Is gold part of your investment portfolio? Not yet? Let me tell you that according to most financial advisors, gold should constitute about 5-10% of your investment portfolio depending upon your risk appetite. The reason is that it not only provides diversification benefits but also acts as a safe haven during the financial crisis. Want to learn the basics of investing in gold and other commodities? Join the NSE Academy Certified Currency & Commodity Markets course on Elearnmarkets.

Read More: Is it a Good time to Invest in Gold?

During the period of financial distress, gold acts as a safe haven.

In the last decade, it had rallied from Rs 10,800 to Rs 29,668 per 10 gm giving a CAGR of 10.23%.

Gold witnessed a steep rally since the stock market crash in 2008 i.e. where other investments were struggling to provide even the normal return, the yellow metal outperformed all asset class in that period.

The reasons for the inclusion of gold in your investment portfolio are stated below-

1. Safe haven

It acts as a safe haven both during the time of financial as well as geopolitical uncertainty since people has a tendency to shift to safer asset class during the crisis. It is also known as crisis commodity.

2. Hedge against inflation

Gold has a tendency to go up with the increase in the cost of living of individual and it has acted as an excellent hedge against inflation in the past.

Know More: The Uninvited Guest – Inflation

3. Diversification benefit

Gold as an asset class provides diversification benefits since it has a negative to low correlation with stocks and other financial assets.

4. Boost by the government

The proposal made by the government to provide tax benefits on Gold bond and monetization scheme has made an attractive option for the investors to invest in gold.

Let’s understand various options for investment in gold which includes Physical gold, Gold ETF, Gold funds, Gold bonds and Gold monetization scheme.

Source: MoneyControl

The decision of the government to provide tax benefits on Gold bonds and Gold monetisation scheme in the budget has made gold an attractive investment option for the investors and it is sure to increase the demand in the days to come.

In India people love gold and you can find it probably in every Indian household. Moreover, it’s customary in the Indian wedding.

Gold investment through Demat account

Purchasing gold in physical form like jewelry may pose a resale value problem or concern over impurities.

But you can use your demat account to invest in gold without any such issues.

Let’s understand the various ways of gold investment-

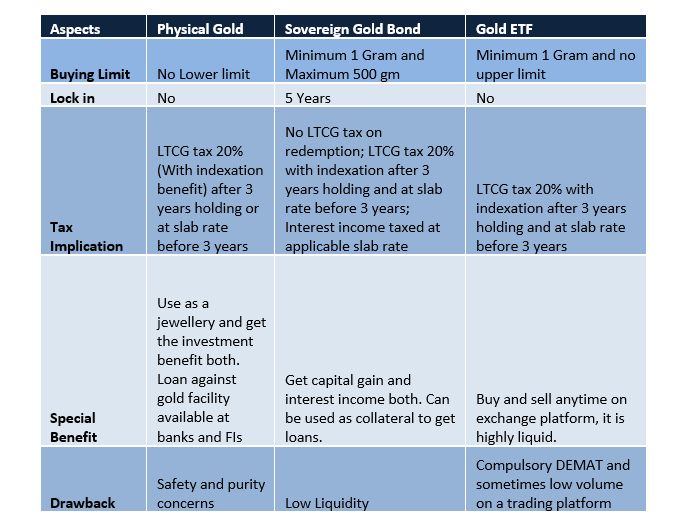

Gold ETF

It’s a great way to invest in gold without any hassle of storing them. These are passively managed fund which tracks the prices of gold and invests in gold bullion.

It’s a smart and simple product which provides the simplicity of investing in gold and the flexibility of stock investment.

The best thing is that you can buy as small as 1 gram of gold.

You just need to have a demat account to buy and sell gold ETF. Here you do not need to worry about the quality of gold. Moreover, it gives you tax benefit and is a much safer option.

Read More: Why to Invest in Gold ETF in India

E-gold

It’s an electronic form of investing in gold and you are allowed to convert in physical gold at anytime you want to.

You should have a separate demat account to invest in electronic gold or e-gold.

The life of investors has become much simpler with the introduction of e-gold and it has become common these days.

You just need to visit the NSEL website and choose a depository to open the demat account. Once it’s open, you are ready to trade in gold online. You are required to buy in units which correspond to 1 gram.

Gold funds

As the name suggests, they invest in the various form of gold which could be either physical gold or the equity stocks of gold mining companies.

Here the investors can buy pure gold at low cost and can also sell them anytime at market price.

These are very similar to mutual fund investments.

Here you don’t require a demat account and it works same as other gold investment options.

There is a complete safety associated with these account and you do not need to worry about your gold investment.

These options are simple and a great way to invest in gold but you should conduct your own research before making an investment.

Key drivers for gold

1. Investors

The increase in the number of investors has played a key role in driving the gold price. The rise in gold price and the safe haven status has attracted many investors in the recent past. After the 2008 market crash, people diverted their money in gold since they lost faith in other asset class. The sudden increase in the number of investors has led to such a massive move.

2. Oil Price

Gold and Crude oil are inter-related and often goes hand in hand. The reason may be that crude prices are inflationary and gold acts as a hedge against inflation. With the increase in inflation, the value of gold also increases. Gold acts as a hedge against the rise in oil price.

3. Dollar

Gold is quoted in terms of U.S. dollar. It is generally seen that a weaker dollar leads to rising in the gold price and vice versa. This may be since people often invests and trades in the dollar when the dollar is strong. However, during the time of uncertainty in the economy, people prefer to invest in gold since dollars becomes weak.

4. Central bank’s reserves

Central Bank holds gold in reserve which it purchases from bodies like IMF (International Monetary Fund). Most of the nations around the world have reserves consisting primarily of gold which includes U.S., France, Greece etc. When they buy or sell gold, it impacts the price of gold.

5. Global jewelry demand

The major demand for gold is in the form of jewelry which accounts for about more than 50%. Some of the largest consumers of gold in the form of jewelry are India, China and U.S. So a change in demand for consumer goods like jewellery may have a significant impact on the gold price.

6. Geopolitics

Gold is proclaimed to be a “safe haven” and it has been proved in the number of times in the past. Say whether it was Soviet Union invasion of Afghanistan in 1980 or Iraq invaded Kuwait in 1990 or when Arabs descended into a civil war in 2011, each time the gold spiked up significantly. During the period of uncertainty in the economy, you will find people rushing toward gold.

Bottomline

I personally believe that one must include gold in their portfolio. Rather than waiting for the right time to invest in gold, I think it’s better to start investing in gold periodically over the years. The reason is that it not only helps to fight inflation but also acts as a safe haven during any trouble in the economy.

Take care and keep learning!!

Very nicely written!!

Thanks for sharing Ankit.

Thanks Sanjana!

You may also like this article on gold:

http://www.elearnmarkets.com/blog/7-reasons-why-to-invest-in-gold-etf/

Well written….Thanks for the great information on gold investment especially through demat account.

Thanks Venkat!!