Government has left no stones unturned to save its bag of income in form of taxes which is recycled for building the economy. However, quite often we come across this term called tax evasion.

Let us understand tax evasion with the help of an example:

Mr A earns a substantial income and is required to pay a tax worth Rs. 10 lakh. On contrary to this, Mr. A vide all his ways and means ends up in paying Rs. 1 lakh.

This reduced payment may result from undervaluation of assets or hiding some income or resorting to any other means that shows an under stated income figure.

When income is reduced, eventually, the tax payable gets reduced. This gap in the actual payment of tax and tax actually paid is called tax evasion. So Mr. A has evaded the tax of Rs. 9 lakh and hence, the Government is deprived of its treasury for the said amount.

This entire idea of tax evasion is discouraged through several means of reporting and one such method that we are required to follow is called The Foreign Account Tax Compliance Act (FATCA).

In this article, we will understand what is FATCA and its affects.

What is FATCA?

FATCA is a law in United States (US) specifically meant for financial intermediaries and Foreign Financial Institutions (FFIs) to abstain evasion of US taxes by US citizens who hide money outside US.

The FATCA provisions were initially enacted as a part of Hiring Incentives to Restore Employment (HIRE) Act, later on was made a part of US law.

FATCA is a medium that ensures a well designed information system by providing for greater accountability through eligible documentation and reporting by the concerned person.

Whom will the FATCA affect?

FATCA will affect not only the financial intermediaries per se, but also the entities outside the ambit of the financial groove, in terms of reporting and documentation requirements for the transactions both in and outside US. The major liability of FATCA compliance will fall on the FFIs.

What if you are a FFI?

Under the FATCA provisions, a FFI has following two options:

A FFI may get into an agreement with the tax authority of US for the purpose of reporting the information about the US account holders in the FFIs. Under this option, the FFI becomes a “participating FFI”.

A FFI which does not go for the first option will be required to pay a withholding tax @ 30% on all the US directed payments in the US account holders bag.

For example, Mr X is a US account holder with the FFI, but the FFI is not a participating FFI, as mentioned above. So, in this case, if Mr. X holds receives any dividend income, or interest income pr any proceeds from sale of property, then a withholding tax @ 30% will be deducted from the total receivable.

Hence, FATCA is a regulatory requirement which puts an additional compliance requirement for ensuring transparency in the US tax regime.

How are we as individuals affected?

We are all aware of the of Know Your Client (KYC) requirements. Now whether it is opening of a bank account, a demat account or any other related accounts with a bank or a financial institution, this is a mandatory filter we need to go through.

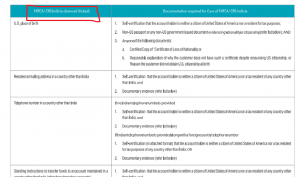

Recently, we came across FATCA requirement in a mutual fund application form. The extract of the application form provided below shows the FATCA requirement option to be complied with.

The above requirement was an example of the FATCA requirement you may come across. Likewise, there may be other areas wherein the FFI you are going to enter into a transaction with, may be in agreement with a US authority and consequently, you as an investor shall be required to be a part of this entire compliance process.

It’s good to manage your income, but unethical to curb Governments bit of income via tax evasion. These disclosures are not additional burden but a regulatory cross check that are least that we can do to safeguard Governments income.

Happy Learning