Listen to this:

An investor is often confused in terms of which financial statements should be used to make investment decisions i.e. to analyze standalone vs consolidated financial statements or both.

Let us understand what is the difference between both and which should an investor analyze or are both equally relevant.

| Table of Contents |

|---|

| What are Standalone Financials? |

| What are Consolidated Financials? |

| Financial Statements – Case Study |

| Which Financial statements should be used for analysis? |

| Key takeaways |

What are Standalone Financials?

Standalone financial represents the financial statement of the entity as a single entity i.e. the financial represents only the position of the single entity.

By analysing the standalone financials the investor will not be aware of the position of its subsidiaries which might affect its investment decisions.

For Instance, the parent company might be a debt-free company but the subsidiaries of that company may be heavily debt-laden and hence this vital information could be missed out on the standalone financials.

What are Consolidated Financials?

Consolidated financial represents the financial position of the group as a whole i.e. the parent along with its subsidiaries.

By analyzing the consolidated financial statement the investor gets an overall view of the position of the entity i.e. the shortcoming of the standalone is overcome by analyzing the consolidated financials.

Also Read : Consolidated Financial Statements

The consolidated gives an overall view of the entity and makes the investor better informed about making the investment decisions.

For instance, the heavy debt in the books of the subsidiary which was being missed while analyzing the standalone finances of the parent could be identified in analysing the consolidated financial.

However, because the subsidiaries form one economic entity thus investors, regulators, and customers find consolidated financial statements more beneficial to gauge the overall position of the entity.

For Instance,

The parent and the subsidiary perform transaction among them as if they are unrelated. An automaker, for example, might own the company that makes its transmissions, but still pays that company for the transmissions it provides.

Or

The parent company supports the subsidiary during struggling time in a hope to recover the amount paid to subsidiary from its operation.

Transactions of this nature will appear on standalone financial statements because they affect the profitability of the standalone units. But such transactions do not appear on consolidated statements because they don’t affect the overall nature of the larger company.

When a parent owns stock in a subsidiary, the stock have different treatment in the books of parent and subsidiary, the stock appears as an asset on the parents standalone balance sheet but as equity on the subsidiary’s sheet.

When the parent buys something from the subsidiary, or vice versa, each accounts for the transaction to be shown separately on its cash flow or income statements. If one party lends money to the other, the treatment is different from both perspectives; the loan is an asset on the lenders balance sheet and a liability on the borrowers.

During consolidation, intra company transactions will be eliminated to avoid double recording of the transactions..

The listed companies do not disclose detailed financial position of their unlisted subsidiaries in the annual report. Therefore, to find out the utilization of cash or investment made by the subsidiary companies, an investor needs to compare the standalone and consolidated financials.

Financial Statements – Case Study

To compare standalone and consolidated financial statements, let’s assume that a company XYZ Ltd only makes investments in subsidiaries and it does not have any other business operation of its own.

The only income XYZ Ltd shows in its profit and loss statement (P&L) is the dividend income received by it from its subsidiaries.

Further let us assume that all the subsidiaries of ABC Ltd are making huge losses.

But sometimes the subsidiaries survive by taking loans from banks and use these loans to declare dividends for its shareholders like XYZ Ltd.

If in such a situation, while analysing XYZ Ltd, an investor considers only the standalone financials of XYZ Ltd,

Then it will be found that XYZ Ltd has very little debt and is showing profits due to the dividend received from its investments in its subsidiaries

However, if the investor analyses the consolidated financials of XYZ Ltd, then they would immediately come to know that XYZ Ltd (as a group including its subsidiaries) is making huge losses and have loans outstanding.

The investor would immediately become aware of the problems being faced by XYZ Ltd.

Therefore, after analysing consolidated financials of XYZ Ltd, the investor may take a better informed investment decision.

Which Financial statements should be used for analysis?

From the above understanding of the consolidated and standalone financial statements, we could conclude that analyzing the consolidated financial statement is better than analyzing the standalone financial statement.

In analyzing the consolidated financials the investor is well informed about all the transactions and information which might be missing in analyzing the respective standalone financials.

For instance, the debt structure which looks good in the parent book and heavily indebted in the subsidiary book might be correctly captured and understood in the consolidated financials.

Moreover, for a better-detailed analysis, the investor should lay more emphasis on the consolidated financials but at the same time analyze the standalone along with it because it will give a detailed analysis and better understanding of the financials on an individual basis also.

Also Read : How to better analyse Financial statement of a company

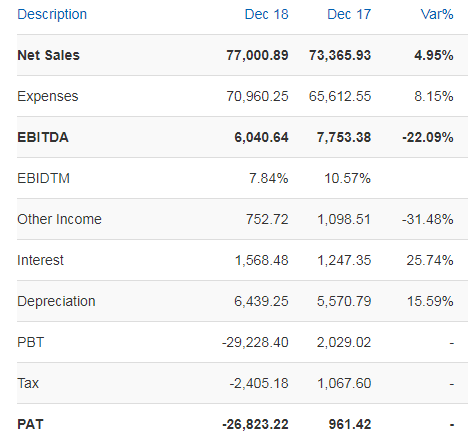

Comparative analysis of EBITDA

Company: Tata Motors Ltd

Below is the quarterly financials of Tata Motors Ltd both consolidated and standalone.

Analyse the EBITDA in both the financials below:-

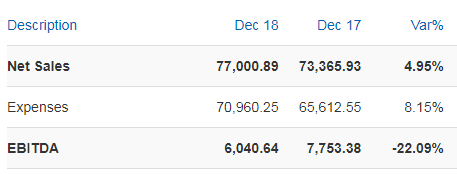

Consolidated Basis

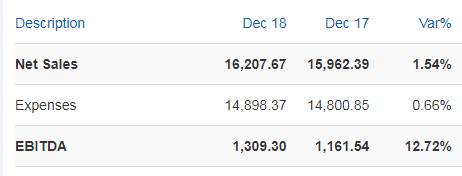

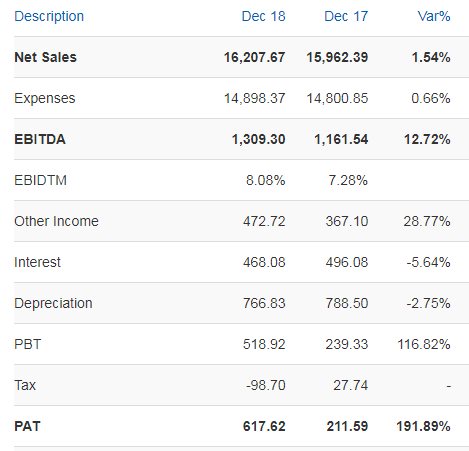

Standalone Basis

By analysing the EBITDA from both standalone and consolidated basis, we derive that the major portion of the ebitda are from the subsidiaries.

The company’s standalone ebitda makes up a very small portion of the consolidated ebitda and hence any major changes in the subsidiaries in any aspect will have a larger impact on the group as a whole.

Therefore, for making any decisions regarding this company, a close watch needs to be kept on its subsidiary’s operation because they play a significant role in the group as a whole.

Comparative analysis of Trade Receivables

Company: Tata Motors Ltd

Now let us analyse the Trade Receivables of Tata Motors for both standalone and consolidated basis for the year ended 31/03/2018.

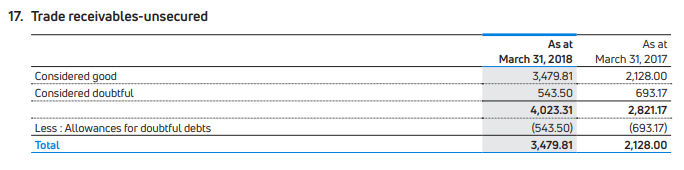

Standalone Basis

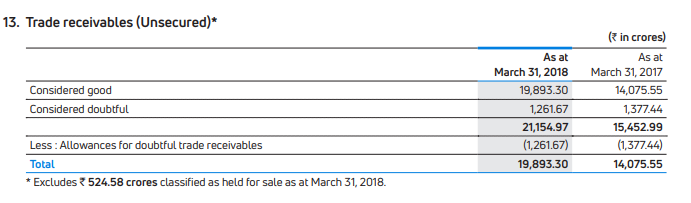

Consolidated Basis

We need to analyse the trade receivables in both standalone and consolidated financials.

The reason being, the transaction between the parent and the subsidiary will automatically be cancelled in the consolidated financials.

This implies that the company needs to analyse the subsidiary’s receivables carefully because they make up a major portion and any default on their end will affect the company.

Hence this will help in knowing the quantum of receivables between parent and subsidiary.

This can be noticed by the investor only if they analyse both the standalone and consolidated financials of the company.

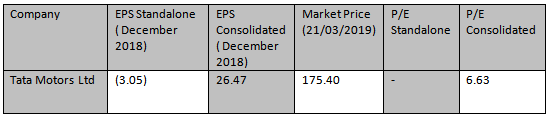

Comparative analysis of P/E for the quarter ended 31/3/2018

Company: Tata Motors Ltd

On a consolidated basis, the company’s P/E is 6.63.

The investor will not be able to calculate P/E ratio if analysing only standalone financial because the standalone earnings are negative.

Therefore the P/E could only be calculated on a consolidated basis as the earnings are positive.

- Hence the investor will be benefitted by analysing financials both standalone and consolidated.

Comparative analysis of PAT

Company: Tata Motors Ltd

Below is the quarterly performance of Tata Motors for the quarter ended 31/12/2018

Consolidated Basis

Standalone Basis

The consolidated performance, reports a negative PAT.

The company said it took one-time exceptional non-cash charge for asset impairment of 3.1 billion pounds and the overall performance was dented on account of JLR.

The overhang of Brexit with no clarity is affecting the business of its subsidiaries.

By analysing the company’s performance on a standalone basis, the company reported a positive PAT.

Thus by analysing the company on a standalone basis it seems profitable business, but when clubbed

with the subsidiary’s performance it shows sign of problems.

The China issues,uncertainty of Brexit are all hampering the company on a consolidated basis.

Hence all these factors have to be considered because they affect the company to a great extent.

However the company is stating that the domestic business continues with strong momentum and is delivering market share and profitable growth.

Key takeaways

By understanding the difference between standalone and consolidated financial statement in detail, we could conclude that analysing the financials from a consolidated standpoint is better than analysing the financials with standalone point of view.

The consolidated financial being analysed along with standalone basis will give the investor an in-depth analysis and also the chances of any material information being missed or misinterpreted could be reduced..

Any investment decision should be taken only after analysing both the Standalone and Consolidated Financials for companies having subsidiaries.

In order to get the latest updates about Financial Markets visit https://stockedge.com/