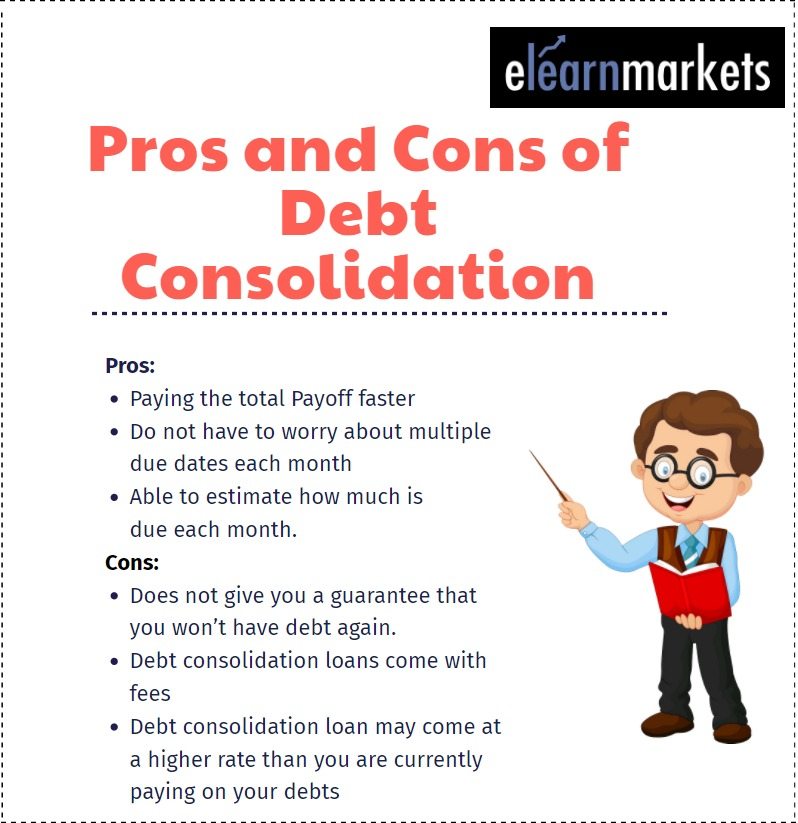

- Getting a debt consolidation loan may help you in paying the total payoff faster especially if you have many credit card debts.

- When you are consolidating debt then you will not have to worry about multiple due dates each month as you will have one payment to be made.

- If you are taking a personal loan to pay off your debt then you can make an estimate of how much is due each month and when will be your last payment.

Cons of Debt Consolidation:

Below are the cons of debt consolidation:

- Consolidating debt does not give you a guarantee that you won’t have debt again. If you live beyond your means then you might do so again once you feel free of debt. So to avoid this you should also start building an emergency fund that can be used for paying financial emergencies.

- Usually, debt consolidation loans come with fees that may include Loan origination fees, Balance transfer fees, Closing costs and Annual fees.

- The debt consolidation loan may come at a higher rate than you are currently paying on your debts due to the current credit score.

Let us now come to that important part which will help you in deciding which one you should choose for settling your debt:

Which is better- Debt Settlement or Debt Consolidation?

For people who do not want to declare bankruptcy and feel helpless with their financial situation then debt settlement could be the short-term answer.

This method may help you if you have enough money to make a good lump-sum offer to your creditor.

However, if you think that you will require credit in the future for purchasing a home or a car then debt settlement might not be the best option as it will have a negative impact on your credit report.

Then the method of debt consolidation will help you in this case, you can take a loan and pay multiple bills at once.

You can also check our course on Financial Planning and Wealth Management

Bottomline:

One should remember that before signing onto a debt consolidation offer, one should review their current monthly minimum payments and also the expected length of time to repay the debt and then compare that to the time and expense which is associated with the loan. Both methods of getting rid of your debt will help you in achieving financial freedom.

Happy Investing!

For stock related queries visit web.stockedge.com