The risk profile of an option can be reduced and paid off using synthetic options. It accomplishes this by judiciously combining underlying tools and many settings.

Combining a long position with a long position in an at-the-money put option results in a synthetic call.

However, the opposing position results in a synthetic put. This entails holding both a long position in the at-the-money call option and a short position in the underlying.

In contrast to plain options, the synthetic option can assist in removing the problems. It occurs without being influenced by the options or their expiration date.

So, in today’s blog, we will discuss Synthetic Put Options Strategy:

What is Synthetic Put Options Strategy?

To represent a long-put option, this strategy combines a short stock position with a long call option on the same stock. It’s also known as a long synthetic put. An investor who is short a stock buys an at-the-money call option on that same stock. This action is taken to protect the stock’s price from rising.

Institutional investors can use this startegy to disguise their trading bias on specific securities, whether bullish or bearish. However, synthetic puts are best used as an insurance policy for most investors. An increase in volatility would be advantageous to this strategy, whereas time decay would be detrimental.

Synthetic Calls and Puts

The main difference between Synthetic Puts and Call is:

A synthetic call is formed by combining a long position in the underlying with a long position in a put option that is at the money. A synthetic put is formed by combining a short position in the underlying with a long position in an at-the-money call option.

Now, let us discuss how the synthetic put strategy works:

How does it work?

Let us discuss how to implement the synthetic put options strategy:

1. Outlook

The synthetic put is a strategy investors can use when they have a bearish bet on a stock but are concerned about its potential near-term strength.

It is similar to an insurance policy, except that the investor wishes for the underlying stock’s price to fall rather than rise.

The strategy combines a security short sale with a long-call position on the same security.

2. Strategy

This strategy involves:

- Short 100 shares of XYZ stock

- Long 1 XYZ 60 call

You can also read our blog on 12 Common Option Trading Strategies Every Trader Should Know

3. Maximum loss\risk

The maximum risk is limited to the strike price-price at which the underlying is sold+ call premium paid.

4. Profit

The profit is unlimited.

You can also join our course on Advanced Options Strategies

5. Breakeven stock price at expiration

The breakeven price is the price at which the underlying is the sold-call premium paid.

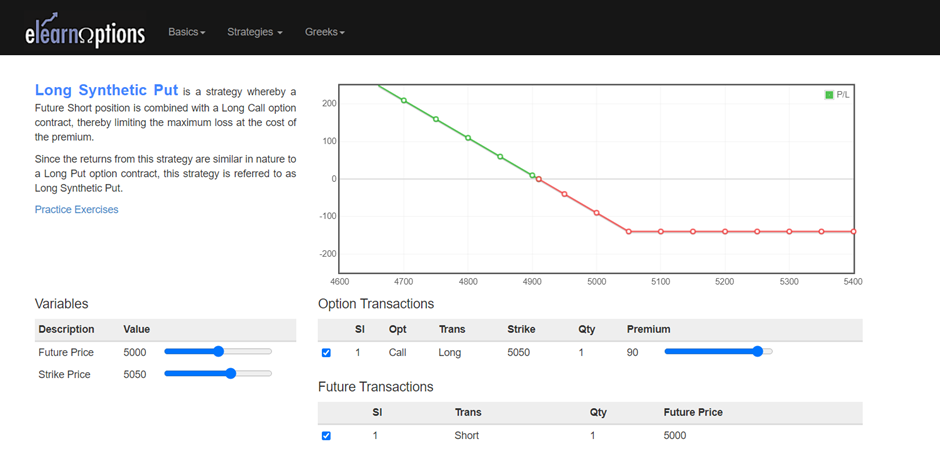

6. Payoff Diagram

Below is the payoff diagram of this strategy

You can practice more such strategies in ElearnOptions

Bottomline

Thus, synthetic puts are frequently used as insurance policies against short-term price spikes (in an otherwise bearish stock) or as a hedge against an unexpected upward move in the stock price.

Newer investors may benefit from knowing that their stock market losses are limited. This safety net can give them confidence as they learn about various investment strategies. But, of course, any protection comes with a price, which includes the cost of the option, commissions, and other possible fees.

You can join our Options trading training and kickstart your journey.

We hope you found this blog informative and use it to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.