By this time, we know what are mutual funds, how to read a mutual fund offer document and other related topics. You can also join the NSE Academy Certified Financial Planning & Wealth Management course on Elearnmarkets to learn more.

We all are aware that howsoever hungry, we may be, but if we can’t eat the delicious food in front of us, then it’s all vain.

Likewise, we may know as to what mutual fund is, types of mutual funds scheme, however, if we are not aware as to how to invest in a mutual fund scheme, then the knowledge gained becomes a waste.

In case you want to know in which type of mutual funds scheme, you should invest in download Kredent Money App

In this article, we will be discussing the steps to be followed by investing in a mutual fund scheme.

Also, we will be talking about the methodology to be followed for investing in a mutual fund scheme.

Want to know more about how to invest in mutual funds ? Watch the video below:

Beginners guide

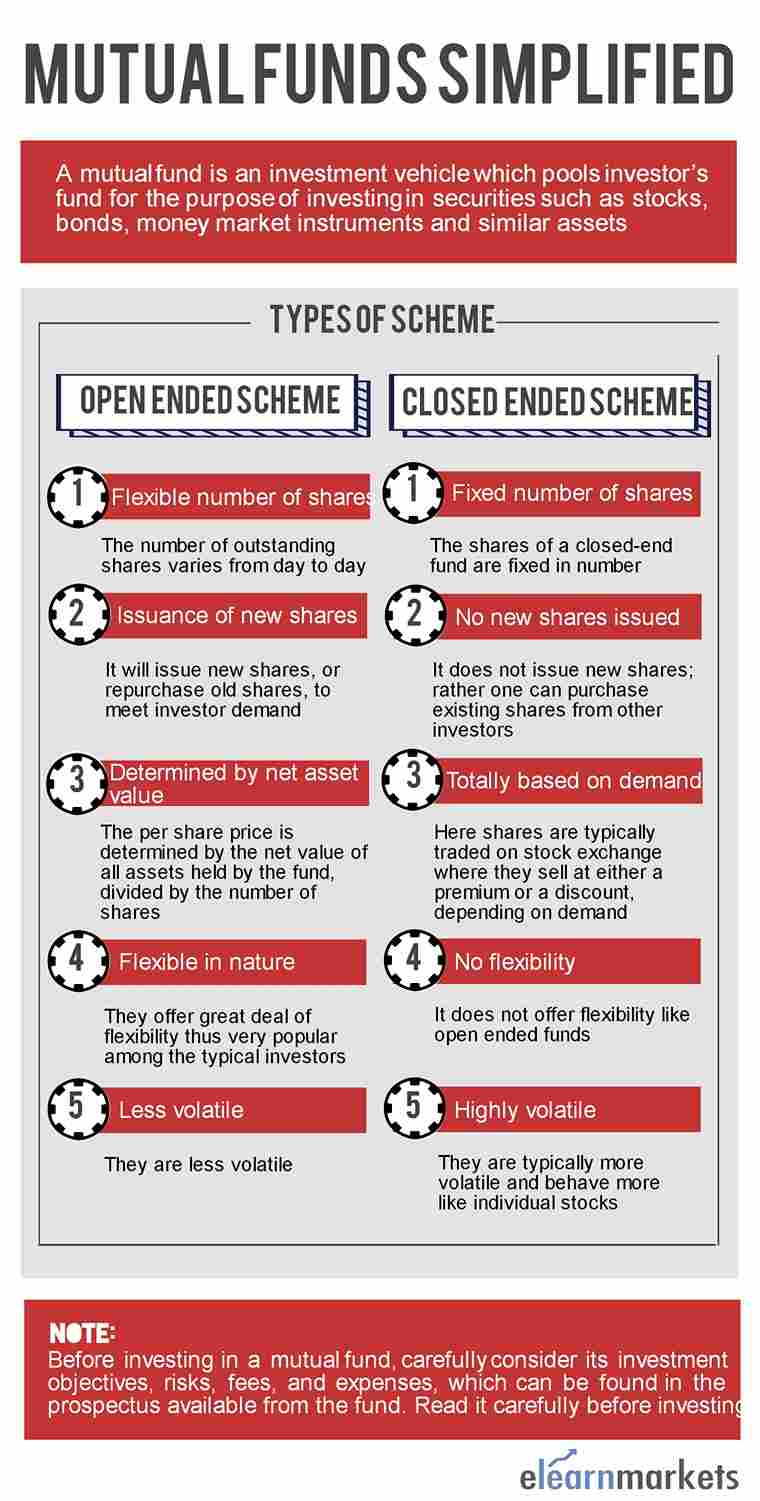

There are two ways of investing in a mutual fund scheme:

Online mode:

The investor can register themselves online through the online investment portal facilitated by the Asset Management Companies (AMCs).

Offline mode:

Under this mode, the investor can either consult the financial intermediaries or walk in to the nearest branch of the mutual fund company.

Financial intermediaries comprise of brokerage houses, banks or certified financial advisors.

Once you are aware of the online and offline mode, one of the pre-requisite before investing in a mutual fund scheme is the documents in either of the aforementioned modes:

- Permanent Account Number (PAN)

- Photograph

- Proof of Name & Address

- Know your client (KYC) & Foreign Account Tax Compliance Act (FATCA)requirements

- Bank Details

The above documents are required mandatorily.

Apart from these, additional documents may be asked depending upon the requirements of the mutual fund scheme you invests in.

Online mode to invest in mutual fund scheme:

The following steps are required to be followed for investing in a mutual fund scheme through the online mode:

- Go to the online portal; register yourself by providing the necessary information asked for.

- The user will receive a pin number in its corresponding e-mail id and the registered mobile number.

- With the help of the pin number, create your own User ID and password for security reasons.

- Proceed with the login bit.

- Go ahead with your investing plans. Happy investing.

Offline mode to invest in mutual fund scheme:

Under this method you need to personally approach the agent or the branch of the mutual fund company and will need to follow the following steps:

- Fill in the application form and provide the necessary information required in the form.

- Annex the documents asked for along with the cheque or the demand draft as required

- Under this mode, the mutual fund company will issue a folio number and will also give an account statement.

Bottomline:

Technology is growing invariably.

More than anything else, the smart phones have added an additional; mobility to the work that we want to get done.

The investors can now download applications (apps) on their smartphones which can help them to switch from one mutual fund scheme to another mutual fund scheme on the tips of their hands. These apps also help in managing the portfolios.

The above methodology gives you a broad view of the modes that you can opt for in order to give a head start to your investment in the mutual fund scheme.

Now, when you know so much about the investment in a mutual fund scheme, don’t delay anymore. Go ahead, click on the online or offline mode and streamline your investment plans accordingly.

Happy Learning!1

Mention the good mutual fund of different companies.

Mr. Mohanty,

Thank you for reading the post. Our blogs are basically educational and we do not render any professional advice in this regard.

However, please consult a SEBI registered financial advisor for seeking professional advice.

In case you need any finance related academic guidance, please suggests us a topic, and we would be happy to do the needful.

Thanks for guidance of investment of mutual funds.

Mr. Singh,

Thank you for evincing interest. Please let us know any other finance related topic on which you wish to seek any academic guidance.

Please mention the names of the mutual funds which can produce good short term returns in the current market scenario.

Mr. Majumdar,

Thank you for reading the post. Our blogs are basically educational and we do not render any professional advice in this regard.

However, please consult a SEBI registered financial advisor for seeking professional advice.

In case you need any fiance related academic guidance, please suggests us a topic, and we would be happy to do the needful.

Thank you for sharing with us, I think this website truly stands out : D.