Technical analysis mainly involves forecasting of future price movements which are based in examination of past price movements.

It helps investors to anticipate what is likely to happen over the time using variety of different kind of charts which show price over time.

For maintaining consistency in technical analysis, It is important to learn and understand trading patterns, trading tactics, trading psychology and money making techniques.

| Table of Contents |

|---|

| Performance |

| Levels |

| Technical analysis indicators |

In this blog, we will bring technical analysis a step closer to you by using one of the leading stock market application StockEdge

We have divided the blog into three practical stages:

- Performance

- Levels

- Indicators

In the examples ahead, we have taken Reliance Industries Ltd (Reliance) under consideration for understanding the technical analysis parameters.

1.Performance

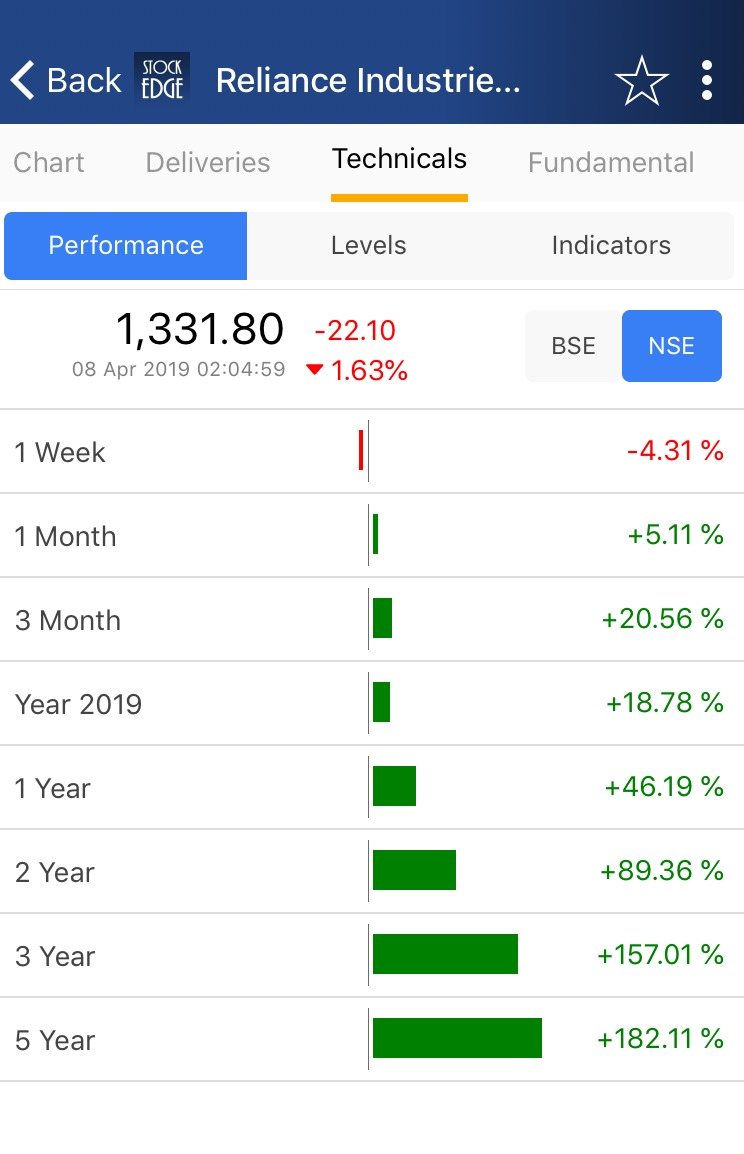

It is important to analyse how the stock have performed in the following time frame, as shown below in the screenshot.

- last week

- Monthly

- Quarterly

- Yearly

- Past five years

For each market, sector and stock, an investor should analyze long term and short term charts to make decisions whether to enter the stock or not.

Learn from Market Experts: Technical Analysis Course

From StockEdge application we can see both BSE and NSE performance of Reliance.

We can see from the data below that we had invested in Reliance five years ago we would have received 182.11% of return in our stock.

What a return! Isn’t it?

This indicates that in the last 5 years Reliance had done really well and may continue to generate positive return in the future also.

We can see that last week the return was negative as overall the market had fallen down and took correction after continue rise.

2. Levels

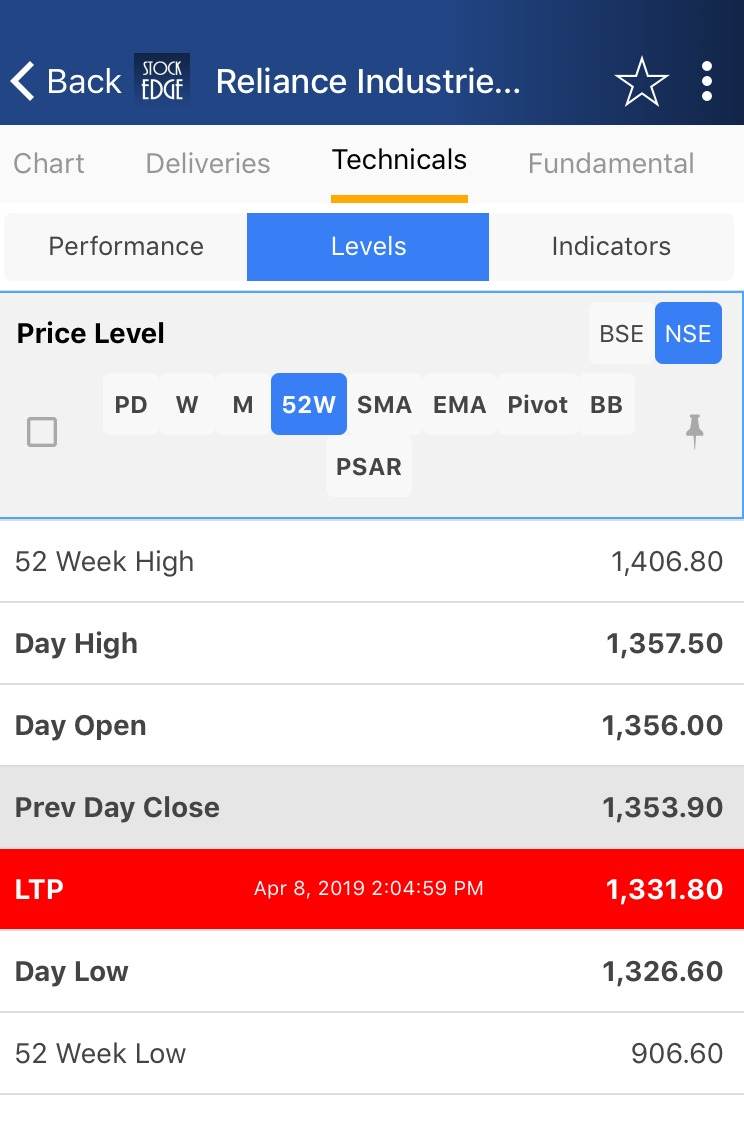

This section of StockEdge shows us different price levels of the stock of both NSE and BSE.

It shows us previous day, weekly, monthly, 52 week, SMA, EMA, Pivot, Bollinger Bands, and Parabolic Sar.

It is important to know all these levels as they form Resistance and Support levels for the prices of the stock.

For example if you want to invest in Reliance for long term, you should look at 52 week high as resistance and 52 week as support.

For Reliance the 52 week high is 1406.8 and 52 week low is 906.8.

Note: If it breaches these two levels then it may be considered as continuation of ongoing trend but if it bounces back from these levels then it may be considered as reversal of the trend.

3. Technical Analysis Indicators:

Technical indicators are mathematical calculations which are based on the price, volume or open interest of a stock.

By analyzing historical data, technical analysts use these indicators to predict further price movement.

Examples of common technical indicators are Relative Strength Index, Money Flow Index, Stochastic %K , MACD etc.

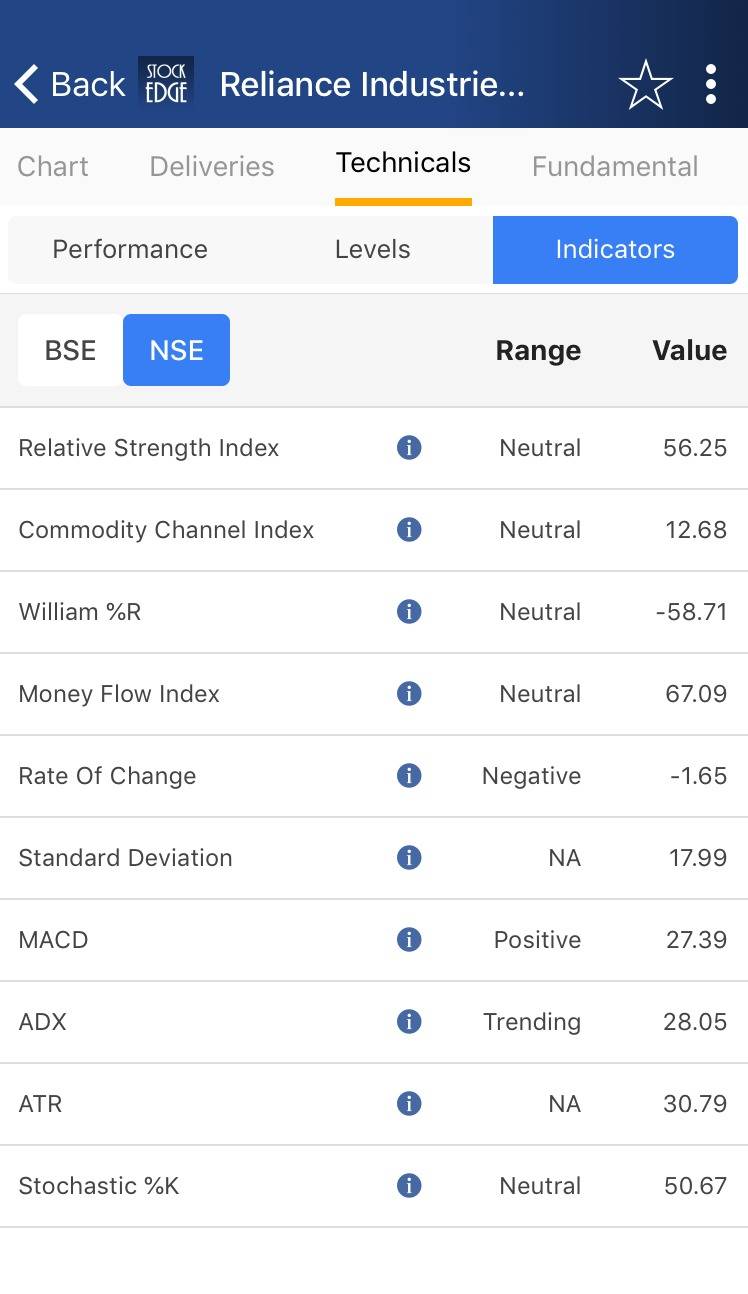

In StockEdge we can find the range and value of these technical indicators. Let us discuss what they mean and what do they indicate:

Relative Strength Index

Relative Strength index is a momentum indicator which measures the speed and change of price movements. It oscillated between 0 and 100. The RSI is considered to be overbought when it is above 70 and oversold below 30. Relative Strength index can be used to identify the general trend.

To know more about this indicator, watch the video below:

We can see that in that the range of RSI is neutral and value is 56.25. This indicates that Reliance is neither in the overbought nor oversold region.

Commodity Channel Index

Commodity Channel Index is a momentum oscillator which is used to determine whether the stock is reaching an overbought or oversold region. This indicator is used to determine price trend strength and direction.

When the Commodity Channel Index moves from negative to 0 then it may indicate that the price is starting new trend and when the indicator goes from positive to 0 then a downtrend may be starting.

To know more about this indicator, watch the video below:

We can see that in that the range of CCI is neutral and value is 12.68.Similarily like RSI, this indicates that Reliance is neither in the overbought nor oversold region.

William % R

William % R is also a type of momentum indicator which moves between 0 and -100 and measures overbought and oversold regions. This indicator may be used to find entry and exit points in the market.

When William % R is between -20 and 0 then the price is overbought. When it is between -80 and -100 then the price is oversold. When the indicator is between -20 and -80 then it is said to be neutral.

To know more about this indicator, watch the video below:

We can see that the value of Reliance is -58.71 which is neutral. That means that stock is neither in the overbought nor oversold region.

Money Flow Index

Money Flow Index is an oscillator which uses price and volume to identify overbought and oversold region in an asset. Unlike Relative Strength Index, the Money Flow Index incorporates both price and volume data.

A MFI reading above 80 is considered to be overbought and reading below 20 is considered to be oversold. The reading between 80 and 20 is considered to be neutral.

We can see that in that the range of MFI is neutral and value is 67.09. This again indicates that Reliance is neither in the overbought nor oversold region.

Rate of Change

The Rate of Change (ROC) is a momentum oscillator which measure the percent change in price from one period to the next period.

The Rate of Change signals positive if change is more than 0% and negative if change is less than 0%.

We can see that the ROC of Reliance is -1.65 which means that the prices of Reliance are falling down.

Standard Deviation

Standard deviation is a method of dispersion (from mean) which is found in a data set. It is said to be higher when more dispersion is found. Deviation is calculated by finding the square root of variance.

The standard deviation for Reliance is 19.71 and the Range is given as NA because it does not indicate whether the stock is in overbought or oversold zone.

Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence (MACD) is a trend following momentum indicator which shows the relationship between two moving averages of a security’s price and calculated by subtracting the 26 period EMA from 12 period EMA.

The MACD has a positive value when the 12 period EMA is above 26 period EMA and negative value when the 12 period EMA is below 26 period EMA

To know more about this indicator, watch the video below:

The MACD value of Reliance is 27.39 and the Range is given as positive which means that 12 period EMA is above 26 period and is bullish.

Average Directional Index

The Average Directional Index determines when the price is trending strongly. Readings above 25 suggest that the stock is trending and readings below 25 suggest that the trend has no strength.

To know more about this indicator, watch the video below:

The ADX value for Reliance is 28.5 which means that the stock is in strong uptrend.

Average True Range

Average True Range measures market volatility through decomposing the entire range of a security’s price for a specific period.

If the stock is having a high level of volatility then ATR will be high and low volatility stock has a lower ATR.

Reliance has ATR value of 30.79 which means that the stock is quite volatile.

Stochastic %K

Stochastic is a momentum indicator which compares a particular of a security to a ranges of its prices a particular period of time.

The stochastic oscillator moves between 0 and 100. Readings over 80o are considered t o be in overbought region and below 20 it is considered to be oversold.

We can see that the value of Reliance is 50.67 which is neutral. That means that stock is neither in the overbought nor oversold region.

I hope that this blog will help you in doing technical analysis at your fingertips!

Keep Learning!!

Thanks for sharing very interesting blog, it helps to those people who need more information about technical analysis.

Hi,

Thank you for reading our blog!

You can read more blogs on technical analysis here.

Keep Reading!