Understanding how the Indian capital market works is an essential prerequisite to learning how to trade and invest.

In general terms, capital means finance. To keep the economy rolling, finance lubricates the growth pattern of an economy. For example, you may have a huge amount of liquid cash at your disposal. Keeping them in your locker will not help the money multiply.

Alternatively, you may move such funds into the bank or financial institution and invest in various schemes, so in turn, this money will flow into the economy via financial markets. Saving not only generates funds for you but also for the economy as a whole.

Thus, the Indian capital market plays a vital role in the mobilization of these savings/liquid cash for investment purposes.

By allowing a platform for infusing capital into the economy, trading securities, raising long-term finance, etc., the financial market plays an imperative role in keeping the economy rolling.

Table of Contents

Components of Financial Markets

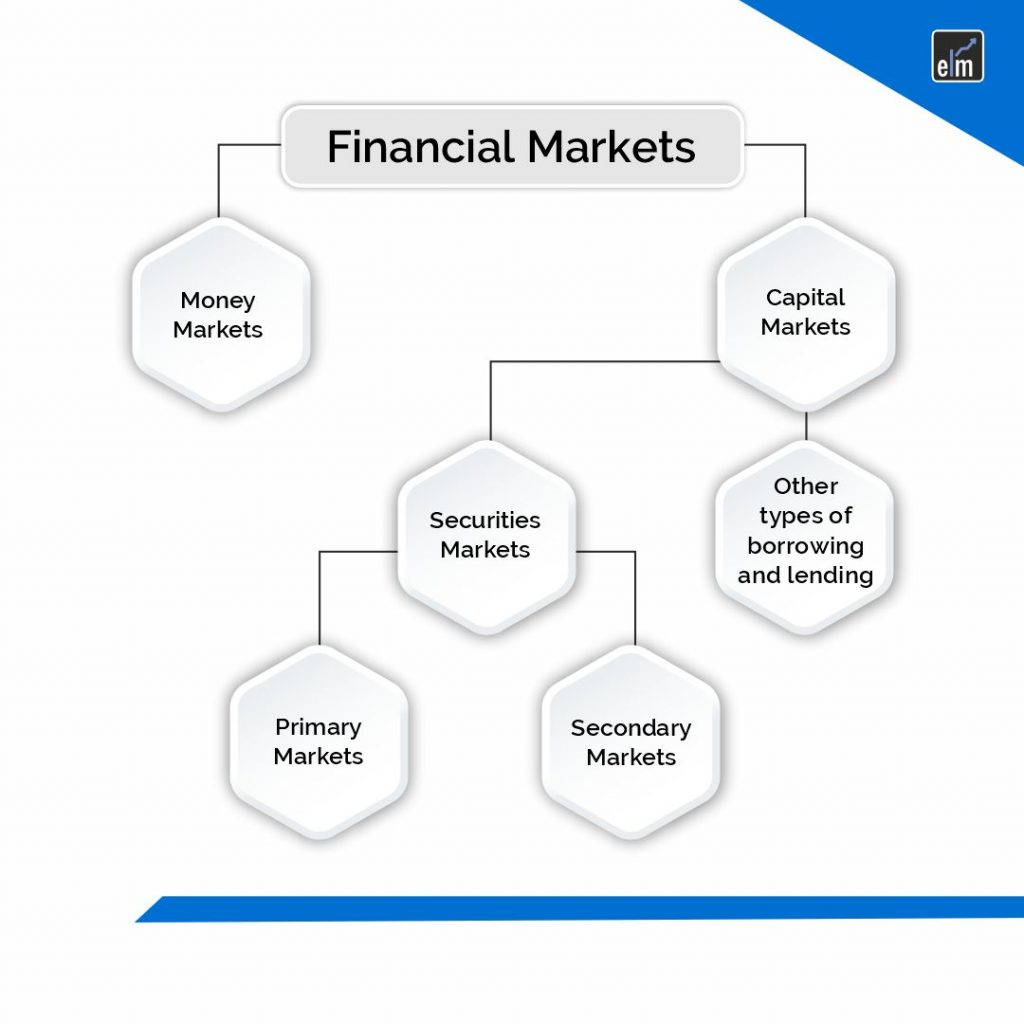

Financial markets are majorly divided into the following components:

What is a Capital Market?

Capital markets are a type of financial market. It is a market for buying and selling financial securities. It acts as a conduit in the flow of funds from the savers to the fund seekers.

In fact, capital markets are the most popularly followed financial markets.

The spontaneous platform provided by the capital market helps the Government and businesses to raise funds for a variety of long-term purposes such as the expansion of business, mergers and acquisitions, etc.

In the case of capital markets, the money is pooled for a period of more than a year.

As compared to what capital markets were in the past, the present capital market system is well equipped with an electronically based trading system which provides an expansive platform, bringing together traders from different zones and countries.

The capital market and in particular the stock exchange is referred to as the barometer of the economy. – ICSI study material

What is a Securities Market?

The securities market provides the platform for those financial instruments that are transferable by sale.

It further comprises two important components: the primary market and the secondary market.

Primary markets deal with newly issued stocks and securities, whereas secondary markets deal with already issued ones.

1. Primary Market

Primary markets allow the mobilization of funds via the issue of new securities.

Such funds are primarily utilized for long-term purposes, such as starting a new project or modification of an old project.

For example, Company A Limited requires funds. It issues shares in the primary market. When the company issues shares for the first time, it is called Initial Public Offering (IPO). A further issue of shares is known as a Follow-on Public Offer (FPO). The primary market comprises of both IPO and FPO.

2. Secondary Market

The secondary market, primarily consisting of the stock exchange, provides a forum for buy-sell of already issued securities.

After the listing of securities in the stock exchange, the investor can trade in such securities in the secondary market.

For example, Trading on the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), Calcutta Stock Exchange (CSE), etc.

For example, You want to buy shares of TATA Steel.

When you open the NSE website and type TATA steel on the search block, you get complete details about that particular stock.

Similarly, for any other stock that you wish to trade in or carry it for long-term purposes, you can get complete details herein.

Apart from the stock exchanges, there are several websites that show you the market statistics, stock prices, etc, such as www.moneycontrol.com.

2) The Secondary Market is further classified as follows:

- Spot market: The delivery and payment of securities are made immediately without delay.

- Futures Market: Securities are bought and sold for some predetermined future date.

Money Market

The borrowers and lenders can avail of short-term funds for up to a maximum period of one year. Money markets are highly liquid in nature, carrying low default risk.

Unlock the secrets of the Indian Capital Market with our Futures Trading Course. Start your journey today!

Bottomline

Thus, capital markets initiate the entire process of mobilization of savings and channel such savings to those sources through the investors. The growth of the economy is marked by the process of flow of funds through the aforementioned markets.

Frequently Asked Questions (FAQs)

What is a capital market?

A capital market is a type of financial market where derivatives, stocks, bonds, and other financial securities are traded by both individuals and institutions. It makes it easier for money to move between lenders and investors.

How does the capital market function?

The way the capital market works is by connecting entities (like governments or firms) that need finance for a variety of reasons with investors who have money to invest. By buying the securities these companies issue, investors give them money for expansion or investment initiatives.

What are the primary components of the capital market?

The stock market, which is where shares of publicly traded firms are bought and sold, and the bond market, which is where debt securities are purchased and sold, are the two main parts of the capital market. Furthermore, there exist markets for derivatives where contracts get their value from underlying assets like bonds, currencies, stocks, or commodities.

Hello Shruti! This blog explains about the Indian capital market in great depth..For someone like me, who is new to this market, it was very helpful..Thanks for sharing your knowledge..

@Sukanya – Hi, Thank you for reading through and appreciating.

We will be further coming up with blogs on related topics. Let us know in case of any similar topics you wish us to add further.

Happy Learning

Hi, Thanks for sharing the basic details around Indian capital market and I was searching for details on it. Actually I am currently pursing CFA level 1 exam and am going through all the educational site to give basic insight around finance anf found it very useful

Hi Mudra,

Thank you for appreciating. Let us know in case you need to know about any similar topics.

We would be glad to provide details on same.

Thank you for the information. We can also add Currency markets being the largest market in the world. This includes all aspects of buying, selling and exchanging currencies at current or determined prices. Currency markets is a global decentralized or over-the-counter (OTC) market for the trading of currencies. Foreign Institutional Investors (FIIs) to participate in Indian Currency Exchange platform to trade and/or hedge with lower costs and higher leverage in an organized regulated environment as compared to the OTC market.

I had been freed from the bracket of ambiguity that I involved in. Your blog gives explicit insight about money and capital market. Thank enormously. Improve on

Welcome