The Law of Demand is an important macroeconomic element. You can learn more about other topics of macroeconomics with the NSE Academy Certified Macroeconomics course.

Does the law of demand really work all the time? Do you agree?

Umm, I don’t.

Let’s dig deeper and see how does it work.

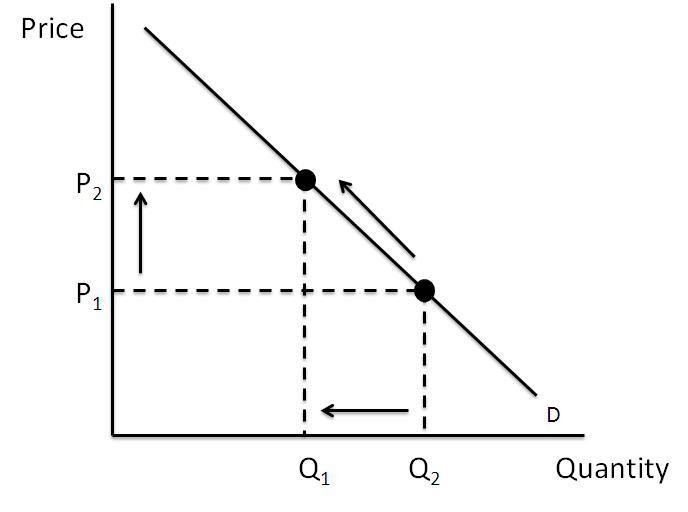

Well, let’s understand what is the law of demand? The law of demand states that all other factor remaining constant, as the price of a product increases, quantity demanded decreases and vice versa. For example, when the price of air tickets comes down, the demand shoots up and people prefer to travel by airplane than railways or any other means.

The following diagram shows the law of demand-

Does law of demand really hold good in stock-market as well, what do you think?

Let’s see an example to understand.

As we can see in the above chart, that whenever the price goes up, the volume also picks up and when the price comes down, volume doesn’t pick up thus disregarding the law of demand. If you see the Indian stock market in the last 1.5-2 years, the situation is same all across the board.

However, the right course of action would be just opposite i.e. we should be more eager to purchase the stocks when the market comes down thus giving us a good price point to enter the market, ensuring a margin of safety.

Also Read: Margin of safety matters!

There’s a famous quote by legendary investor Warren Buffett, who said-

Be fearful when others are greedy and greedy when others are fearful

If we look closely, it relates to the concept of herd mentality.

Herd mentality states that how people get influenced by the masses around them to adopt certain behavior, follow trends and walk on the path of general masses. In simple words, mimicking the actions of other people.

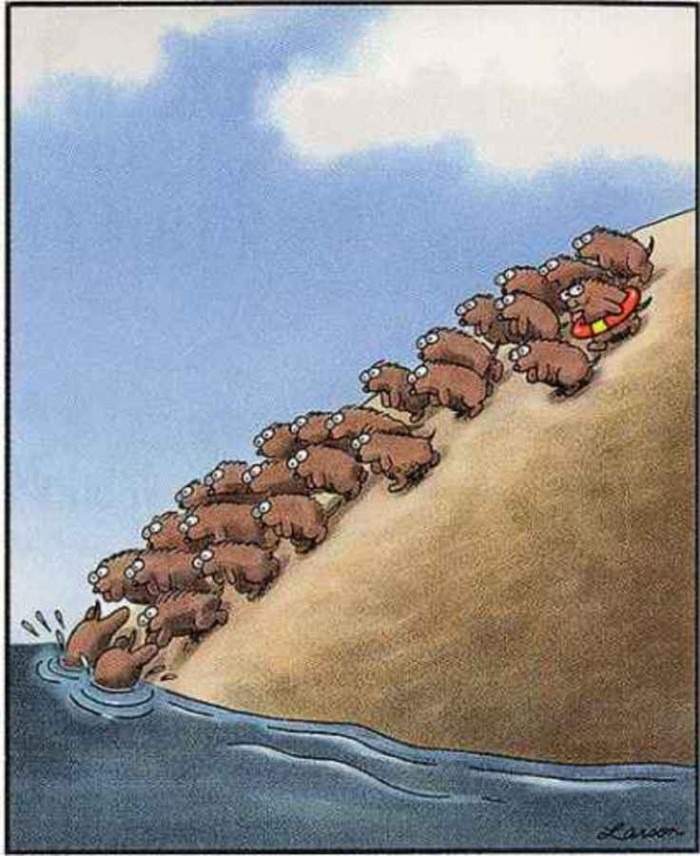

This phenomenon can also be seen in nature. For instance, Lemmings are known for periodic mass migration which occasionally ends up in drowning.

Source: www.ottawaskeptics.org

The phenomenon of herd mentality can also be seen in the stock market where people often follow the herd to take a course of action.

Herd mentality works well most of the time in real life but when it comes to sharemarket, it’s not a right course of action always, as money cannot be made where the herd is heading. Most of the people just blindly accept or follow the market and take action based on the direction of the market. However, the smart investors usually follow the contrarian path.

The real danger of allowing ourselves to fall into the trap of unconsciously following the herd is that it quickly breeds mediocrity.

Bottomline

The right course of action would be to stick to the law of demand and indulge in buying when the market corrects since it gives you an opportunity to buy good companies at an affordable price. Moreover, it’s important to conduct your own research and stick to your belief no matter what others are doing.

This is the only mantra of success.

Take care and keep learning!!