Listen to this:

Fundamental analysis is a bedrock to investing. A basic knowledge of fundamental analysis will help you in laying a better foundation for your investment decisions.

Today we’ll discuss the objectives and goals of fundamental analysis and for whom it is relevant.

Before we do that, let us first understand what is fundamental analysis:

| Table of Contents |

|---|

| What is Fundamental Analysis? |

| Goals of Fundamental Analysis |

| Who should use Fundamental Analysis? |

What is Fundamental Analysis?

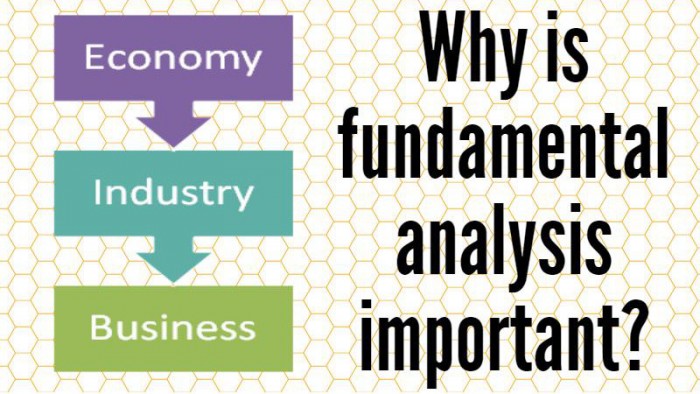

Fundamental Analysis is a process of analyzing a security in order to determine its fair value (also known as intrinsic value), by evaluating relevant economic, financial, non-financial and other quantitative and qualitative factors.

In other words, a fundamental analyst evaluates the health and performance of any company by observing the crucial numbers and major economic indicators.

Also Read – How to evaluate management of a company

A fundamental analyst tries to answer some basic questions such as :

- Is the company experiencing rising revenue?

- Does the company make an actual profit?

- Can it beat its competitors in the future?

- And mush more!

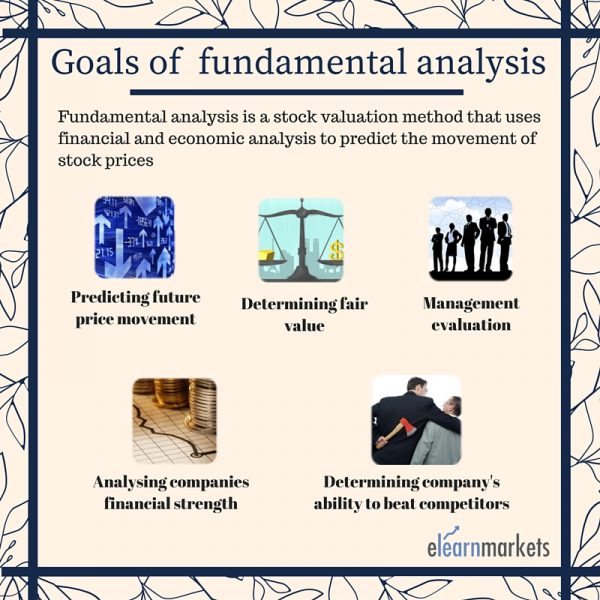

Goals and Objectivesof Fundamental Analysis

1. Predicting future price movement

It scans the industry and the economy, thus forecasting the future price movements of the securities. The fundamental analyst attempts to predict the future stock price based on certain parameters.

2. Determining fair value

It helps in determining company’s fair value and also helps to decide whether it’s undervalued or overvalued. The fundamental analyst would love to purchase the stock if the current market price is below its intrinsic value and would sell the stock when the market price goes far above the intrinsic value. Hence, fundamental analysis is important in stock picking.

3. Management evaluation

Management plays a very important role in making company a successful one. So fundamental analysis helps in evaluating management and also to make internal business decisions.

4. Determining company’s ability to beat its competitor

Simply analyzing a company’s overall performance will not fulfill the goal; rather conducting peer comparison analysis is equally important. You should always question yourself before investing in a company whether the company is in a strong position to beat its competitor in the future?

5. Analysing the company’s financial strength

The real test will be to determine company’s financial strength and its ability to repay debts. No matter how good or bad the management or other factors are, at the end of the financial performance matters.Due to the huge amount of complications involved in fundamental analysis, people have a tendency to avoid the stock research.One mistake which is very prevalent in the market is that initially after buying the stock without conducting any research, people start researching once the price corrects.

To do self-research of stocks based on fundamental factors download StockEdge, India’s best and the fastest growing Equity markets analytics, and research App.

Who should do Fundamental Analysis?

1. Long-term investors

These people are willing to hold onto their positions for the long term unless there is any serious problem associated with the company. They are very patient investors who don’t care about the short-term volatility in the stock price.

2. Financial advisors

These people render financial service and also give stock advice to their clients in terms of what and when to buy and sell the securities.

3. Value investors

They look for stocks where there is mispricing in the market i.e. price and value doesn’t match. They try to identify companies that are extremely beaten down or the stocks that the market is avoiding at the current juncture.

4. Fund managers

These guys work in the big fund houses (insurance company or pension fund) that manages a huge pool of money. Since they have a very big role to play and a large amount of capital is at stake, they have a team of qualified professionals who conduct in-depth stock research.

We would like to hear from you that which areas of finance you want us to write and please give us your valuable feedback in the comment section below.

Take care and keep learning!!

Click here to learn about Fundamental Analysis from our detailed module.

Great write up on the basics of fundamental analysis. It’s more relevant to people who are starting with the study of fundamental analysis.

Fundamental analysis is important because that is the basic thing you have to learn before you start investing

Indeed a good insight.It would have been more good if one classic example would have given.

Thanks a lot. This is great content. I might share some for you guys too. Great work poster!

Absolutely composed subject matter, thankyou for information .

Hi,

Appreciate the great article. It covers all facets. The great

thing is you can actually reference various parts. It’s not simply a skeletal system but this points “got beef on her bone.”

Very interesting all through.. You accomplish that.

Not just in the articles nevertheless the responses.

Cannot put it off to learn the remainder of this website.

I’m certain it will likely be just like this post.

I really thank you for thoughts as well as

writing!.

Great writing in short I easily understood the content

This is a great read for any beginner. Thank you!

Hi,

We are glad that you like our blogpost.

Keep Reading!