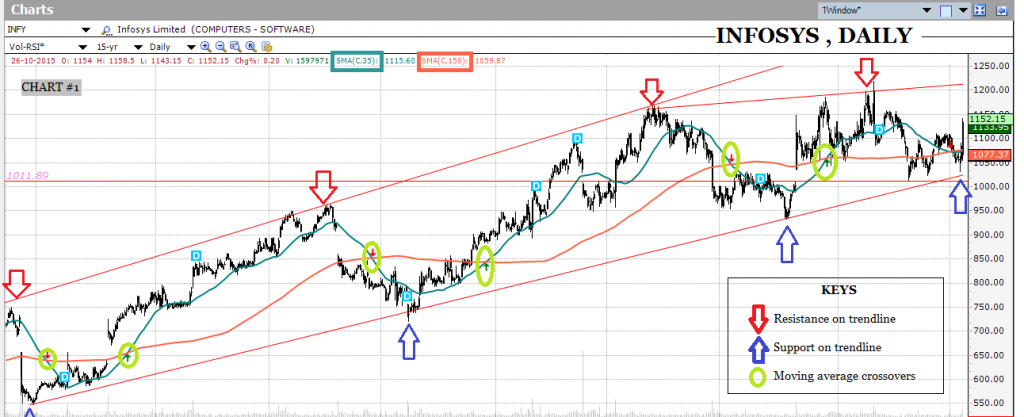

INFOSYS, DAILY:

Infosys is one of the most beloved stock in Nifty that trades on the exchange. Amazing patterns and mind-blowing confirmations are a common thing on this stock’s chart. Today, following the announcement of its Third Quarter result, it has given a very sharp move on the upside. Let’s look at the charts and dissect this movement, identifying signs which hinted towards it.

We will study the following phenomenon on the daily chart of INFOSYS :

- Resistance on trendline – leading to downturn in prices

- Support on trendline – leading to upturn in prices

- Moving average breakout- effective signal of trend change

In Chart # 1, the blue arrows are marking the points where Infosys has bounced back sharply making new highs, whereas the red arrows are marking the points where Infosys has halted its advance and made higher low, as are customary in an uptrend. According to Dow Theory, this sequence of higher-highs and higher-lows are components of an uptrend and as long as this keeps happening, the trend is considered intact. Also plotted on the charts are two simple moving averages (SMA): 35-day and 150-day.

Moving averages, as the name suggests, are the average of the stock’s closing price for a specified period. The crossover in two SMAs is a trend change signal more often than not. On the chart of Infosys, the green circles highlight the crossovers between the 35 day SMA and the 150 day SMA.

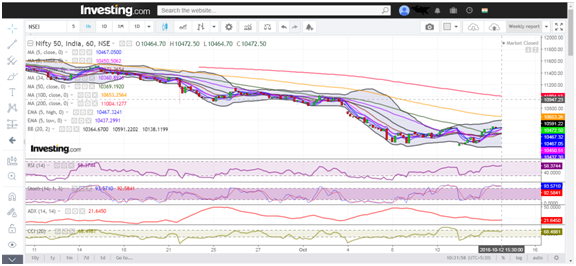

Now if we zoom into today’s movement and look at Chart # 2, there are two points we need to focus upon:

1) On 12th January, Infosys had taken support on the lower trendline and ;

2) The next day it gave a closing above the 35 day SMA and 150 day SMA together.

Such phenomenal signals and confirmations are rare to observe. This is a text-book-perfect example of the strength of a trendline in supporting falling prices and the importance of a moving average in marking out opportunities on days when prices ‘close’ above them.

Lastly, given the chart development and the phenomenal response to trendlines, naturally 1220 becomes the next resistance zone to look out for in the days to come.

Do you know how to read charts and patterns? Check out for NSE Academy Certified Technical Analysis course on Elearnmarkets.

Good day! I just wish to give a huge thumbs up for the good info you will have right here on this post. I can be coming again to your weblog for extra soon.

I am constantly looking online for articles that can help me. Thank you!

Some truly nice and useful info on this site, also I think the style holds fantastic features.