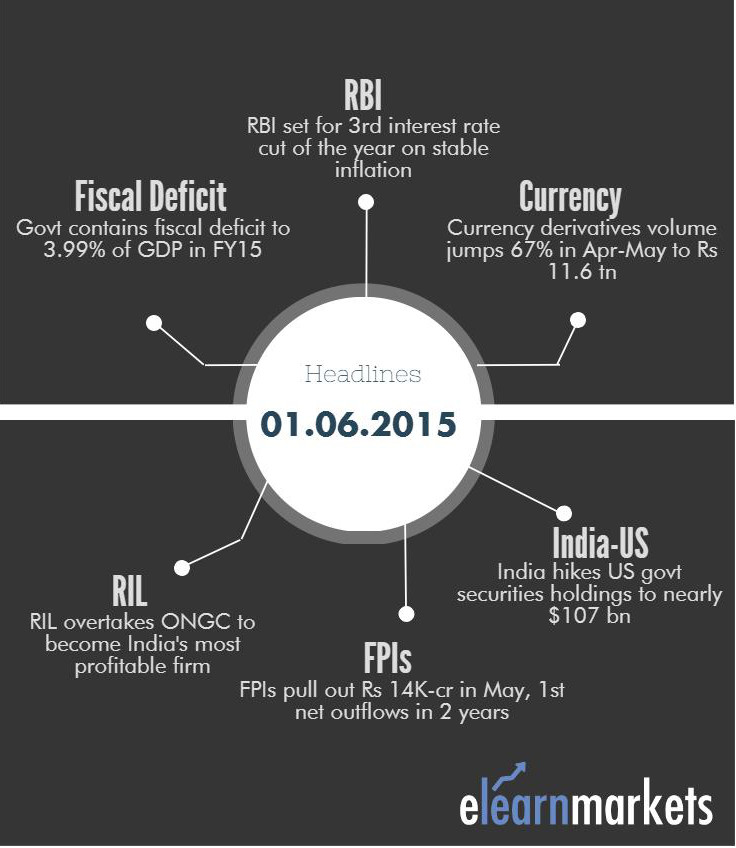

Here is a glimpse of the important Market News from today morning across several business newspapers: –

Economic Times – Business Standard

Ø RBI set for 3rd interest rate cut of the year on stable inflation

Ø Govt contains fiscal deficit to 3.99% of GDP in FY15

Ø Govt mulls sale of unused land of pharma PSUs

Ø M&M sets up separate business unit for Africa focus

Ø India may invite foreign govt cos to build highways

Ø Currency derivatives volume jumps 67% in Apr-May to Rs 11.6 tn

Ø RIL overtakes ONGC to become India’s most profitable firm

Ø India Inc’s sales, profit growth weakest in 2 yrs

Ø Govt simplifies IT return forms, extends last day to Aug 31

Ø Adani Group considering to bid for Sindri urea plant

Ø Switzerland to publish list of dormant bank accounts

Ø RIL rejigs investment portfolio, sells blue chip stocks

Ø India hikes US govt securities holdings to nearly $107 bn

Ø FPIs pull out Rs 14K-cr in May, 1st net outflows in 2 years

Business Line – Mint

Ø Land Ordinance re-promulgated for 3rd time, Opposition to step up protests

Ø Service tax hike unlikely to affect retail investors’ interest in stock markets

Ø Tribunal stays SEBI’s directive on UB Holdings

Ø Govt plans to divest 5% more in Concor

Ø Rs. 27,000 cr lying unclaimed in EPF: Labour Minister

Ø AIBEA calls for nationwide bank strike on 24 June

Ø Switzerland to publish list of dormant bank accounts

Ø L&T reports 27% fall in Q4 net profit

Ø EIH Q4 net profit rises 31%; company plans expansion

Ø Power Grid Q4 net profit rises 20%

Ø Pipavav Defence posts stand-alone Q4 net loss of Rs236.04 crore

Financial Express – Financial Chronicle

Ø Tata Steel workers vote for strike in UK

Ø Co-operative societies: Deposits from public under Supreme Court lens

Ø Private sector banks overtake PSU peers for first time

Ø Suzlon’s loss widens to Rs 1,212 crore in Q4

Ø Hindustan Powerprojects commissions 8,000 crores 600 MW COD of Anuppur plant for Rs 8,000 cr

Ø UB Group to hike stake in MCFL; to buy shares from Zuari

Ø RBI policy to set the tone for market this week: Experts

Ø US, Europe reinsurers to pitch in nuclear pool

Ø Snapdeal to expand payment by credit, debit cards on delivery

Ø Essar Oil to ramp up coal gas production in Bengal

Ø India will do better on ease of doing biz this year:CII