FII and DII Analysis: Relation with NIFTY price movements

In today’s blog let us dive deep into the analysis of FII DII Data and its relation with NIFTY price movement. The analysis of stock market indices to predict the state of the markets is an important part of technical analysis. Mr. Narendra Modi coming to power as the Prime Minister of India in June 2014 led to the hopes of a long-term bull market.

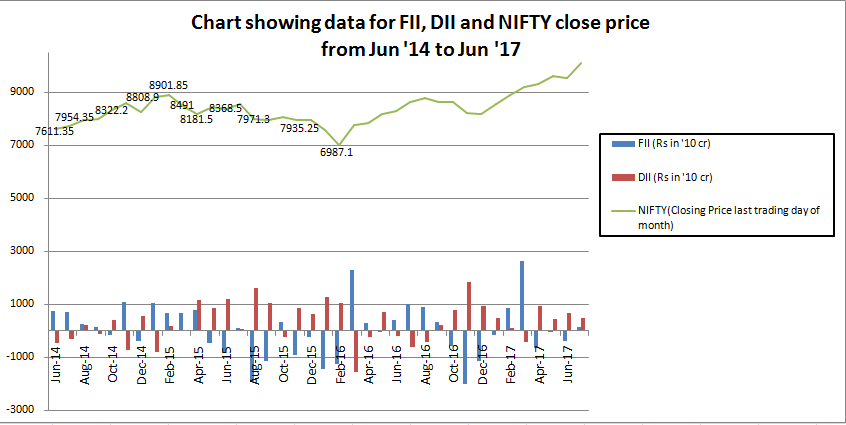

As it can be seen from the chart, soon after the new Prime Minister was elected, NIFTY witnessed a steady upmove for 8 consecutive months (July ’14- Feb ’15).

The sharp correction in February 2016 (NIFTY close price: 6987), combined with the constant downtrend in the past 1 year (March ‘15- Feb ‘16) negated market hopes of the start of a long-term bull market completely.

However, when March 2016 saw an unanticipated rise in NIFTY prices, the hopes were instilled again.

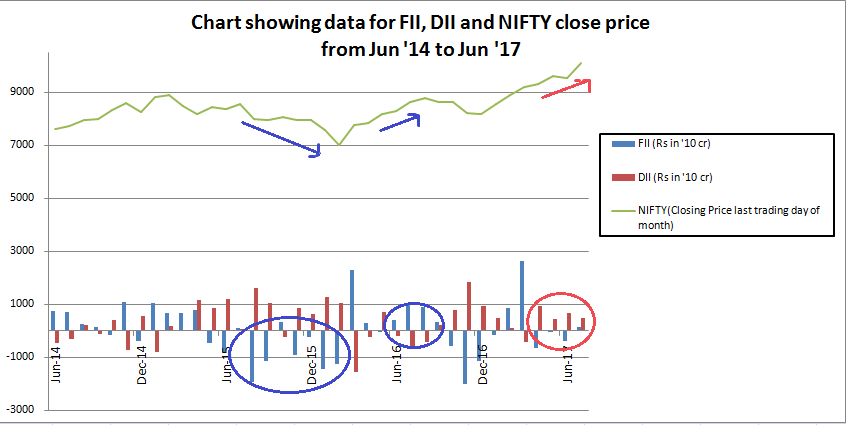

In the above chart, the first thing that the eyes automatically track is the clear change in trend during the period January 2016 to March 2016.

We can see a sharp dip in the NIFTY prices in February 2016, in contrast to a slow gradual downtrend seen in the previous 1 year.

March 2016 marked an upcoming rally in NIFTY prices which seems to be continuing even today.

Although there have been temporary corrections since March 2016, overall there was a clear uptrend.

As of February 2016, not domestic investors but rather, Foreign Institutional Investors (FIIs) were deemed to be the force behind providing a direction to the Indian markets.

This is because, according to the Indian Express, FIIs held around 40% of the free-float of Indian markets.

And according to this guiding principle, FIIs which sold Rs. 125.13 crore worth equities in February 2016 can be assumed to be the reason behind the fall in the NIFTY prices in that month.

FIIs had moved out, citing trouble from a global growth perspective and on account of incurring losses in commodity and oil prices, combined with the phenomenon of increasing Non-Performing Assets (NPAs) of the Public Sector Banks in India.

Since the market mayhem was mostly driven by global factors, Domestic Institutional Investors continued to show positive figures (buying trend) in February as well.

Throughout the downtrend from March 2015 to February 2016, DIIs have almost always been highly positive (net buyers) and FIIs have almost always been negative (net sellers).

This can lead us to make an assumption that there was fundamentally no or minimal problem in the nation and the market movement, driven by FIIs was a result of a global outlook.

November 2016 witnessed FIIs selling equity stake worth Rs. 199.82 cr, a direct impact of the government announcing demonetization of 500 and 1000-rupee notes, combined with the surprising results of the US Presidential elections.

March 2017 witnessed extremely high FIIs in the Indian market.

With NIFTY ending higher for the 3rd consecutive month in March 2017, FIIs recorded the highest monthly inflow in the history of India, according to the data provided by Central Depository Services (India) Ltd.

The higher high of NIFTY and the huge FIIs reflecting higher investor sentiment seemed to be the result of a change in ruling party in Uttar Pradesh with the election of a new Chief Minister.

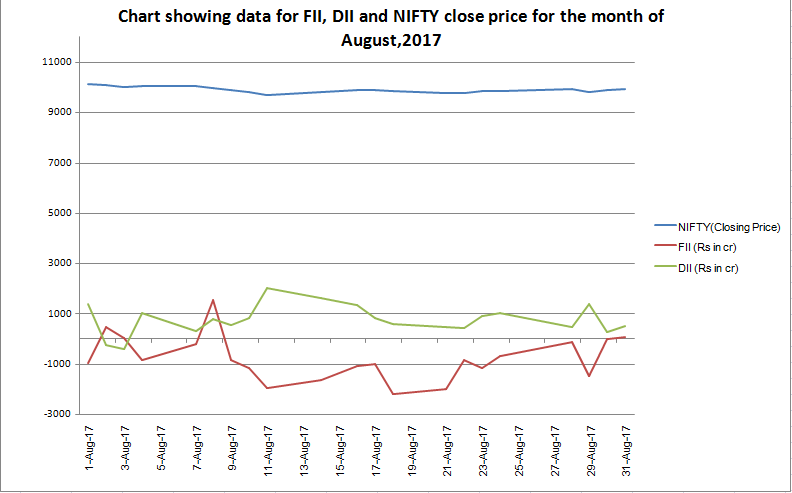

As we can see from the chart above, FIIs no longer dominate the trend of the market, that is, they no longer determine the direction of NIFTY price movement.

Since June 2017, DIIs have come to dominate the NIFTY price movement and this can also be seen in the August 2017 chart (below).

Despite continued selling of FIIs throughout the month, NIFTY remained around its range of 9711-10115.

Thus, a detailed analysis of the month of August 2017 shows us a constant selling trend in FIIs with the exception of 8th August 2017. This day witnessed heavy buying in both FII and DII of around Rs.1539 cr and Rs. 798 cr. respectively. The entire month witnessed positive DII values and hence, we can assume that internally, the Indian economy is quite secure and steadily growing.

You can get a more clear understanding of the analysis of FII DII data relative to the NIFTY Price movement by watching the video below:

Bottomline:

Thus, we can see from the above article that FII and DII analysis acts as an important force to influence the Nifty movement to a large extent.

NOTE: All data has been taken from the StockEdge.

Discover FII DII monthly data from the StockEdge App. Also, find FII F&O data in StockEdge.

All the above FII and DII Analysis are for the cash market.

Also Read: FIIs Importance In Indian Stock Markets

Keep Learning!!