English: Click here to read this article in English.

আশা করি আমরা সকলেই জানি শেয়ারের প্রাইস অ্যাকশন বিচারের জন্য টেকনিকাল অ্যানালাইসিস বেশ জনপ্রিয় এবং কার্যকরী | এই টেকনিকাল অ্যানালাইসিসের একটি গুরুত্বপূর্ণ অংশ হলো ট্রেডেড ভলিউম এবং ডেলিভায় ভলিউম| এই দুই প্রদার ভলিউম নিয়ে অনেকের মনেই অনেক সংশয় রয়েছে, আজকের এই লেখনীর মাধ্যমে আমি আশা করছি আপনাদের এই দুই ভলিউমের মধ্যের পার্থক্য বোঝাতে সমর্থ হবো |

স্টকের দামের গতিবিধি/ মোমেন্টাম অধ্যয়ন করার জন্য প্রাইস / দাম ও ভলিউম এই দুই উপাদানই ব্যবহৃত হয় |

অপর দিকে স্টক এক্সচেঞ্জ “ডেলিভারি ভলিউম ” নামে অন্য এক প্রকার অতিরিক্ত তথ্য সরবরাহ করে থাকে |

এটি ট্রেডারদের শর্ট টার্ম মার্কেট ডাইরেকশন বছর করে সিদ্ধান্ত নিতে সহায়তা করে থাকে |

একজন টেকনিক্যাল অ্যানালিস্ট হিসাবে আমার মনে হয় আসুন আমরা এই ব্লগের মাধ্যমে “ট্রেডেড ভলিউম এবং “ডেলিভারি ভলিউম ” নিয়ে আলোচনা করি যার মাধ্যমে এই দুই বিষয় সম্পর্কে জানাযা যাবে এবং দুই বিষয়ের মহাদয়ের পার্থক্য ও বোঝা যাবে |

ভলিউম কি ? :

একটি নির্দিষ্ট ট্রেডিং সেশনে যে নির্দিষ্ট পরিমান শেয়ার হস্তান্তর হয় / ট্রেডিং হয়ে থাকে তাকেই স্টক মার্কেটের পরিভাষাতে ভলিউম বলা হয়ে থাকে | সুবিধার্থে ট্রেডিং সেশনকে বিভিন্ন টাইম ফ্রেমে ভাগ করা যেতে পারে, যথা – ৫ মিনিট , ঘন্টা , দৈনিক , সাপ্তাহিক , মাসিক ইত্যাদি |

ভলিউমকে কখনোই – বায়িং ভলিউম – সেলিং ভলিউম এই ভাবে ভাগ করা যায় না |

কোনো ট্রেড সম্পাধন করার জন্য নূন্যতম ১ জন ক্রেতা এবং ১ জন বিক্রেতার প্রয়োজন |

কোন নির্দিষ্ট সময়ের উচ্চ ভলিউম সেই সময়কালের এবং দামের রেঞ্জে ট্রেডারদের ভাল অংশগ্রহণের ইঙ্গিত দিয়ে থাকে |

কোনো নির্দিষ্ট শেয়ারে নির্দিষ্ট দিনের ট্রেডিং চলাকালীন কত পরিমান ট্রেড হয়েছে তার দৈনিক হিসাব হলো – ট্রেডেড ভলিউম |

ডেলিভারি ভলিউম কি ?:

এটি মোটেও প্রয়োজনীয় নয় যে সকল ট্রেডই কেউ অনেক দিন ধরে রেখে দেবে | কিছু ট্র্ডে ইন্ট্রাডে ও হয়ে থাকে, অর্থাৎ এটি এমন কোনো প্রকার একটি ট্রেড যে পজিশনটি নির্দিষ্ট দিনে ওপেন হওয়ার পরে সেই দিনের ট্রেডিং ঘন্টা শেষের নির্দিষ্ট সময় আগে শেষ হয়ে যায় |

ডেলিভারি ভলিউম : নির্দিষ্ট দিনের টোটাল ভলিউম – নির্দিষ্ট দিনের ইন্ট্রাডে ভলিউম |

ডেলিভারির জন্য যখন শেয়ারের সংখ্যা নেওয়া হয় তখন এর অর্থ হ’ল অনেক বেশি পরিমাণে শেয়ার জমা হচ্ছে / ডেলিভারি ক্রয় – বিক্রয় হওয়ার পরিমান । এর মাধ্যমে কোনো নির্দিষ্ট স্টক / ফিনান্সিয়াল ইন্সট্রুমেন্টে বিশেষ সম্ভাবনা তৈরী হওয়ার আশা করে অনেক বিনিয়োগকারী পজিশন হোল্ড করেছেন |

আমরা কীভাবে ডেলিভারি ভলিউম ব্যবহার করতে পারি?

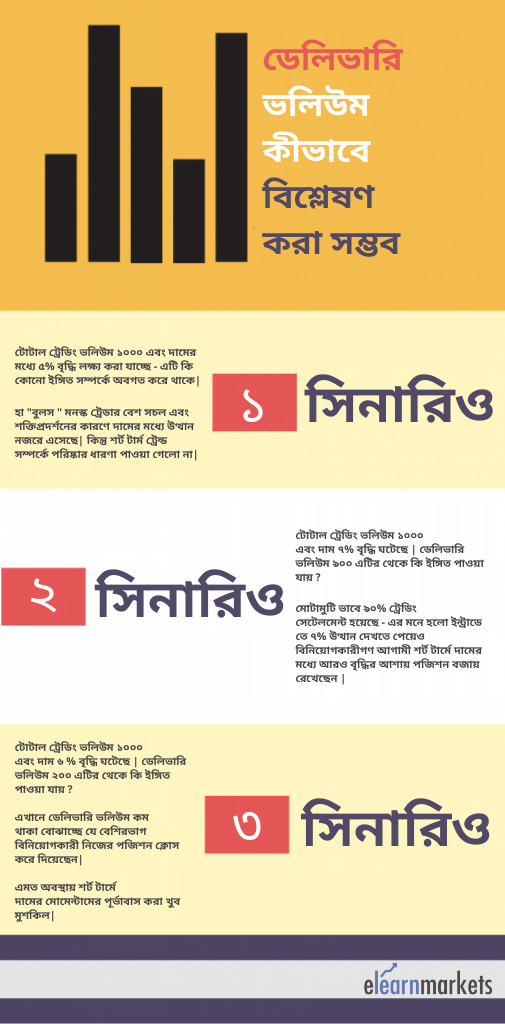

বিশেষত ব্রেকআউটগুলির সময় ডেলিভারি ভলিউম বিশ্লেষণ করে প্রবণতাটির পূর্বাভাস দেওয়া বেশ সম্ভব, ট্রেন্ডটি শক্তিশালী কিনা তা নির্ধারণ করার জন্য আমাদের উচ্চ ডেলিভারি ভলিউম পরিমাণের প্রয়োজন।

আমরা কীভাবে ডেলিভারি ভলিউমটি বিশ্লেষণ করতে পারি তা বুঝতে আমাদের বিভিন্ন পরিস্থিতি আলোচনা করার প্রয়োজন রয়েছে |

ট্রেডেড ভলিউম এবং ডেলিভারি ভলিউমের পার্থক্য :

ট্রেড ভলিউম এবং ডেলিভারি ভলিউমের মধ্যে প্রধান পার্থক্য হ’ল – “কোনো নির্দিষ্ট দিনে কোনো শেয়ার ট্রেড হওয়ার সংখ্যা ” এবং “ডেলিভারি ভলিউম ” ইন্ট্রাডেতে স্কোয়ারঅফ না হওয়া কোনো ডিম্যাট অ্যাকাউন্ট থেকে অন্য ডিম্যাট অ্যাকাউন্টে শেয়ার স্থানান্তরিত হওয়ার সংখ্যা |

আসুন নীচের উদাহরণগুলির সাথে এটি বোঝার চেষ্টা করি :

উদাহরণ ১ :

ধরাযায় এইখানে তিনজন বিনিয়োগকারী রয়েছেন | যথাক্রমে – A , B , এবং C

ট্রান্সাকশন ( লেনদেন ) ১ :

A ১০০ টি শেয়ার ক্রয় করেছে – B ১০০ টি শেয়ার বিক্রয় করেছে |

সুতরাং ভলিউম হলো : ১০০

ট্রান্সাকশন ( লেনদেন ) ২ :

A ৭০ টি শেয়ার বিক্রয় করেছে এবং B ৭০ টি শেয়ার ক্রয় করেছে

ভলিউম : ৭০

সামগ্রিক দৈনিক ভলিউম : ১০০ + ৭০ = ১৭০

A ৩০ টি শেয়ার ডেলিভারি তে ক্রয় করেছে = (১০০- ৭০)

B ১০০ টি শেয়ার ডেলিভারি তে বিক্রয় করেছে এবং C ৭০ টি শেয়ার ডেলিভারিতে ক্রয় করেছে |

সুতরাং A এবং C ডেলিভারি তে ক্রয় করেছে যথাক্রমে ৩০ এবং ৭০টি শেয়ার (৩০+৭০ ) , B ১০০ টি ডেলিভারি শেয়ার বিক্রয় করেছে |

সুতরাং দেখা যাচ্ছে – টোটাল ট্রেডেড ভলিউম ১৭০ এবং ডেলিভারি ভলিউম ১০০

উদাহরণ ২ :

এই উদাহরণে ২ জন অংশগ্রহণকরি রয়েছেন

ট্রান্সাকশন ( লেনদেন ) ১ :

A ১০০ শেয়ার ক্রয় করলো B ১০০ শেয়ার বিক্রয় করলো

ভলিউম : ১০০

ট্রান্সাকশন ( লেনদেন ) ২ :

A ৭০ টি শেয়ার বিক্রয় করলো B ৭০ টি শেয়ার ক্রয় করলো

ট্রেডেড ভলিউম = ৭০

উদাহরণ ৩ :

ওপরের উদাহরণ গুলির মধ্যে যখন ৩ জন অংশগ্রহণকারী ছিল তখন বৈচিত্র লক্ষ্য করা গেছিলো |

ট্রান্সাকশন ( লেনদেন ) ১ :

A ১০০ টি শেয়ার ক্রয় করলো , B ১০০ টি শেয়ার বিক্রয় করলো |

ট্রেডেড ভলিউম : ১০০

ট্রান্সাকশন ( লেনদেন ) ২ :

A ৭০ টি শেয়ার বিক্রয় করলো এবং C ৭০ টি শেয়ার ক্রয় করলো

ট্রেডেড ভলিউম : ৭০

ট্রান্সাকশন ( লেনদেন ) ৩ :

C ৫০ টি শেয়ার B কে বিক্রয় করলো

ট্রেডেড ভলিউম : ৫০

টোটাল ট্রানসাকশান : ১০০ + ৭০ + ৫০ = ২২০

A ৩০ টি শেয়ার ডেলিভারিতে ক্রয় করেছে (১০০ – ৭০ )

B ৫০ টি শেয়ার ডেলিভারিতে সেল করেছে (১০০ – ৫০ )

এবং C টো টি শেয়ার (৭০-৫০) ডেলিভারিতে ক্রয় করেছে |

সুতরাং A এবং C মোট ৫০ (৩০ + ২০) টি ডেলিভারি শেয়ার ক্রয় করেছে , B ৫০ টি ডেলিভারি শেয়ার বিক্রয় করেছে |

সুতরাং টোটাল ট্রেডেড ভলিউম ২২০ এবং টোটাল ডেলিভারি ভলিউম : ৫০

বিশেষ সারমর্ম :-

- ট্রেড ভলিউম হ’ল শেয়ারের সংখ্যা যা একটি নির্দিষ্ট শেয়ারের জন্য ট্রেডিংয়ের সময় দৈনিক ভিত্তিতে লেনদেন হয়।

- উচ্চ ভলিউম সেই নির্দিষ্ট সময়ে এবং দামের রেঞ্জের মধ্যে ট্রেডারদের ভাল সংখ্যায় অংশগ্রহণের ইঙ্গিত দেয়।

- ডেলিভারি ভলিউম : নির্দিষ্ট দিনের টোটাল ভলিউম (বিয়োগ) নির্দিষ্ট দিনের ইন্ট্রাডে ভলিউম |

- ট্রেড ভলিউম এবং ডেলিভারি ভলিউমের মধ্যে প্রধান পার্থক্য হ’ল ট্রেডিং ভলিউম হ’ল এক দিনে লেনদেন করা মোট শেয়ারের সংখ্যা এবং ডেলিভারি ভলিউম হ’ল ইনট্রাডিয়ে ভলিউমের থেকে টোটাল ভলিউম বিয়োগ করা ।