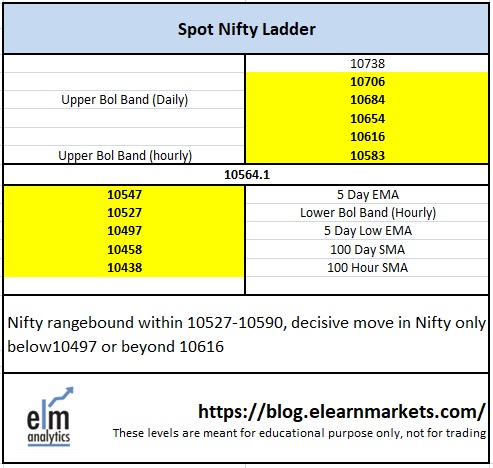

Nifty close 10564.1: Nifty took sharp recovery on Monday’s session from 50 Day SMA but stuck in a narrow range in the last four trading session. The index has been struggling to cross over 10600 level and is expected to trade in a range of 10300-10600 before any fresh move.

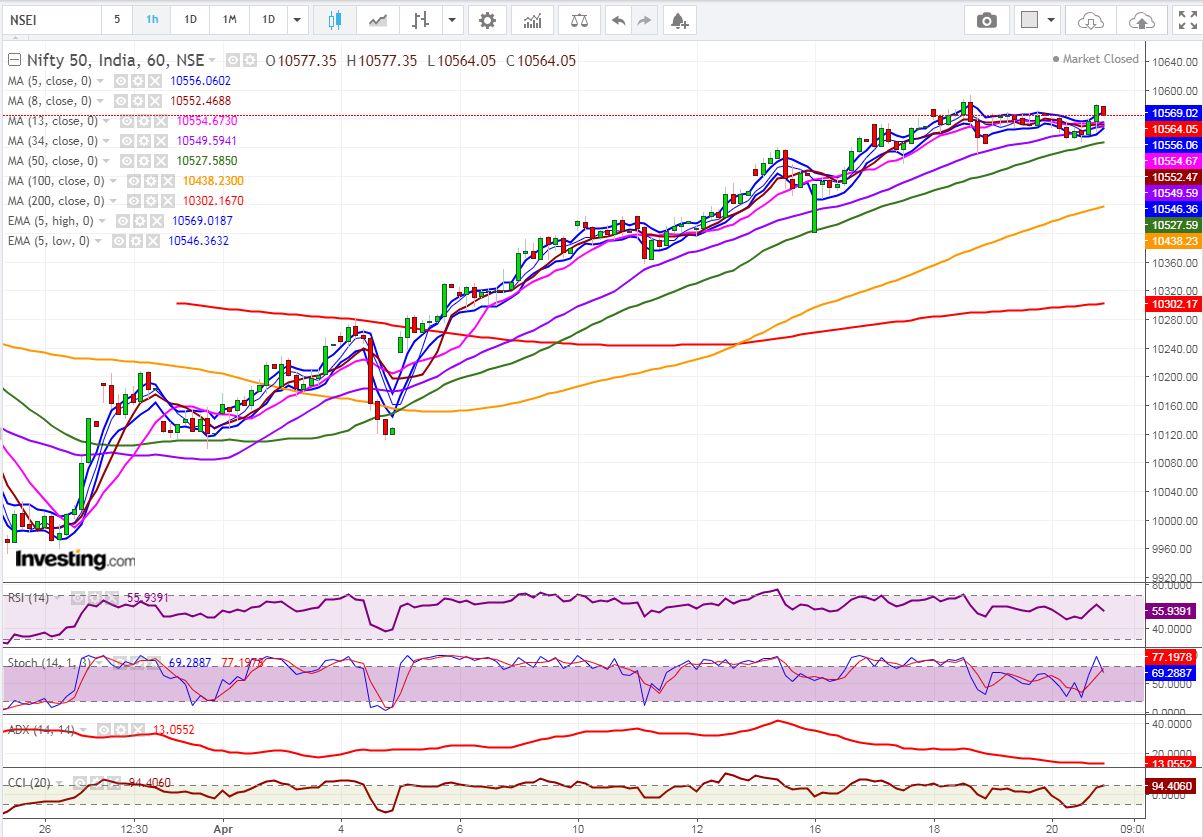

Hourly Technical

In the hourly chart, Nifty is trading above most short term moving averages. The probable support in the hourly chart comes at lower Bollinger line(presently at approx. 10527) and 100 Hour moving average (presently at approx. 10438).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx. 10583).Hourly RSI, Stochastic and CCI are trading close to the upper bound of their respective range suggesting strength in the hourly time frame. Overall, Nifty appears strong in the Hourly chart.

Hourly chart

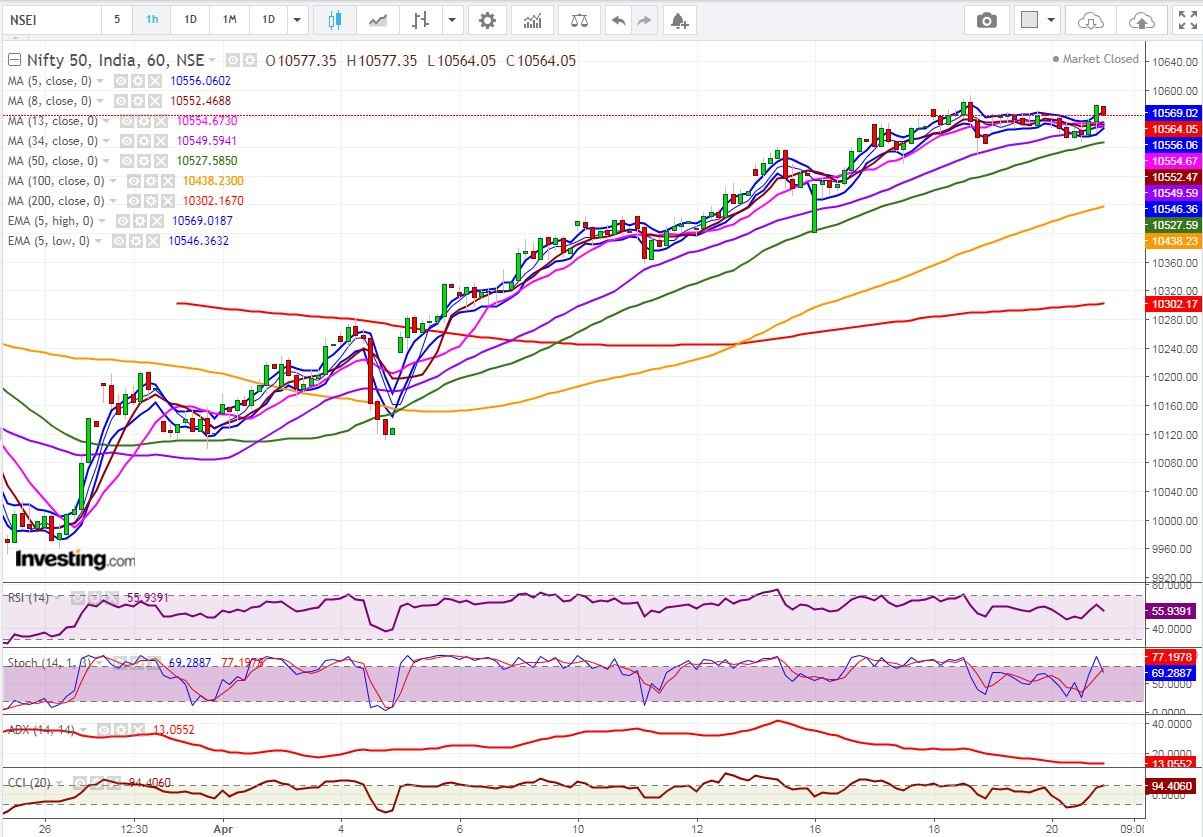

Daily Technical

In the daily chart, Nifty is trading above 5 week High EMA and also above most moving average suggesting upside momentum. However narrow range bound trade in last 4 trading sessions and presence of doji on last trading session suggests that 10600 to be a strong resistance in the coming days.

The probable support in the daily chart comes at 5 Day high EMA (presently at approx.10547) and 5 Day Low EMA (presently at approx.10497).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx.10684). Daily Stochastic and CCI are trading above the upper bound of their respective level and RSI is in the normal zone but very close to the upper reference line. Overall, Nifty remained neutral to bullish in the daily chart.

Daily Chart

Weekly Technical

Nifty has given a positive close for the fourth consecutive week and presently standing at a very crucial level of 10600. The Karnataka election which is going to take place after 3 weeks will play a key role in deciding the direction of Nifty going forward but as of now, the Index is expected to remain range bound in the short term.

The close above 10600 can be seen as a gap filling opportunity for Nifty and can possibly take index to higher levels. Weekly CCI, RSI and Stochastic are in the normal zone. Overall, Nifty remained neutral in the weekly chart.

Weekly Chart

Nifty ELM Matrix