Want to know more about the Financial Schemes of the Government of India? Join our Free Course: Government Financial Schemes on Elearnmarkets.

Do you think that the girls are a financial burden to the family?

I don’t think so.

I really don’t understand why people distinguish between a boy and a girl.

In India, on one hand, we believe girls to be an incarnation of Goddess Lakshmi (goddess of wealth), while on the other hand, they are looked upon as a burden – not fair.

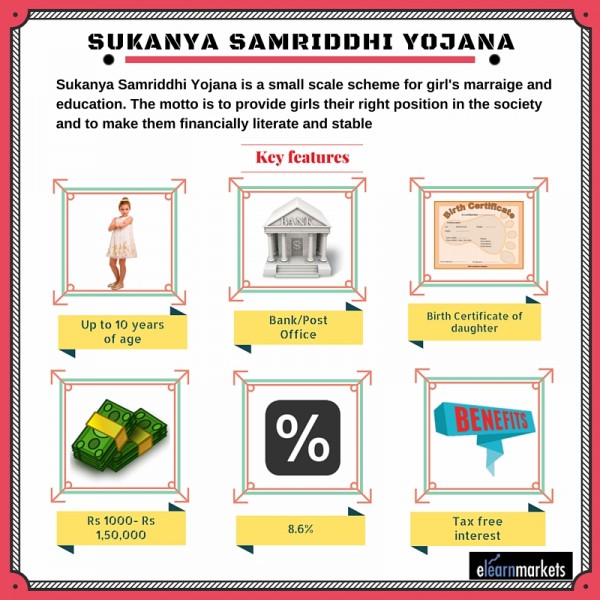

Very recently our prime minister, Narendra Modi has initiated a plan called “Sukanya Samriddhi Yojana”, the motto of which is to provide girls their rightful position in the society and to make them financially literate and stable.

Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana is a small scale savings scheme for your girl’s marriage and education.

The government through this scheme wants to convey a message that if a parent could make a proper plan for their girl child, then they can definitely improve and secure their daughter’s future.

Key points:

1. This account can be opened for your girl child up to 10 years of age.

2. The account can be opened in any post office or some selected banks.

3. You need to provide the following documents to open an account-

a. Birth certificate of your daughter

b. Identity proof of parents

c. Address proof of parents

4. You can open the account with the minimum balance of Rs 1000 and can deposit a maximum of Rs 1,50,000 yearly.

5. One good thing about this account is that the interest received here is very high at 8.5% as compared to 4-6.5% on the savings account, 3.5-7.8% on bank fixed deposit and 7.6% on Kisaan Vikash Patrika.

6. The interest received on this account is tax-free. Moreover, for the amount deposited in the scheme, there are tax deductions of up to ₹ 1,50,000 under section 80C of the Income Tax Act, 1961.

7. You can deposit the amount up to a maximum of 14 years from the account opening date.

8. Another very good point about this scheme is that there is a provision of lock-in-period and you cannot withdraw the amount unless your daughter is 21 years of age.

In India, since the marriageable age is 18 years, anyone planning to get married before 21 is allowed to withdraw the amount but is restricted to only 50% of the total amount.

9. The best thing which I like about Sukanya Samriddhi Yojana is that once the maturity date comes, the amount is handed over to the respective girl child only.

10. According to Sukanya Samriddhi Yojana program, you can open one account per girl child. In case you have three daughters, you can open an account for a maximum of 2 girl children. But in case you have a twin daughter after your first daughter, you are allowed to open one extra account.

To open a third account, an affidavit and the birth certificates of the children need to be submitted.

Bottomline:

We hope that the above write up gave you a clear idea of Sukanya Samriddhi Yojna Scheme.

I would appeal to every parent to definitely open this account since it will give her freedom and also help her to be financially sound.

Happy Learning!!

It’s fantastic and really needed far the parents of girls

Thanks Bharat!

I agree that every parent should definitely start for their daughters.

it is a very good scheme i think it is a highest interest paying policy for girl by it parents easily save money for there girl child.

Thank you, Sneha for your comment.