PRINCIPLE OF POLARITY

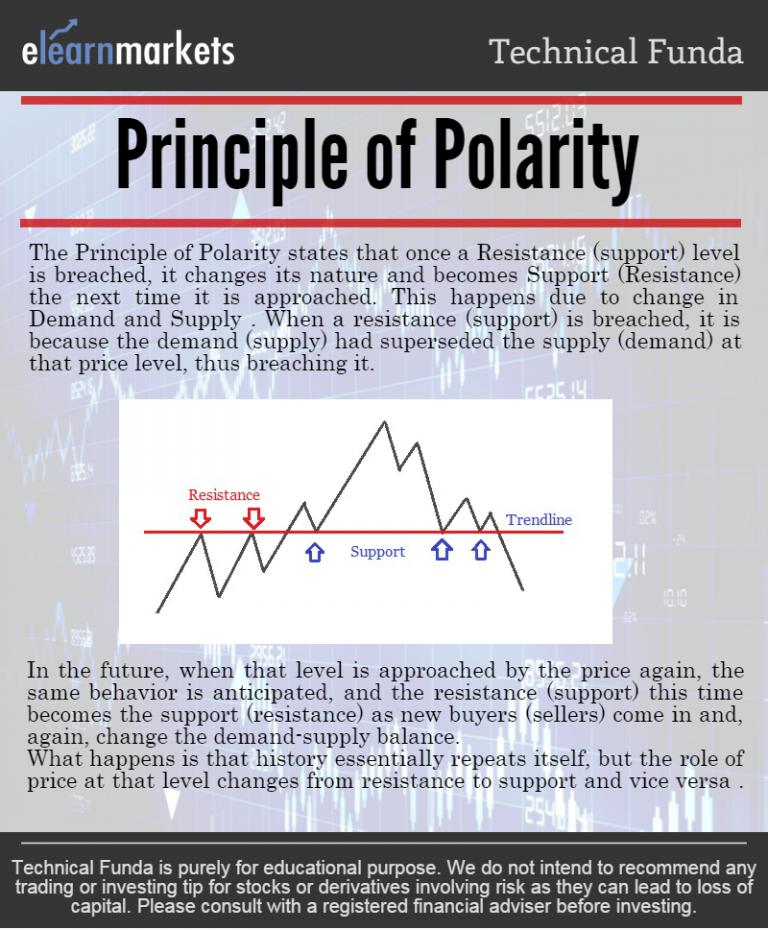

The Principle of Polarity states that once a Resistance (Support) level is breached, it changes its nature and becomes Support (Resistance) the next time it is approached.

This happens due to change in Demand and Supply.

Also Read: Are You Aware Of The Relationship Between Demand And Supply

When a resistance (support) is breached, it is because the demand (supply) had superseded the supply (demand) at that price level, thus breaching it.

In the future, when that level is approached by the price again, the same behavior is anticipated, and the resistance (support), this time becomes the support (resistance) as new buyers (sellers) come in and again change the demand-supply balance.

What happens is that history essentially repeats itself, but the role of the price at that level changes from resistance to support and vice versa.

If you want to know more about technical analysis you can enroll in NSE Academy Certified Technical Analysis course on Elearnmarkets.

Below are some examples of this phenomenon in the real market.

The charts shown are for Supreme Petrochem Ltd. (SUPPETRO), Bajaj Holdings and Investments Ltd. (BAJAJHLDND) , and Power Grid Corporation of India Limited (POWERGRID).

Bottomline:

The Principle of Polarity is an important concept in Technical Analysis.

After going through the above write up we hope you have gained a clear understanding of the Principle of Polarity.

Feel free to give your feedback by writing to us in the comment box below.

You may read some more related technical analysis articles.

Happy Learning!!