Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

Dishonour of Cheque- Have you come across a situation where your cheque has been dishonoured?

Dishonour of Cheque or cheque dishonoured entry mainly happens because most of us are not aware of creating and operating bank accounts & their services. Thus they end up making silly mistakes while writing a cheque. Therefore, it is important to understand the important banking terms and safeguard your money from fraud and save your different types of cheques from getting rejected.

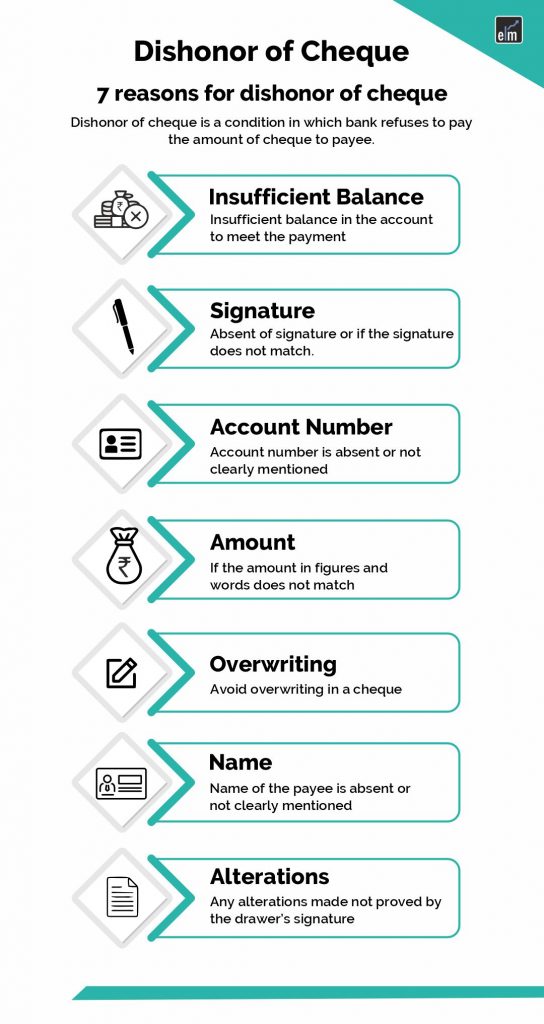

Read to find out the top reasons for the dishonour of cheque.

What is Dishonour of Cheque?

When a bank returns a cheque unpaid, it is called dishonour of cheque. It is said to be honoured if the bank gives the amount to the payee. While, if the bank refuses to honour the cheque and pay the amount to the payee, the cheque is said to be dishonoured. In other words, dishonour of cheque journal entry is a condition in which the bank refuses to pay the amount of cheque to the payee.

Whenever the cheque is dishonoured, the drawee bank instantly issues a ‘Cheque Return Memo’ to the payee banker specifying the reasons for dishonour. An out cheque return means that the cheque, issued by one person or organization to another, is returned by the bank for various reasons such as insufficient funds, an irregular signature, a stale cheque, or a stop payment.

The payee banker provides the memo and the dishonoured cheque to the payee. The payee has an option to resubmit the cheque within three months of the date specified on the cheque after fulfilling the reason for the dishonour of the cheque.

Moreover, the payee has to give notice to the drawer within 30 days from the date of receiving the “Cheque Return Memo” from the bank. The notice should state that the cheque amount will be paid to the payee within 15 days from the date of receipt of the notice by the drawer.

However, if the drawer fails to make a fresh payment within 30 days of receiving the notice, the payee has the right to conduct a legal proceeding against the defaulter as per Section 138 of the Negotiable Instruments Act.

Reasons for Dishonour of Cheque

1. If the cheque is overwritten. Know ‘How to write a Cheque?’

2. If the signature is absent or the signature in the cheque does not match with the specimen signature kept by the bank.

3. If the name of the payee is absent or not clearly written.

4. If the amount written in words and figures does not match with each other.

5. If the account number is not mentioned clearly or is altogether absent.

6. If the drawer orders the bank to stop payment on the cheque.

7. If the court of law has given an order to the bank to stop payment on the cheque.

8. If the drawer has closed the account before presenting the cheque.

9. If the funds in the bank account are insufficient to meet the payment of the cheque.

10. If the bank receives the information regarding the death or lunacy or insolvency of the drawer.

11. If any alteration made on the cheque is not proved by the drawer by giving his/her signature.

12. If the date is not mentioned or written incorrectly or the date mentioned is of three months before.

What are the problems in the Dishonour of Cheque?

In the case of Dishonour of Cheque, a ‘cheque return memo’ is offered by the bank to the payee stating why the cheque has been bounced. The payee can resubmit the cheque if he believes that it will be honoured a second time. The payee can prosecute the drawer legally if the cheque is bounced again.

The Negotiable Instrument Act, 1881 is applicable for the cases related to the dishonour of cheques. In accordance with section 138 of this act, dishonour of cheque is a criminal offence and is punishable with a monetary penalty or imprisonment of up to 2 years or both. Below are the consequences of wrongful dishonour of cheque:

1. Penalty

If a cheque is bounced, then a penalty is levied on both drawer and payee by their respective banks. The person will additionally have to pay late payment charges if the dishonoured cheque is against repayment of a loan.

2. Damage To Credit History

Your credit history is negatively impacted if a cheque is dishonoured since your payment activities are reported to the credit bureaus by financial institutions. The lenders will trust you if you have a good credit score. In order to have a good credit score, it’s good practice to avoid your cheques from being bounced. Your good payment activities will help you build a good CIBIL score and benefit you at the time of lending money from financial institutions.

Keep the above points in mind while writing the cheque so that the cheque is not dishonoured.

Go digital, avoid dishonour of cheque charges!

An efficient way of avoiding cheque dishonour charges is to bank digitally. Instead of issuing a cheque, one can choose to transfer funds online. You can use NetBanking or Mobile Banking for transferring funds to third-party accounts. You can also make transfers within your accounts using the digital payment system.

If you have to issue a cheque, here are a few things to keep in mind;

- Make sure you issue an account payee cheque.

- Use the signature that is registered with the bank.

- Ensure that there is sufficient balance in your account.

- Fill in the details on the cheque carefully

Bottomline

In conclusion, it is best to avoid dishonoring checks at all costs because it not only reflects badly on the check writer but also jeopardizes the stability and confidence of the financial system as a whole. To preserve confidence and promote a sound financial environment, people and businesses must operate with honesty and financial responsibility in all of their dealings.

Frequently Asked Questions

What will be the consequences of the dishonouring of cheques?

According to Section 138 of the Act, the dishonour of a cheque is a criminal offence that is punishable by imprisonment for two years or with a monetary penalty or with even both. If the payee decides to proceed legally, then the drawer can be given a chance of repaying the cheque amount immediately.

What if the bank dishonoured a cheque by mistake?

If a cheque is dishonoured by the bank by mistake then the bank will have to reimburse the cheque and return back charges to the customer.

What is the difference between a dishonoured cheque and a stale cheque?

A stale cheque refers to the cheque that is presented to the bank for payment after three months from the date mentioned on it, then it is known as. The cheque will be dishonoured after the expiry of that period

For More Market Updates, Visit StockEdge

You must make sure that you hire the best web hosting company India

to get the best deals and offers for web server hosting. People, who are planning to use their own software, they must not choose this hosting service.

There are thousands of web-hosting service providers and all

of them claim to be the best.

If a drawee forget to sign in a cheque which he issue to payee . My question is is that any amount will be deducted from the payee account. If yes then how much.

Hi,

Thank you for the read. In case you have not signed on the cheque, it does not complete the cheque. Which means that your cheque has no validity. Hence, no amount of money can be withdrawn from your account by you or someone else until the cheque is signed by the account holder/ you in this case.

In case of any further queries, feel free to write back.

If the ” stop payment” letter is given by payee to his bank without mentioning date,drawer name, or amount of the cheque and reason for stop payment.of that particular cheque.what is the legal deficiency in that letter if bank stops the payment onthe basis of above mentioned letter.

Hi Hemant,

Thanks for writing us.

If the payee gives stop payment order to the bank without mentioning the reason for the same, there is no legal deficiency in this regard. It’s upon the payee whether he may or may not mention the exact reason for such. In case, the other party asks bank about the reason for stop payment, the bank will answer as per the information received by them in this regard.

In case of any further queries, feel free to write back

Sir I gave cheque without writting name and date one more thing I didn’t sign correct sign my friend nd he is dead now his brother came to home taking cheque ….and he is saying that Ur friend taking money by giving this cheque what to do sir…

Can you plz tell me the reason why we are debiting drawees a/c while the cheque gets dishonour….and plz tell the aspects of it

Hello Malvika

The drawer writes the various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay that person or company the amount of money stated.

In case of dishonour of cheque, in order to settle the account, Drawer’s bank is debited (drawee here but think it from the perspective of a creditor) and crediting payee who was a creditor for us to whom the payment was actually being made but a reverse entry is being passed as he hasn’t received a payment yet.

Useful basic Information. Thanks for the post.

i got my info thanks!!!

Welcome Gray

You can also read How to write a Cheque to get a better understanding of the proper way of writing a cheque.

Happy Reading!

If the cheque presented for payment has both a signature mismatches and has no sufficient fund; how you right on the cheque returning slip? Could both reasons be written or what?

Thanks

If the cheque presented for payment has both a signature mismatches and has no sufficient fund; how you right on the cheque returning slip? Could both reasons be written or what?

Thanks

Hello Sleshi,

Thank you for your comment

Depending upon the internal regulations practiced by specific banks: multiple reasons can be written on the cheque return memo by using pre-determined codes(separated by a comma in case of multiple reasons)

Usually, Code:1 represents insufficient funds while Code:13 represents Signature mismatch

You can read: How to write a Cheque to get a better understanding of the proper manner of writing a cheque.

Happy Reading!

Am glad for the online highlights you provide.

Thank You Alphonce

Awsome website! I am loving it!! Will come back again. I am taking your feeds also.

Hello Karri,

Thank you for your comment.

If you want to know the proper way of writing a cheque , you may read: How to write a Cheque

Happy Reading!

Sir

I have issued a blank cheque with signature but cheque was written by other individual,is cheque is valuable or not ?

Hello Venkataswamy,

Thank you for your comment.

No problem, the cheque is still valid.

To know the proper way of writing a cheque: you may read: How to write a Cheque

Happy Reading!

my orignal cheque return unpaid for reason RISK involved and plz explain word risk

Hello Imran,

Thank you for your comment.

You should consult your Bank.They will be able to guide you in a proper manner in this regard.

To know how to write a cheque in a proper manner: you may read our blog: How to write a Cheque?

Happy Reading!

Hello malik Imram,

When your bank returned your check with message RISK INVOLVED, it’s very much possible you could had thrown a crossed check open carelessly or you’ve probably ordered for the payment of amount beyond withdrawable limit across the counter. Possibly your signature is irregular, however contact your bank to address this issue swiftly.

If you’re in a distance, reach them through their toll free line available on their website. You can get their website by key wording your bank name on Google then follow the direction and will most possibly land at their website, go to contact us page to get their lines or email address. Hope that helps?

If the payee order the bank stop cheque payment.

So him/ his what were the doing against cheque payment for payee.

He’ll take leagal action against payee ?

Plzz explain me……urgent basis

Hello Dinker,

Thank you for your comment.

Your lawyer will be the best one to guide you as to whether a payee can take any legal actions against the drawer of a cheque if the cheque is dishonoured due to Stoppage of Payment.

To know the proper manner of writing a cheque you may read: How to write a Cheque

Happy Reading!

hello could you expain to me advantages of using a cheque plizz?

Hello Felix,

Thank you for your comment.

Some advantages of using a cheque are as follows:

1.Safe: Only the recipient named in the cheque will be able to cash the cheque in a bank or any other financial institution and therefore are safe.

2. Trusted: Since this mode of payment has been present for a long time: therefore people trust this mode of payment over digital payment modes sometimes.

3.Proof of Payment: Cheques leave a paper trail which can be used to solve disputes.

To know the proper manner of writing a cheque: you may read: How to write a Cheque

Happy Reading!

Hi,

My cheque has been dishonored due to insufficient fund however the fund was available.

What I need to do now ?

Hello Mukesh,

Thank you for your comment.

Your bank will be the best person to guide you in this situation.

To know the proper way of writing a cheque you may read: How to write a Cheque?

Happy Reading!

Hi Mukesh, In this regard some factors could be playing out such as:

1. Your withdrawal demand is insufficient less your account minimum operating balance. What this means is that you’re supposed to have a certain amount in your account called the operating balance, you’re not expected to withdraw this amount so long you’re still operating with the bank.

2. You’re account could had accrued some charges depending on your account type which had been automated to pass debit into your account on a future date.

3. You probably could had been on your bank loan file, they’ll have to deduct the loan amount for the period or month under review in a circumstance where the available fund is not enough to service your monthly instalment debt, you cannot make withdrawals. Any of these points could had been why you weren’t able to make withdrawal.

Hello, how long does it take for a cheque to be dishonoured?

Hello Musa,

Thank You for Your Comment.

Your Bank will be the best person to guide you with regards to your question.

To know the proper way of writing a cheque you may read: How to write a Cheque?

Happy Reading!

I really luv d message passed it helped me tnx for informing me now I know reasons why cheque is dishonoured.

Hi,

Thank You!

Keep Reading!!

check dishonoured but i don”t know the person details properly?

Thank you for explaining in a very simple language.

Hi,

Thank you for Reading!

Keep Reading

nice

Hi,

Thank you for reading our blogs!

Keep Reading!

Oh wow I see

nice… very Useful article

Hi,

Thank you for reading our blog!!

Keep Reading!