The Donchian Channel is developed by Richard Donchian.

Donchian Channels are useful in the trending as well as the ranging markets.

This indicator consists of three bands in which the mid-band is an average of the upper and lower channel lines.

The indicator can be used in all time frames, such as intraday or weekly charts and can be applied to forex, stocks, options, or futures markets.

In this blog we will discuss Trading strategies using Donchain Channels:

What is Donchian Channels?

Donchian Channels is a popular indicator that determines volatility in the market prices.

These are created by three lines which are generated by moving average calculations.

This indicator is formed by upper and lower bands around a median band.

The upper band represents the highest price of a security over particular periods say N periods whereas the lower band represents the lowest price of a security over N periods.

The area between the upper and lower bands is the Donchian Channel.

Calculation of Donchian Channel

Donchian Channels is a simple indicator which plots the highest high and lowest low of the last “n” periods.

The “n” periods depend on the trader’s choice, who can select the period according to their trading strategy that ranges from a day, hour and minutes, etc.

The default period is set as 20 days by Richard Donchian which is used by most of the traders.

It does not include the current price bar in its calculation.

For instance, if you want to apply this indicator for over 20 candlesticks, then the bands are calculated based on the 20 prior candlesticks.

Trading with Donchian Channels

One of the ways of using Donchian Channels is to determine the support and resistance levels.

The channels get wider when there are heavy fluctuations in prices and get narrow when prices are relatively flat.

In the below image, you can see that the wider price range is highlighted in red whereas the narrow price range is in green.

Use of Donchain Channels in Trading

It can be used in the following ways:

1. Breakout indicator

Donchian channels are used for identifying the breakout of a stock that helps the traders to take either long or short positions.

When the stock is trading higher than the Donchian channels then traders can take a long position, and book their profits or short the stock if it is trading below the channels

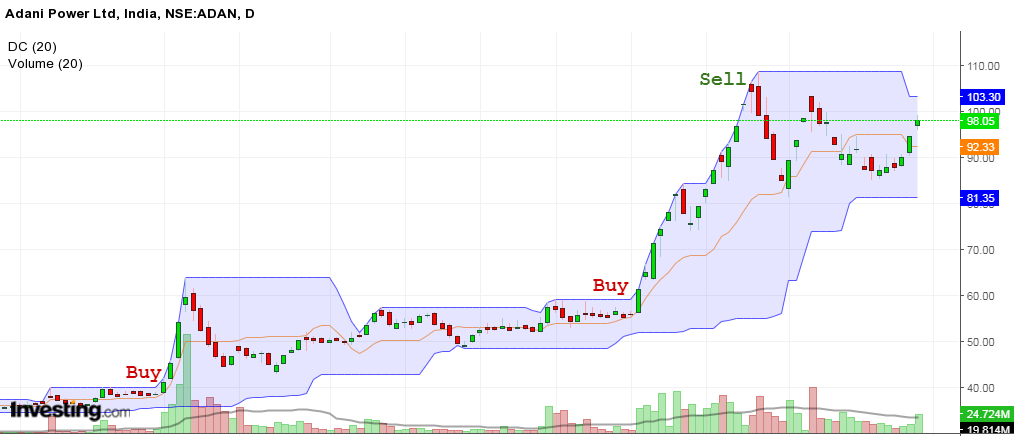

In the image below we have highlighted major breakouts in the daily chart of Adani Power Ltd.:

2. Trading with the Middle Band

The middle band is calculated as the average of the upper and lower bands. This band in Donchian channels is also used as a breakout indicator.

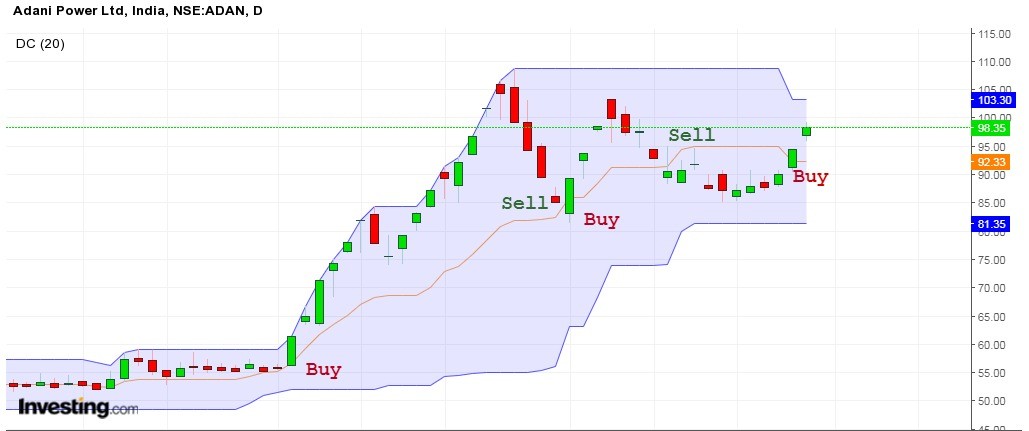

Open a long position when the stock rises above the middle band and short when the stock is trading below the middle band of the Donchian channel as shown below on the daily chart of Adani Power Ltd.:

Traders can also use other indicators like MACD, Stochastics, Volume Oscillator to develop their own trading strategies using this indicator.

Key Takeaways

- Donchian Channel is a popular indicator that determines volatility in the market prices.

- This indicator is formed by upper and lower bands around a median band.

- It is used for identifying the breakout of a stock that helps the traders to take either long or short positions.

- The middle band is calculated as the average of the upper and lower bands. This band in Donchian channels is also used as a breakout indicator.

- Traders can also use other indicators like MACD, Stochastics, Volume Oscillator to develop their own trading strategies using this indicator.

Happy Investing!

Good evening.respected sir/Medam. I wanted learn trading.

Hi,

We are glad that you liked our post, please refer to our blog on Basic Toolkit for Stock Market Beginners

Thank you for Reading!

Very well explaned.

Hi,

We are glad that you liked our post.

Thank you for Reading!