Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

For being a technical analyst, it’s important to understand volume traded along with volume delivery to derive the demand and supply.

Both price and volume are used as inputs for studying the price movements of the stocks.

Meanwhile, the stock exchange also provides additional information about volume known as ‘delivery volume’.

This can help traders to predict near-term market direction.

Therefore, let us understand volume and delivery volume and also differentiate between these two widely used tools in the stock market:

| Table of Contents |

|---|

| What is Volume? |

| What is Delivery volume? |

| Difference between Traded Volume and Delivery Volume |

| Key Takeaways |

What is Volume?

The quantities of share trading in a particular trading session are known as the volume in the stock market. The trading session can be categorized in various time frames such as 5 Minutes, 1 Hour, daily, weekly, and monthly, etc.).

Volume cannot be termed as buying volume or selling volume.

Also Read: Importance of Volume in Trading

For a trade to take place there should be one buyer and one seller.

The high volume indicates good participation of the traders during that period and price range.

Traded volume is the number of shares that are traded on a daily basis during the trading hours for a particular share.

One should remember that when counting traded volume, each buys or sells transaction is only counted once. If A sells 500 shares and B buys 500 shares. Then the traded volume is 500 shares and not 1000 shares.

What is Delivery volume?

It is not necessarily that every trade settles. Some trades are of intraday in nature, in which the trade positions are closed within the day.

Delivery volume can be derived by deducting the intraday volume with total volume.

When the number of shares is taken for delivery it means that more shares are being accumulated. It shows the investors are getting more interested in this stock because of prospects.

How we can use delivery volume?

It is quite possible to predict the trend by analyzing delivery volume especially during the breakouts, we need high delivery volume to determine if the trend is strong or not.

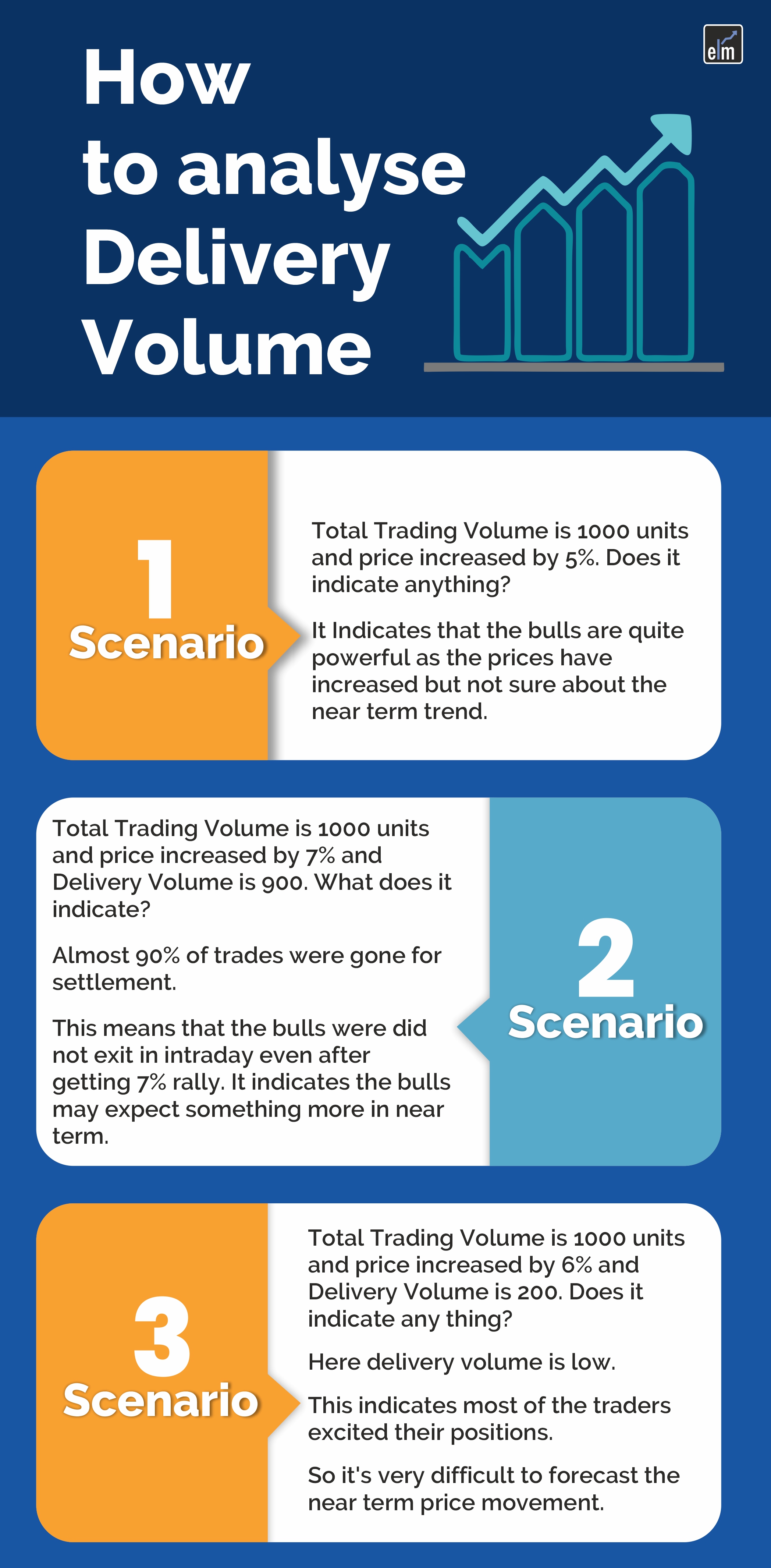

Let us discuss various scenarios to understand how we can analyze delivery volume:

Difference between Traded Volume and Delivery Volume

The main difference between traded volume and delivery volume is that traded volume is the total number of shares traded in a day and delivery volume is the shares that get transfers from one Demat account to the other and are not squared off within a day.

Let us understand this with the examples below:

• Example 1:

When in the same example you have three players A, B, C

Transaction 1: A buys 100 shares, B sells 100 shares

Volume = 100

Transaction 2 = A sells 70 shares, C buys 70 shares

Volume = 70

Total day transaction = 100 + 70 = 170

A buys 30 shares in delivery (100-70)

B sells 100 shares in delivery and C buys 70 shares in delivery

So A and C buys 100 (30+70) in delivery, B sells 100 shares in delivery

Hence the total traded quantity is 170 and the total delivery is 100

• Example 2:

My example took two players,

Transaction 1: A buys 100 shares, B sells 100 shares

Volume = 100

Transaction 2: A sells 70 shares, B buys 70

Volume = 70

So Delivery volume is 100-70 = 30 and Total traded volume in day 100+70 = 170

• Example 3:

When in the above example you have three players A, B, C and transactions are a little varied

Transaction 1: A buys 100 shares, B sells 100 shares

Volume = 100

Transaction 2 = A sells 70 shares, C buys 70 shares

Volume = 70

Transaction 3: C sells 50 shares to B

Volume= 50

Total day transaction = 100 + 70 + 50= 220

A buys 30 shares in delivery (100-70)

B sells 50 (100-50) shares in delivery and C buys 20 (70-50) shares in delivery

So A and C buys 50 (30+20) in delivery, B sells 50 shares in delivery

Hence the total traded quantity is 220 and the total delivery is 50.

Key Takeaways:

- Traded volume is the number of shares which are traded on a daily basis during the trading hours for a particular share.

- The high volume indicates good participation of the traders during that period and price range.

- Delivery volume can be derived by deducting the intraday volume with total volume.

- The main difference between traded volume and delivery volume is that traded volume is the total number of shares traded in a day and delivery volume is the intraday volume minus the total volume.

In order to get the latest information about Financial Markets visit https://stockedge.com/

Can I simply say what a relief to discover someone who really understands what they are discussing on the net.

You definitely realize how to bring an issue to light and make it important.

More and more people must check this out and understand

this side of the story. It’s surprising you aren’t more popular because you surely have the

gift.

Attractive component of content. I simply stumbled upon your site and in accession capital to say that I acquire

in fact loved account your weblog posts. Any way I’ll be subscribing on your feeds and even I fulfillment you access persistently rapidly.

Its great as your other content : D, thanks for putting up. “Too much sensibility creates unhappiness too much insensibility leads to crime.” by Charles Maurice de Talleyrand.

Wow! Thank you! I always needed to write on my blog something like that. Can I take a fragment of your post to my site?