Trading in a Channel

In this section, we will learn another technique of how swing trading can be performed using a price channel.

Seasoned traders with expertise in technical analysis can identify patterns and channels. Often prices of stocks are range bound, thus allowing traders to draw two parallel lines- one connecting the support prices and the other connecting the resistance prices. These parallel lines are known as channels.

These can be used to determine supply and demand price levels of a stock and swing traders can enter trades accordingly. Traders must keep in mind that they must trade within the channel.

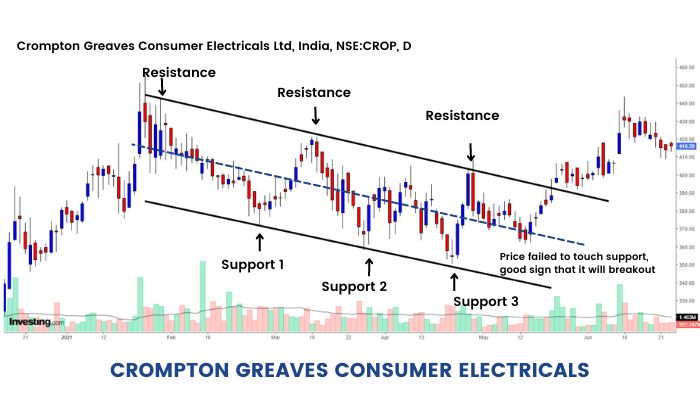

In the above graph we see the price clearly progressing in a bearish price channel. This is called a Downward sloping channel .

It is clearly seen that price is oscillating between a narrow channel and this is where swing traders can make quick profits.

Swing traders can enter into trade at R1, R2, R3 by selling shares with expectation of benefiting from fall in share price till support level of the channel.

Similarly, traders can buy shares at S1, S2, S3 aiming to sell at resistance levels of the channel.

The stop loss for either buy and sell trade should be just outside the channel.

For example, a trader could have bought shares at ₹350 (Support 3) with targetsup to the upper channel at ₹390 or else he could have waited for the price to reach upper end at ₹390 and short sell to benefit from downward fall.

Conversely breakout traders could have bought shares at R3 with the expectation that shares will break out of the channel and move upwards which it ultimately did.

Thus, trading within the channel will give a swing trader multiple opportunities to benefit from the swings within the channel. Focus should be on making small profits, multiple times. Maintaining a strict stop loss will ensure that if there is any breakout from the channel the trader’s capital will still be protected.

There are other swing trading strategies, namely:

- Moving Average Strategy

- RSI & Stochastic Strategy

- Bollinger Band & Super trend Strategy

- Price Pattern Breakout Strategy

We will discuss each of them in our subsequent units.

Sign up with Google

Sign up with Google