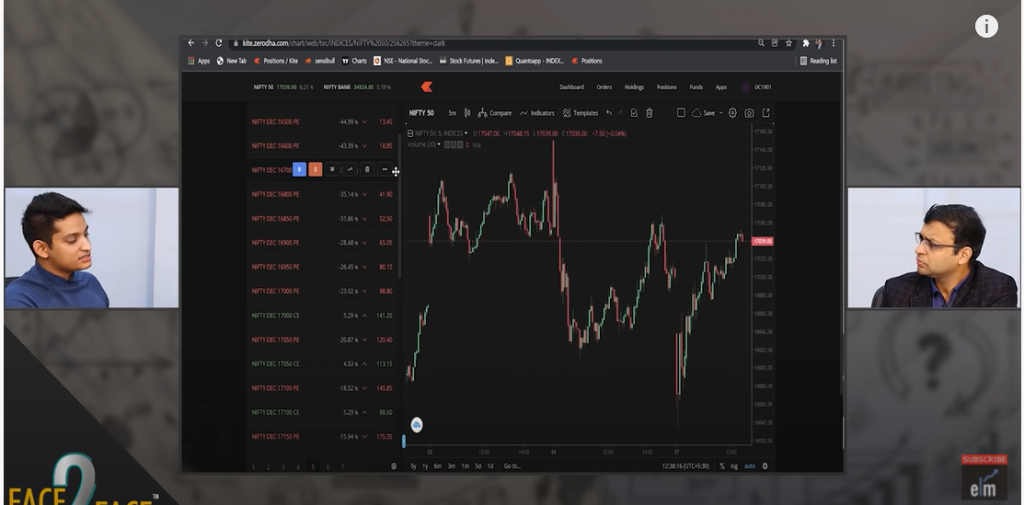

In an interesting session as a part of the highly popular Face2Face series, conducted by Elearnmarkets, Mr Vivek Bajaj, Co-founder of Elearnmarkets, invited Mr Shreyas Bandi, a successful stock market investor with many years of experience, to decode How to do proper risk management in options trading.

Shreyas Bandi is a 30-year-old derivatives trader who has been an active market participant since 2017. He has managed to generate a little over 17x on his starting capital throughout this period by turning his initial corpus of Rs 30 lakh into over five crores as of date.

His style is mostly, but not limited to, intraday trading, and he believes that his edge comes from his mindset and risk management.

In this blog, our expert trader will talk about the strategies he has been using for wealth creation and trading. Using proper risk management and other techniques, he has created a large amount of capital in a short time.

Before we start the discussion on risk management, let us discuss a game:

What is meant by “Edge”?

These days edge is used very often; many people talk about it, but the edge is; basically, they said this is their advantage in the market that’s what they try to convey, but the edge is purely mathematical.

For example, in the coin toss game, suppose we both have 1 lakh each, and each time we’ll toss a coin for One-one rupee on the bet, and if we played this for two-three years, then what do you think would happen between my account.

Then we both will have one lakh as it is a straightforward 50 50. So basically, there is no edge in the system.

A positive expected value means that for every bet that we place or every investment that we make on one rupee, it needs to have an expected value of more than one rupee.

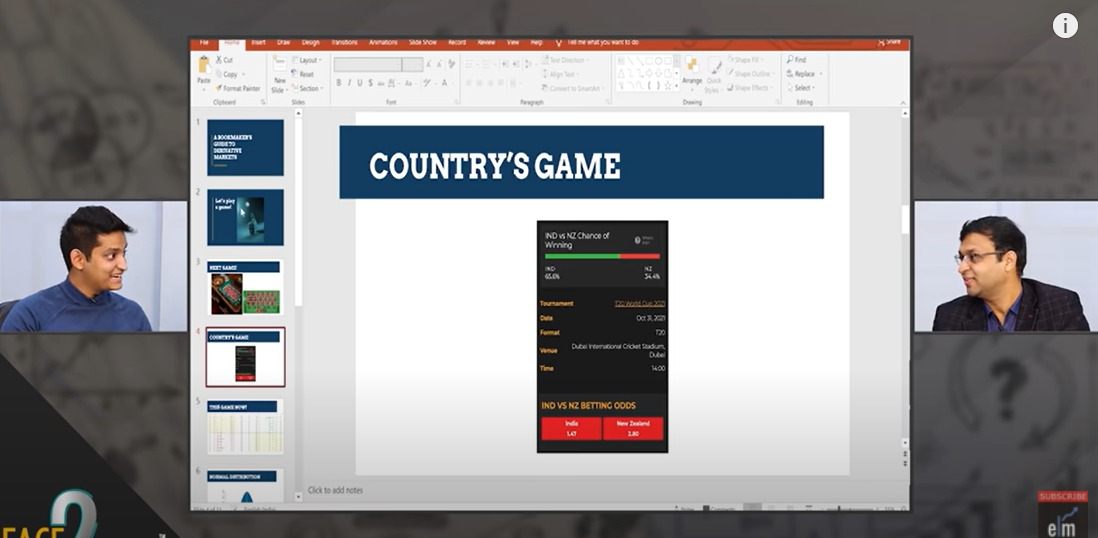

According to Mr Shreyas Bandi, the best way to know the outcome of an event now, even if you are not a punter, you’re not into betting, is to look at the bookies’ odds.

Suppose you want to see elections also now; if elections come up and you want to see who is going to win exit polls, you look at what is the bookies’ odds because when somebody is putting their money on the table, that is where you know the highest chance of predicting an outcome.

As money is the best way to predict. Bookmaker is like joe. Whoever wins in this India versus New Zealand match was there to make money. He doesn’t care if India wins or New Zealand wins.

So, whether you win or not, the bookie will make money because he has a statistical edge in the pricing of his bets.

In the stock market also, there is a bookie, so through this blog, we will find who is the bookie in the stock market:

Identifying Edge in the Stock Market through Options Trading

We will probably address one of the myths that people have that if you are in high probability trades, you are the bookmaker and will make money.

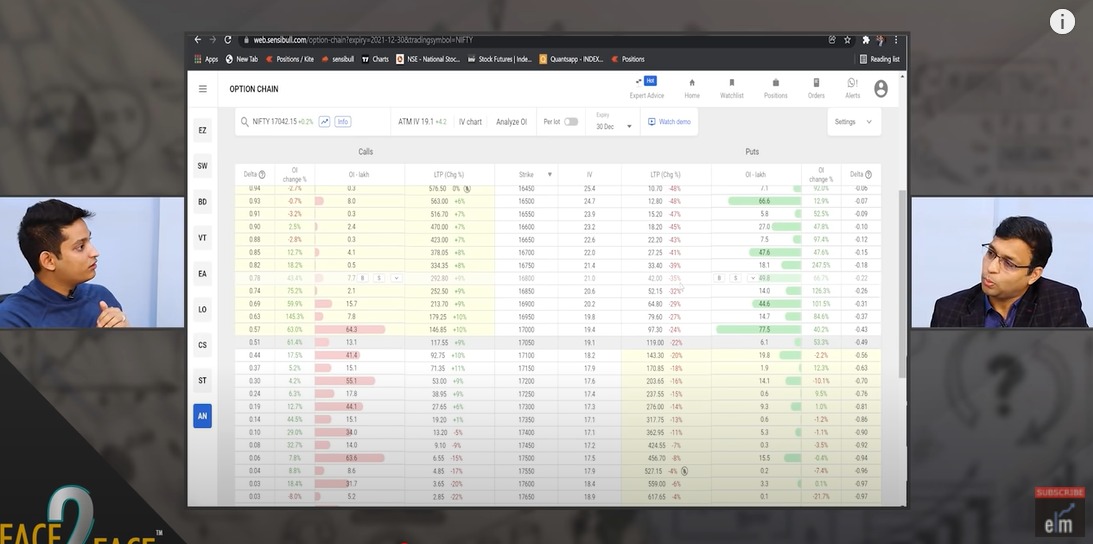

For example, so that day the market was flat were at 17000 the prices gap down and from there we pulled to 17000.

So let us say that the market will expire around 16000 or below 16700. One way of placing your bet would be to buy the 16800 put option for 46 rupees and sell the 16700 put option for 30 rupees.

So, you will be paying about 15 rupees, and the maximum profit is Rs. 85 and making 100 rupees is what you will get.

Similarly, one other way of looking at is the delta column delta that gives you the rough probability that a particular strike is at the money at the expiring time.

According to the expected value concept, if you go by risk and reward, that cannot be a positive expected value.

As for anyone here, because you can be on the buying side of this probability or the selling side of this probability, you can either buy the put option or sell the lower put option, inherently, there is no edge in selling or buying.

But edge can come from your risk to reward like 15 rupees today intraday, so let’s say that we executed the strategy and bought a put option and sold put option.

So, we paid 15 rupees and executed it. So, if it goes to 10 rupees intraday, you take a stop loss of 15 rupees.

There is no intrinsic edge in selling or buying options mathematically, which makes no sense to people who say that I sell options—so putting a stop-loss that is my edge because we made money.

You can also join our course on Certification in Online Options Strategies

Trading system of Mr Shreyas Bandi

Mr Shreyas Bandi is an intraday trader, and he starts trading at the beginning of the day because, having traded, he has a good estimate of how much he would stand to make when he enters his trade.

He defines his maximum loss for the day for whatever reason; no matter what happens once that loss is hit, his trading is done after that; even if he sees many opportunities to re-enter, he will not renter his trade.

He accepts bets on both sides because the way to look at it is as an individual in general.

He prefers having high probability trades to win most of the time because, as human beings, he thinks they’re psychologically programmed that we should win, and that’ll keep our morale.

But at the same time, when he loses on that high probability trade, his idea is to cut those losses quickly.

There are three things that he analyses- he analyses the charts first, looks at open interest, and he looks at the pricing of the options itself so that the pricing of risk will also give away a good amount in terms of what can be said as the market volatility,

He looks at the hourly time frame and the basic swing highs and swing lows.

You can watch the entire video here

Bottomline

We hope you found this blog informative and use it to its maximum potential in the practical world. You can checkout one of the fastest growing courses on derivatives in India and enhance your knowledge. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.