–“Big gains come in small packets”. This phrase suits well for small cap stock universe. We have seen in the past that small-cap stocks have over the period turned out to be multi-baggers and also have evolved with time to turn into mid-cap and large-cap stocks. To get a comprehensive idea about the different types of mutual funds you may do: NSE Academy Certified Financial Planning & Wealth Management course on Elearnmarkets.

The small-cap stocks must be selected very carefully with proper analysis because it has the potential to be multi-baggers as well as wealth eroders if proper due diligence is not performed.

History of Small Caps

In the past, we have seen that some quality small-cap stocks have delivered high returns to the investors while others have eroded their entire capital.

From the above, we can observe that over the period, the small-cap has the potential to outperform the mid and large-cap stocks.

It can be seen that after the NDA led government came to power in 2014, the small caps witnessed a bull run. But 2018 has seen the small-cap stocks correcting after a big bang Run and high valuations.

How to select Small caps

After the recent correction, some of the small caps have become relatively cheaper and look attractive in terms of valuations. Moreover, after the re-election of NDA in the recent elections, the small-cap universe can get boosted by the various government policies and initiatives.

To get assistance on which type of mutual funds you should invest in, you can download: Kredent Money App

The small-cap stocks should not be viewed in totality but should be viewed in isolation depending upon the business model, quality of the management, valuations etc.

In the current scenario, the overhang which prevailed that all small caps will generate returns have backfired and only the quality stocks with a good pedigree of business have continued to generate returns for the investors.

There is still value unlocking potential in selected small cap stocks which makes us bullish on the small-cap space.

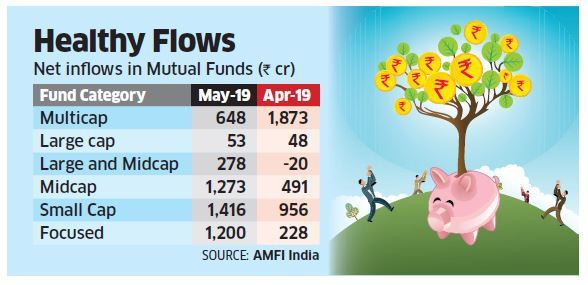

The small-cap funds have also gained investor’s interest after the recent meltdown in the stocks and hence the inflows in these funds have started improving. The inflows in the small-cap funds are better as compared to the previous year through both direct and SIP route, which shows confidence among the investors for the revival of them.

The inflows in the small-cap funds are better as compared to the previous year through both direct and SIP route, which shows confidence among the investors for the revival of them.

There are many investors who have been stuck in the low-quality small cap stocks which have eroded investor’s wealth, but as historically observed over the long term only quality stocks survive.

Hence investors should not blindly exit stocks because they have corrected from their highs but they should stay invested in quality business stocks which can deliver good returns once their earnings start reviving.

We can also call it as Survival of the fittest in the gloom and doom.

Hence our advice to the investors stuck in these stocks is to exit the stocks which have quality issues, corporate governance issues and stay invested in the high-quality stocks which will over the period help them make good money.

Thus invest wisely and sit tightly.