Listen to this:

TDS and Form 26AS go hand in hand. We often fail to remember the innumerable TDS deductions made during the financial year.

Due to the miscalculation, we end up paying an incorrect amount of taxes. TDS is a factual amount based on the payments/income received by you from various sources of income and is not an estimated figure.

The total TDS amount is reflected in Form 26AS, which gives you the actual figure of tax deducted.

In this article, we will learn not only about TDS and Form 26AS but will also see with the help of examples how it actually works.

What is TDS (Tax Deducted at Source)?

TDS stands for Tax Deducted at Source. “At source” means at the point of origin or issue. Herein it means that tax is deducted at the origin of income.

For example: Mr. X is a salaried person working in ABC Limited. His income is taxable as per the respective tax slab under the provisions of the Income Tax Act, 1961. Herein, ABC limited will pay salary to Mr. X after deducting the tax amount (as calculated under the respective slab for the financial year) and pay the balance amount. Thus, salary refers to the source of income and the amount deducted refers to the TDS amount. Herein ABC Limited is the deductor (one who deducts TDS) and Mr. X is the deductee (on whose behalf TDS is deposited).

Now the question arises that when we already pay our tax at the end of the financial year, then why to bear the extra burden of TDS?

Let me tell you that TDS is not an additional tax that you need to pay. TDS amount can be claimed by the deductee at the time of calculating self-assessment tax.

In case of above example, ABC Ltd. (deductor) will be required to deposit the TDS amount with the Government. After this, the deductor will submit TDS return on a quarterly basis with the NSDL.

The underlying purpose of depositing the TDS return is to inform the Government about the total amount of payments made, nature of payments, deductee details etc. On the basis of the TDS returns submitted, the deductee can avail the claim at the later stage.

You will see that TDS is deducted on several sources of income i.e. interest income, dividend income, royalty income, income from professional services etc. Now in case you have multiple deductions during the year, it becomes very difficult to trace the total amount of TDS paid. Hence, you end up calculating wrong tax amount.

To cross check as well as to prevent any miscalculation with respect to the total unclaimed TDS amount, you need to simply download Form 26AS.

What is 26AS Form?

Form 26 AS is a consolidated statement that provides the complete details of the following:

- Tax Deducted at Source (TDS)

- Tax Collected at Source (TCS)

- Self Assessment Tax or Advance Tax Paid

- Refund received

- High-value transactions

Points to Remember:

- The credit of TDS is given on the basis of the TDS return submitted and the credit of that deducted amount is shown in Form 26AS. For example Mr. Y maintains a Fixed deposit of Rs. 20,00,000 with Axis bank @8 % p.a. The quarterly interest paid by the bank is Rs. 36,000/- [40,000 – 10% (40,000) TDS amount] .This amount of Rs. 4000 is deducted for the period of April – June which will be shown in the TDS return filed by the Axis bank in July.

- The TDS return contains the details of the interest amount, TDS paid, PAN No. of Mr. Y and other related details. On submission of the TDS return by the Axis Bank, the details will appear in Form 26AS of Mr. Y. On the basis of this, Mr. Y will be able to calculate the total TDS deducted for the entire financial year and claim it accordingly.

- Also, Mr. Y will receive TDS certificate from Axis Bank after the submission of the TDS return.

- You can always cross-check Form 26AS and TDS certificate to see if they tally with each other. In case of any mismatch, which is usually due to the wrong PAN No. entered, the deductee/ Mr. Y, in this case, can inform the deductor/ Axis Bank in this case.

- Thereby, Axis Bank will be required to revise the TDS return, then the amount of TDS will be shown in Form 26AS. The tax credit will be available on the basis of Form 26AS only, so one needs to thoroughly check the amount of TDS to be claimed before filing the income tax return or making payment for self-assessment tax.

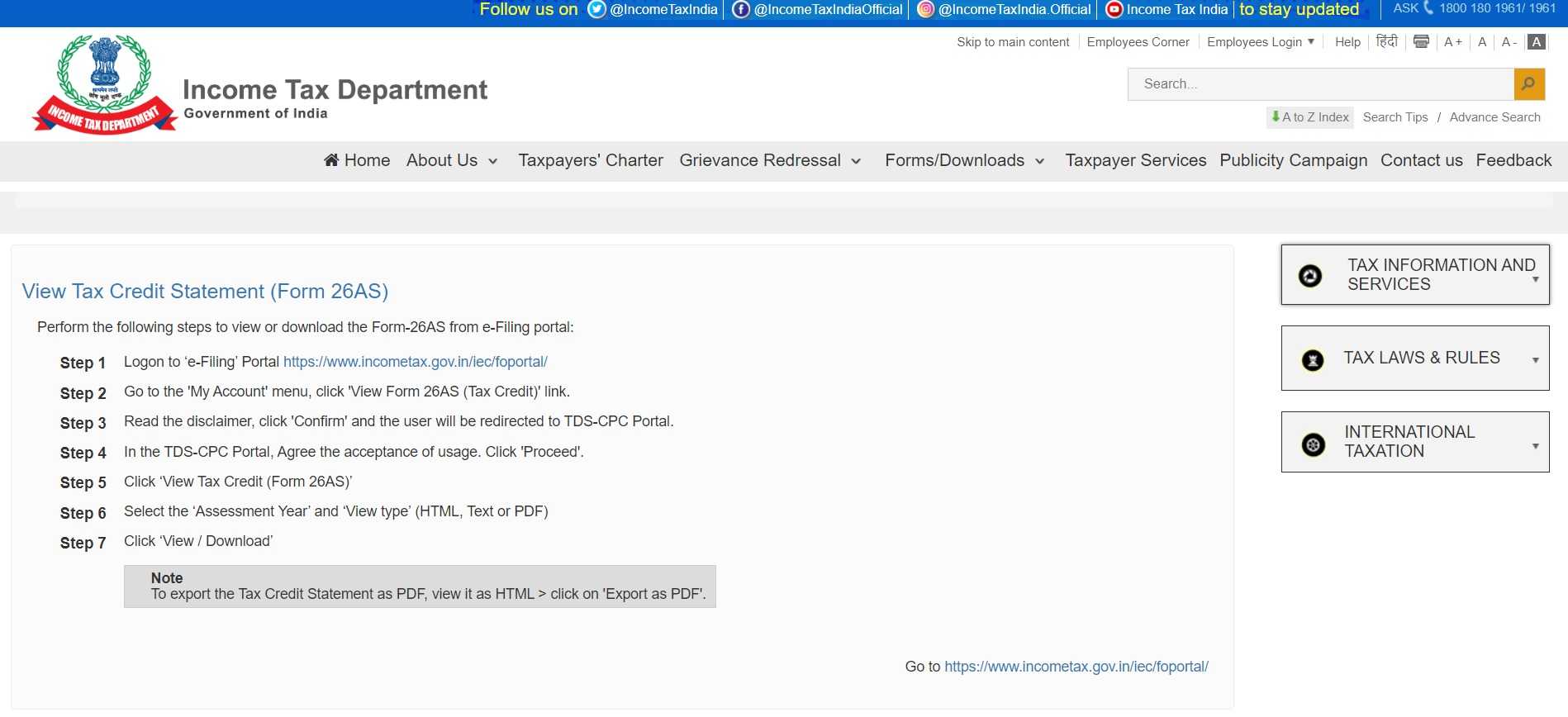

How to download 26 AS Form?

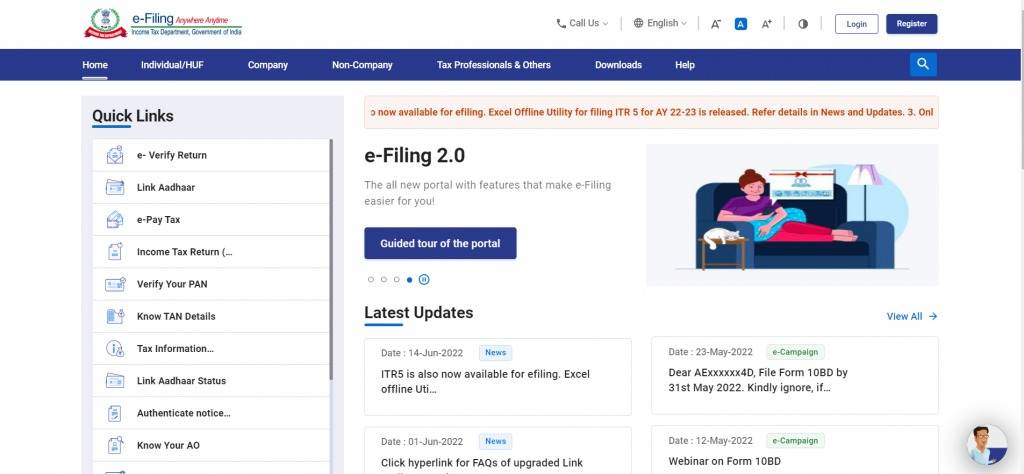

Form 26AS is a form that you are required to download by logging into the income tax site or TRACES as shown below:

Step 1: Go to the income tax site/TRACES:

In case you log in through income tax site:

In this case, A window will open. You need to be a registered user for this. Once you are registered, log in with your User ID and password.

On the left side, you will get the option to view Form 26AS. Click on the same and then you will be redirected to the NSDL website.

In case you log in through TRACES:

In this case, the users will be required to enter the User ID, password and TAN No.,

You can view the details online or download the pdf as well. For opening the PDF, you may also be required to enter the password, as instructed therein.

When you open the pdf, the Form 26AS looks like the following provided below:

Note: The above form is merely a sample to show how does it appear to be like. None of the information is related to any assessee.

You can also refer to the aforementioned website in case of any related FAQs.

Bottomline:

In this way, you will be able to track all the prepaid income tax paid and will be able to calculate the actual amount of income tax payable by you for the relevant assessment year.

Hope we have been able to simply the confusion that may have bothered you for long on the calculation of income tax and the total amount of income tax already paid. You can check for NSE Academy Certified Financial Planning & Wealth Management to understand tax planning better.

What are AIR transactions in 26AS? How is it calculated for Income tax purposes?

Hi Sachin,

Thank you for reading and raising your query.

According to the provisions of section 285BA of the Income Tax Act, 1961 specified entities are required to furnish a statement of financial transaction

or reportable account or Annual Information Return (AIR) of the specified financial transactions or any reportable account registered/recorded/maintained by them during the financial year to the income tax authority or such other prescribed authority.

The Income tax department has prescribed a list on the basis of the value and nature of transactions which qualify to be reported in the AIR.

I didn’t Know much more about it. But I Know 26AS is a statement which describes income tax credit for a particular PAN. It shows the total amount of TDS/ TCS/ Advance Tax/ Self-assessment tax that can be utilized against the payment of full & final tax liability of a person.

Am I right Ms. Shruti Agarwal?

Please share more about it.

Hi Simran,

Thank you for the read.

Yes, you are right. Please help us know what additional information would you like to know about Form 26 AS.

dear sir

i am senior citizen aged 62 yrs staying in chennai. i got retirement from private company..now i do not get any income except house rent which is only rs 6000 per month.

i stay in my own house ( apartment ) in chennai. as such my income is less than rs 1.0 lakh.

i have pan and aadhar card. both linked also. is it necessary to file NIL return

when i inquired income tax office few years back, i wad told filing is not required as income is not taxable.

please clarify. i got sms stating that i have to file return by 31 st july as form 26as shows income.

i forgot my id and password in website of income tax. i tried to contact over phone, no response

pl help me

Very professional & self explanatory briefing on TDS / AS 20 building for the future of tax payers! Thank you Author & a nice blog from the google search ! Keep it up to be better and consistent, extraordinarily, creating connections-building bridges… together