The joy of sending old-fashioned, handwritten letters remains unmatched. That is where we think of Post Offices. Sending, receiving letters, courier services- these are the things often associated with post offices. But, we barely think of Post Offices as an institution for investments. Post Office Monthly Income Schemes are often ignored and the sensitization about the same remains very low.

What is Post Office Monthly Income Scheme (POMIS)?

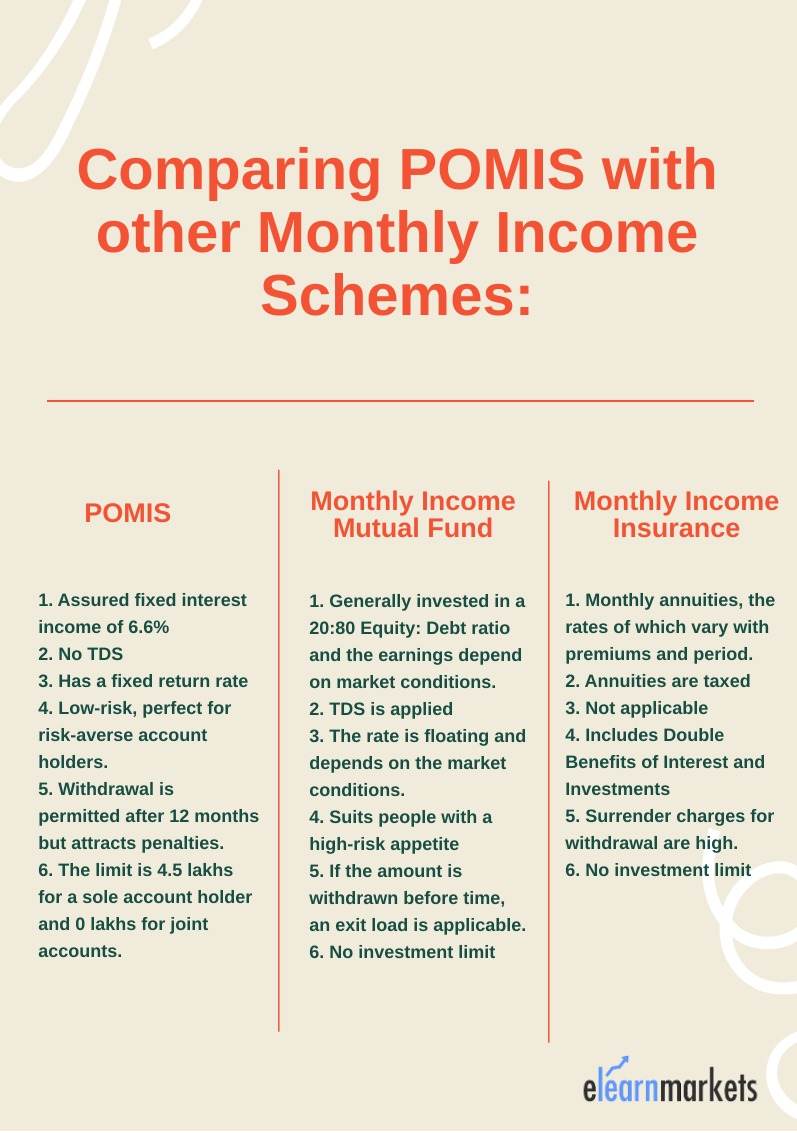

Post Office Monthly Savings Schemes are Government of India backed investment instruments that allow investors to deposit a small sum of money from their savings, and get a stipulated interest rate, based on the current market rates. The scheme effectively transforms the meagre monthly savings into investments with good returns. This scheme is a great low-risk option for investors who are risk-averse and want a fixed income every month. The majority of the Post Office Monthly Income Scheme account holders are senior citizens who rely on the monthly returns from the scheme for their daily expenses.

There is no stipulated limit on the number of accounts that can be held by an individual investor. When it comes to a sole operating account, the maximum investment that can be allowed in POMIS schemes is 4.5 lakhs and the amount is 9 lakhs in the case of joint account holders(specified limit of maximum 3 holders). In the current market scenario, the interest rate that is paid out is 6.6% and the maturity period of the scheme is 5 years from the opening date of the account. The minimum stipulated amount that should be deposited is 1500 and thereafter multiples of 100.

These schemes also have the option of Nominee, which can be updated after opening the account by a beneficiary. After the demise of the account holder, the benefits of the scheme can be claimed by the nominee. These accounts are freely transferred from one account to another.

How to open a POMIS Account?

The procedure to open a POMIS account is relatively simple and hassle-free, provided the investors have a Post-Office Savings Account. In case the investor does not have a Savings account, they should first apply for the Savings account and do the following:

- Procure a POMIS form from the nearest Post Office Branch.

- Submit the form along with the necessary documents(generally a Photocopy of ID Proof, Photocopy of address proof, 2 Passport-sized photographs)

- Submit the original version of the aforementioned documents for verification.

- Collect signatures of the beneficiaries or witnesses.

The initial principal amount can be invested through a dated cheque. The date mentioned on the cheque is considered to be the account opening date. The interest on the principal is disbursed starting from the next month.

Eligibility for Post Office Monthly Income Scheme:

To avail the features of this scheme, there are certain eligibility criteria:

- Only an Indian resident is eligible to open a POMIS account. NRIs cannot avail the benefits of this scheme.

- POMIS also has the option to open the account in the name of a minor, provided they are over 10 years of age.

- The POMIS account can be easily transferred from one post office branch to another, without any extra charges.

Benefits of Post Office Monthly Income Scheme:

- Fixed return every month: No matter what the market conditions are, Post Office Monthly Income Scheme account holders get a stipulated amount every month, with a fixed rate of interest. Hence, this unique scheme is hassle-free and low risk.

- Investment option for senior citizens: Instead of having an idle lump sum, investing in POMIS ensures a steady rate of return without any market risks. This reduced uncertainty with a fixed interest rate is a perfect investment instrument for senior citizens.

- Reinvestment: The returns from POMIS accounts can be used as further investment in other instruments like equity shares or SIPs. However, these entail market risk and can be avoided by senior citizens. A good option is to reinvest the proceedings into a Post Office Recurring Deposit Account.

- No TDS: The interest amount in a POMIS account does not incur any Tax Deducted at Source (TDS).

Restrictions of Post Office Monthly Income Scheme:

With all the benefits that POMIS offers, there are some restrictions that potential account holders must keep in mind:

- Lock-in Period: Post Office Monthly Income Scheme account holders must understand the lock-in policy associated with POMIS accounts. From the date of opening a POMIS account, an account holder cannot withdraw the amount deposited before 5 years. If the amount is withdrawn, penalty charges are levied.

- Maximum limits: The account holders can make a maximum investment of 4.5 lakhs, even if he/she holds the scheme in multiple post offices. The aggregate of those accounts, even in this case, cannot exceed 4.5 lakhs.

- Not for NRIs: This scheme is available only to resident Indians. NRIs cannot avail the scheme.

- Penalty: As mentioned, Post Office Monthly Income scheme come with a lock-in period. In case the account holder wishes to withdraw the investment corpus before the lapse of the lock-in period, a penalty is charged on the withdrawal amount, depending on the time of the redemption. If the holder withdraws the money before one year, there are zero benefits. If the account is closed between the 1st and 3rd year, the deposit is refunded with a 2% penalty, and if the scheme is closed between the 3rd and 5th year, it attracts a 1% penalty on the entire corpus.

- No tax Benefits: Post Office Monthly Income Scheme do not attract any tax benefits under Section 80C.

Comparing POMIS with other monthly income schemes:

Conclusion:

Post Office Monthly Income Scheme has emerged to be one of the most sought-after schemes in India, because of the low-risk factor. This attractive option of getting a fixed interest every month has attracted thousands of Senior Citizens in India.

Happy Investing!

U people doing great job

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!