Capital markets are a medium to raise and invest money. To venture into the financial realm, it is essential to know the correlation between Equity, Bond and Commodity prices and their markets. But before we get into that, we need to understand what these markets are.

| Table of Contents |

|---|

| Relation between Equities and Bonds Prices |

| Relation between Bonds and Commodity Prices |

| Relation between Commodities and Equities |

| Bottom Line |

A Commodity market is a physical/virtual marketplace where buying, selling and trading of raw materials or primary products take place at current/future dates. Presently, about 50 major commodity markets worldwide facilitate investment trade in 100 (approximately) primary commodities.

There are two types of commodities: hard and soft commodities. Natural resources that must be extracted are hard commodities (For instance, gold, rubber, gasoline and oil), whereas soft commodities comprise agricultural products or livestock (For instance, corn, wheat, coffee, sugar).

An Equity market facilitates issuance and trading of shares, via exchanges or over-the-counter (without exchange supervision) markets. Also known as the stock market, it provides companies with access to capital, and investors with ownership in an enterprise with the idea to earn profits based on its performance in the future.

In the Bond market (debt/credit market), the members can issue and trade debt securities. The bond market mainly includes government-issued securities and corporate debt securities, enabling the transfer of capital from savers to the parties requiring capital for corporate expansions and government ventures. It adds to the financial burden of the company, unlike equity.

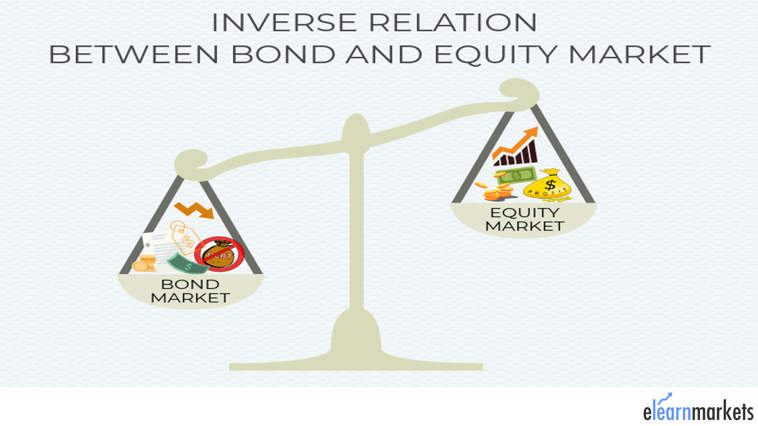

Relation between Equities and Bonds Prices

Bonds and equities are the most common instruments to raise capital. Bond yield indicates the opportunity cost of investing in equity. The opportunity cost of investing in equity rises as bond yield goes up, so equity starts becoming unattractive. Also, when the economy is booming, the company’s profits rise, increasing the demand for stocks. People sell their bonds, reducing bond prices, to finance the purchase of equity. Hence, they share an inverse relationship. It promotes the diversification of a standard portfolio.

But this may not always hold true. When bond prices start falling, stocks will ultimately follow the same direction. With borrowing becoming more expensive and the cost of doing business rising due to inflation, companies’ stock is expected to not do well either, as the earnings per share fall making equity less attractive.

Also, read: Portfolio diversification – do’s and don’ts

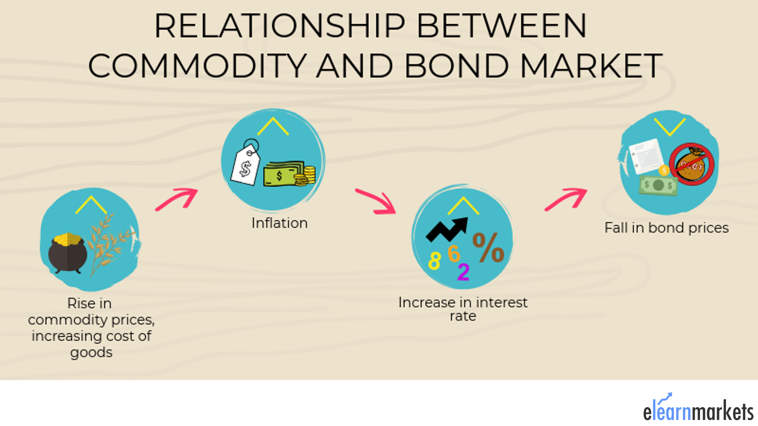

Relation between Bonds and Commodity Prices

With the increase in commodity prices, the cost of goods for companies increases. This increase in commodity prices level causes a rise in inflation. Inflation reduces the value of money over the term of the loan, so the interest rates rise to compensate for the loss of value. This increase in interest rate makes bond issue undesirable for companies, which pulls down the bond prices. Thus, we see an inverse relationship between commodity prices and bond prices.

Also, read: Do you Know the Relation between Bond Price and Yield?

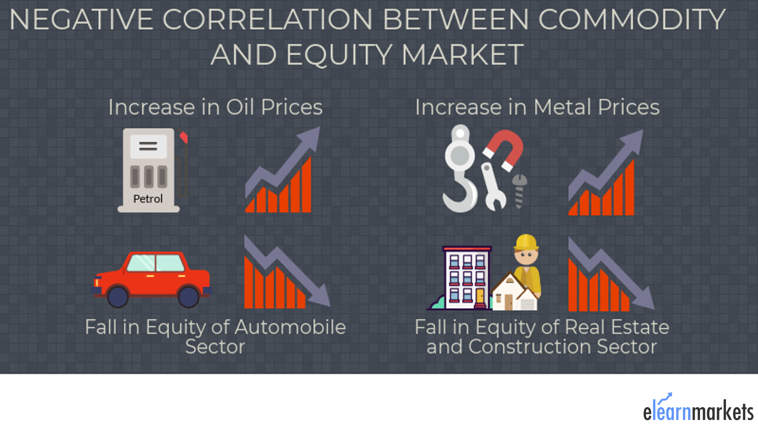

Relation between Commodities and Equities

Due to the production cost remaining same, and revenues rising (due to high commodity prices), the operating profit (revenue minus cost) increases, which in turn drives up equity prices. Sufficient data indicates that commodity price movements have a multiplier effect on related stocks. It means, if a commodity price increases by 5%, the stock of the company involved in manufacturing or processing it, rises by more than that. Moving in the same direction, the commodity prices and its related stocks show a high positive correlation.

Suggested Read : Types of Commodities You Should Consider Investing In

But this is only from the commodity-manufacturing side. When we see the impact of commodity prices on industries that use these commodities as inputs, the increase in commodity prices pulls up the cost of production, which drives the profits down, leaving very little for equity shareholders. It drives the equity market down, thus, establishing a negative correlation.

Bottom Line

Understanding these markets makes an investor’s tasks easier. The commodity prices, bond price, and equity price is interrelated. It enhances portfolio decision-making and helps in diversification. With this information, you’ll find yourself in a better position to approach the capital markets.

In order to get the latest updates on Financial Markets visit https://stockedge.com/

Thank you for some other informative website. The place else could I get that kind of information written in such an ideal way? I’ve a project that I am simply now working on, and I have been at the glance out for such information.