Gold

Introduction to Gold

Gold is a precious metal that has a special place in all our hearts. Who doesn’t like gold? From owning gold jewellery to having gold bars or coins in the safe deposit box, there’s something about gold which makes us feel secure. When it comes to the yellow metal, there are a lot of interesting things to know.

A brief history of gold

Gold has been used since ancient times for making jewellery and coins. Its supply was limited due to the hardships of digging it out of the underground reserves, which led to its higher value – thus earning the title of ‘precious metal’. It was used for trade and stored as wealth.

Slowly, paper currencies and coins made of less precious metals replaced gold. However, gold did not lose its popularity. People still love gold and consider it a mode to store their wealth.

As a country, the United States of America was the first country which started keeping gold as a reserve. Over the years, USA gathered 75% of the world’s gold, which had significant effects in strengthening the US Dollar as a currency. Following this, most countries started fixing their currencies against the US Dollar, making it one of the strongest currencies in the world. Soon, many other nations linked their currencies to gold prices.

The demand for gold

Gold not only has financial value, but it has deep emotional and cultural values attached to it. People of different countries accumulate gold for different reasons, which are strongly influenced by the economic, social and cultural factors. For example, in India and China, the bride is given a significant amount of gold jewellery as a part of the wedding gift.

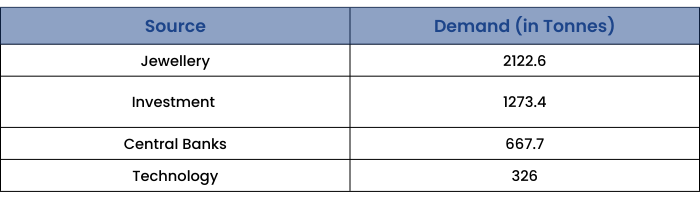

The primary sources of demand are:

- For Jewellery Manufacturing: The traditional use of gold for making jewellery is still persistent. Although the demand has reduced in recent decades, still about 50% of the world’s gold is demanded for this purpose. According to the World Gold Council, most of the demand for using gold for jewellery manufacturing comes from India and China.

- As an Investment Option: Gold has been considered a ‘safe-haven asset’ for investors from around the world. Gold has tangible long-term value, which makes it an investor’s choice. As per World Gold Council reports, the demand for gold as an investment option has increased at least 235% in the last 30 years. We will discuss more in other sections of this module.

- Demand from Central Banks: The Central Banks of all countries (for example, Reserve Bank of India) keep some of their reserves as gold. This is done keeping several economic goals in mind.

- Technology and innovation: Gold is an integral part of various innovations such as in electronic goods, dentistry, purifying water and others. Hence, gold has significant industrial demand.

Source: World Gold Council - https://www.gold.org/goldhub/data/gold-supply-and-demand-statistics

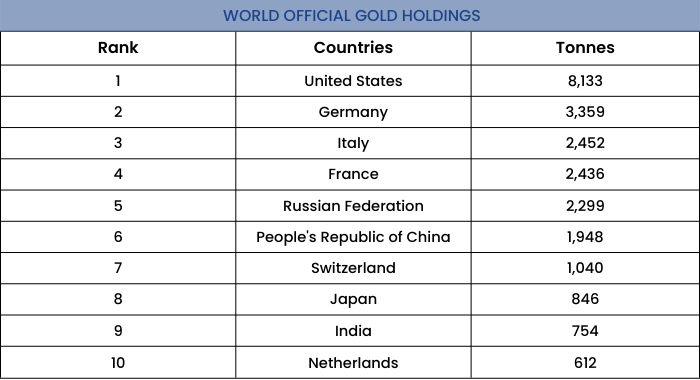

According to the World Gold Council, the total gold reserves is around 31,695 tonnes (September 2021 data) out of which more than 75% is owned by only 10 countries.

Let’s take a quick look at them:

Why do countries maintain gold reserves?

Gold is a universally accepted currency, which does not require any third-party guarantee. Unlike currencies like the US Dollar which has to be guaranteed by the United States government or Indian rupees which is backed by the Government of India, gold is worth something everywhere.

Central banks of various countries hold gold reserves as a kind of insurance policy so that in the case of any unforeseen circumstances, they can trade gold. For example, if tomorrow, the US Dollar declines dramatically in its value, the US government can sell gold to buy the dollar and provide support to the value of the dollar.

Central banks keep increasing their gold holdings so that if inflation rises, and goods become more expensive, the gold holdings can support the economy of the country. Higher gold reserves bring credibility to a country. This is the main reason why the USA and other developed countries hold large reserves of gold.

Why is gold so valuable?

Finally, let’s summarize and list down the reasons why gold is so valuable:

- It has historic, cultural and emotional value.

- It is difficult to mine, hence although it is available in plenty, the supply is limited.

- It is demanded by different people for different reasons.

- It has economic significance.

- The value of the US Dollar is linked to gold reserves and prices.

Investing In Gold

Now let us come to a very pertinent question –What’s in it for you? As with the demand for gold, the reasons why people invest in gold is also varied.

Here are the most common 5 reasons why people invest in gold.

1. Gold is secure

The value of gold doesn’t decline in the long run. Yes, it does go down in the short run, but, in the long run, it has gone up, up and up. For example, in September 2012, gold prices ₹30182.90 per 10 grams, after which it started falling. It reached a price of ₹ 22596.60 per 10 grams in December 2015. For someone keeping a short-term view, this will look like a 25% fall. But keeping a long run perspective, it is important to remember that after December 2015, gold prices started moving upwards and reached ₹49191.10 per 10 grams in August 2020.

You can find more about historic gold price movements in the Gold Prices section of this module.

2. Gold brings stability

The prices of gold are not easily affected by political and economic uncertainties. Hence, it is perceived as a safe investment by millions around the world. The prices of gold are not easily affected by political and economic uncertainties. Hence, it is perceived as a safe investment by millions around the world. For example, the Eurozone crisis which started in 2009 adversely affected the economies of all European countries. The value of the Euro dropped drastically which led to many European countries plummeting into heavy debt. However, gold prices kept increasing steadily during this time and reached a record level of Euro 1332.30 per troy ounce in 2011.

This weak correlation of gold with political and economic turmoil is one of the main reasons why gold is a preferred form of investment in African and Middle Eastern countries.

3. Gold adds diversity to a portfolio

Any portfolio needs to be diversified to perform well in the long run. Gold is an ideal choice for bringing in diversity to the portfolio. The prices of gold are not linked to the stock market, bond market or real estate and hence are unaffected by their volatility.

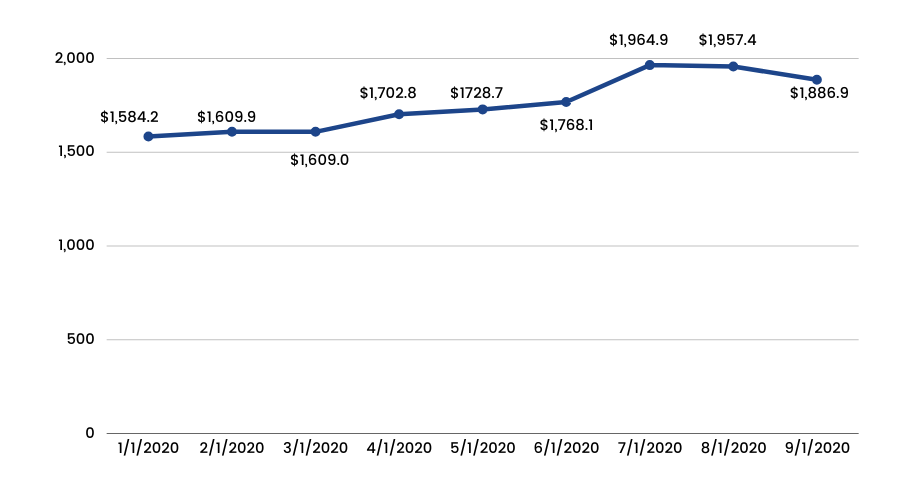

Take the year 2020 as an example. The Coronavirus pandemic affected all economies of the world adversely. Most economies went into a recession. However, gold has seen a steady increase in price since the beginning of 2020.

NYSE Composite Day Close

Gold Prices (USD per troy ounce)

In the graphs given above, you can see that the New York Stock Exchange (NYSE) Composite Index experienced a sharp fall in March 2020 when the Covid-19 pandemic started affecting the US economy. Since then, NYSE Composite has been struggling to go up. However, gold prices have experienced a steady upward movement during this time, quite unaffected by global economic conditions. The situation has been similar in almost all economies around the world.

Hence, investors started trading in gold, rather than participating in the uncertainties of the stock markets.

4. Investment in gold can earn dividend income

Well, traditionally when we talk about gold, the only thing we think about is buying physical gold. However, there are various ways in which one can invest in gold such as purchasing physical gold, gold exchange traded funds, derivative products in gold such as gold futures and gold options, gold mutual funds and much more!

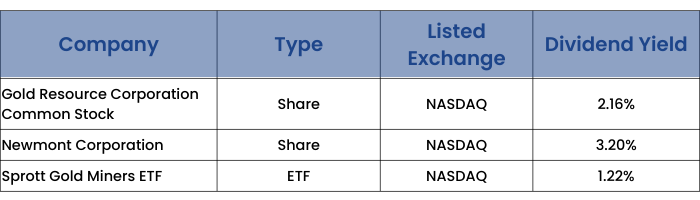

One such mode is investing in the shares of the companies which mine gold or investing in gold ETFs or gold mutual funds. Both gold mining companies and gold ETFs have historic records of paying dividends to investors.

Here’s a list of some prominent global gold mining public companies and ETFs and their dividend yields as on Jun 22:

5. Gold is a hedge against the dollar

For those who are concerned with the international economic scenario in some way, gold is a great investment since it provides a hedge against US Dollar rates. In October 2018, the USD to INR rate was 74.21, which means 1 USD was worth ₹74.21. This started going down (which means INR started to strengthen). In July 2019, this rate went down to 68.69.

Now, what can this mean for an NRI who lives in the USA and sends $10,000 every month to India to build up a savings portfolio?

In October 2018, his $10,000 was worth ₹7,42,100. However, by July 2019, he could get only ₹6,86,900 for his $10,000, which would have made a significant gap in his portfolio planning. However, the price of gold in October 2018 was USD 1,215.0 per troy ounce and by July 2019, it went up to USD 1,427.6.

So, instead of sending the 10,000 USD back to India in October 2018, he had bought gold, his wealth wouldn’t have eroded by July 2019. On the other hand, it would have gone up.

Advantages and Disadvantages of Investing in Gold

Start trading smarter – Enroll in our commodity trading program

Now that we have discussed why investment in gold is a good idea, let us take a quick look at its advantages and disadvantages.

Advantages

- Gold is an eternal metal – there is a strong demand for gold across the globe.

- Gold is ideal for bringing diversity into a portfolio.

- Gold provides significant hedging opportunities against financial and economic risks.

- Gold is a liquid investment – it can be bought and sold anytime you want.

Start trading smarter – Enroll in our commodity trading program

Disadvantages

- Buying physical gold brings in a problem of storage. One may incur additional costs storing the gold and keeping it safe.

- Gold prices can be volatile in the short run.

- One may have to pay brokerage fees while purchasing gold ETFs and shares.

- It has been observed that when the stock market goes up, gold prices go down. Some investors panic when this happens. However, gold prices finally settle down.Hence being patient is important.

Gold Prices

The London Gold Market Fixing Limited which consists of five major banks in London determines the market price of gold. They meet twice a day via conference call at 10.30 am and 3 pm GMT to fix the prices. During these conference calls, the banks declare how many bars they want to buy or sell at the specific price which is declared by the chairman at the beginning of the call. If there are too many buyers and fewer sellers, the price goes up and vice versa.

This process of fixing gold prices has been universally accepted since it brings order to the market. This price is used by banks to conduct gold trading in the markets while refineries and mines value their inventories.

Factors affecting gold prices:

While the above-mentioned process sounds very simple, it is far from being so. Gold prices are affected by several factors, out of which, the common ones are:

1. Monetary Policy

The monetary policy of the US Federal Reserve (commonly known as the Fed) is probably the biggest influencer of gold prices. From time to time, the Fed makes announcements such as its interest rates or policies regarding the US economy which affects gold prices. You must be thinking why does the USA’s policy influence global gold prices? It is because, as mentioned earlier, the US holds the largest reserve of gold in the world.

Out of all of the Fed’s decisions, interest rates affect the prices of gold the most. To understand this, we need to understand something called ‘opportunity cost’. Opportunity cost is basically the loss of an opportunity for making a choice. For example, when you go to a coffee shop, you have a wide range of coffees to choose from. If you choose latte, you are potentially giving up the opportunity of enjoying a mocha. This is called ‘opportunity cost’.

When interest rates go down, investments like bonds and fixed deposits become less attractive. So, investors choose gold over such options, thus increasing the demand for gold, hence the prices of gold increase. Alternatively, when interest rates go up, investors forgo gold to opt for higher interest rate yielding products.

2. Economic Data

Economic data such as manufacturing data, jobs data, wage data, GDP growth and others have an impact on gold prices. The stronger the data, the lower the prices of gold because when the economy is strong, the Fed can tighten their monetary policy by raising the interest rates, thus making gold a less attractive investment option.

3. Inflation

The rising prices of goods and services or inflation can affect gold prices. Higher inflation pushes gold prices up and vice versa. When inflation goes up, goods and services become more expensive. Hence, people tend to hold money in the form of gold. This pushes gold prices up.

4. Supply and Demand

Like with all other items, supplyand demand influence gold prices. Higher demand with lower supply pushes the prices higher and vice versa. For example, as per the World Gold Council, in the first few months of 2016, the demand for gold increased by 15% while supply went up by only 1%. Gold prices went up by almost 20% during this time.

5. Currency Rates

The value of various currencies, especially the US Dollar, strongly influences the prices of gold. A decline in the US Dollar represents a weakening of the US economy, thus making gold more attractive and pushing its prices higher. This is the main reason why gold prices have been so high in 2020 when the US economy was adversely affected by the Covid-19 pandemic.

Historic Gold Prices

The last two decades have been spectacular for gold. While the world went through major economic crises, gold continued its upward price trajectory. In fact, if one had bought 10 gms of gold in 1999 by spending ₹ 4,234.00, she would have been able to sell it for ₹ 48651.00 in 2020 – a whopping 11.5 times increase.

Overall, the price of gold has been on an upward journey in the last decade.Let’s see the last 10 years gold price movement in India:

Gold Price Movement (per 10 gms) in the Last 10 Years (24 carats)

Source: https://ycharts.com/indicators/gold_price_in_indian_rupee

We mentioned earlier that in the long run, gold prices have never declined. In the last 50 years, global gold prices have gone up by almost 51 times. Here is a decade-wise breakup of gold prices in the last 50 years:

Gold Price Movement (per 10 gms) in the Last 50 Years (24 carats)

Source: https://ycharts.com/indicators/gold_price_in_indian_rupee

Hence, from a long-term perspective, gold has proven its mettle in being a reliable investment option.

Gold Prices in 2020

2020 has been a record-breaking year for gold, with its prices reaching ₹ 49191.10 per 10 gms (24 carats) in August 2020. This trend has been observed in the global prices of gold as well with the price reaching USD 1955.85 per troy ounce in August 2020.

Let’s see the movement of gold prices between November 2019 – October 2020 below:

Gold Prices (₹/10 gms)

Source: https://www.gold.org/goldhub/data/gold-prices

The economic slowdown caused by the lockdown due to the global Covid-19 pandemic triggered the demand for the precious metal. As a result, we can see that gold prices have increased by almost 30% between November 2019 and October 2010. The trend has been the same worldwide.

Options For Investing In Gold

When we think of gold, mostly we think of buying the yellow metal in its physical form. But that’s not all. Today, an investor has a world of options for investing in gold. Here are the most common ones:

Physical Gold

Commonly known as gold bullion, one can purchase physical gold in a variety of forms – jewellery, coins, bars and others. Gold can be bought from a jeweller, a bank or any other authorized dealer. This is the most popular form of investing in gold across the world.

However, buying physical gold is quite inconvenient since the initial investment amount can be quite high (because one has to buy at least 1 gm of gold) and the investor has to arrange for its storage and safety.

Pros: Direct ownership of gold

Cons: May incur extra cost for storage and insurance

Gold Exchange Traded Funds

Gold exchange-traded funds (ETFs) are popular and cost-effective methods of investing in gold. ETFs are funds which represent the prices of an underlying asset – in this case, gold.

They are bought and sold in a stock exchange (BSE or NSE) and can be purchased with a relatively low investment. Over the last few years, Gold ETFs have become a very popular form of investment, mainly due to the ease of buying and selling.

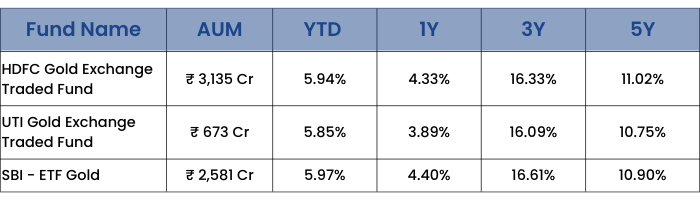

In India, there are many gold ETFs which have given significant returns to investors. Here are a few popular ones:

Data as on June 2022

Pros: Convenient. No need to visit a store to buy or sell.

Cons: The investor is not the direct owner of gold.

Gold Futures & Options

A future is a contract between a buyer and seller to buy/sell a certain asset on a previously decided price at a future date. In the case of gold futures, the underlying asset is gold. In a gold futures contract, a buyer and seller decide to buy and sell gold at a certain price on a future date. You will usually find three future dates for such contract execution at any point of time in the market – at the end of the first month, second month and third month.

Options are contracts, just like futures. However, the parties in the contract do not have the obligation to buy or sell the asset at the end of the contract period which means the asset may or may not be bought and sold upon contract expiry. Gold options are used as a hedge against gold price fluctuations.

Investing in gold futures and options requires more understanding than investing in bullion or ETFs and hence is usually the forte of expert traders. Chicago Mercantile Exchange in the USA is the world’s largest exchange of gold futures and options trading. In India, gold futures and options are traded in Multi Commodity Exchange (MCX).

As on 13th October 2020, 1 gold futures was trading on the MCX exchange with expiry on 4th December 2020. The price was ₹ 50,373.

Pros: No hassle of storage of gold and transportation. Can be very profitable.

Cons: Complex product structure. Needs expertise to trade.

Shares of Gold Mining Companies

Another great way of investing in gold is purchasing shares of gold mining companies. These work as normal share investment. An investor can make a profit when the share prices go up. Like all other companies, mining companies also declare dividends, which can be an additional source of income to the investors.

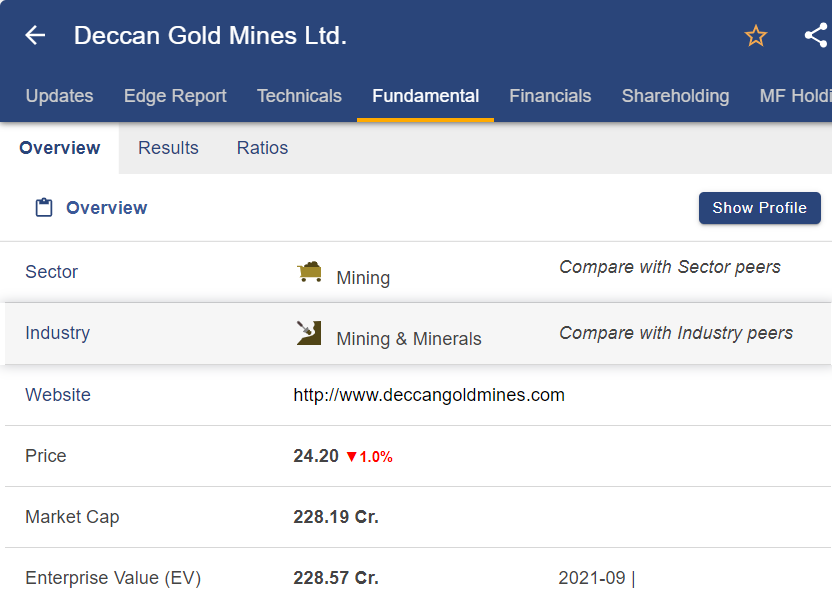

As of June 2022, only one gold mining company in India is publicly listed – Deccan Gold Mines Ltd.

Source: web.stockedge.com

Pros: Not many options of gold mining company shares available to invest in India.

Cons: Can be traded like any other share. Hence, no extra knowledge is required to trade.

Gold Mutual Funds

If you want to invest in a combination of some of the options mentioned above, you can choose to invest in a gold mutual fund. Depending on the fund type, gold mutual funds invest in a combination of gold investment options. They work like normal mutual funds and can be purchased based on their net asset value.

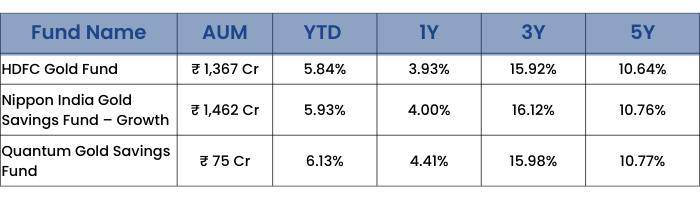

Here are some of the most popular gold mutual funds available in India as of June 2022.

Pros: Ideal for investors who want to participate in the gold price movement but are not aware of how to go about it or do not have a Demat account.

Cons: Costs slightly higher than ETFs

Sovereign Gold Bonds

These are paper gold bonds issued by the Reserve Bank of India on behalf of the Government of India. They were first launched in 2015 as an alternative to investing in physical gold and a method to encourage people to inculcate the habit of investing. Once issued, these bonds are available in the secondary market for buying and selling.

Sovereign Gold Bond 2020-21 Series – VII was open for investment from October 12 to October 16, 2020. The issue price was ₹ 5,051/- ₹ 5,001/ for online investments. An investor could buy minimum of 1 gram and maximum of 4 Kg. The interest rate was 2.50%.

Pros: Safest way to invest in gold since it provides a fixed interest rate to the investors.

Cons: Since the interest rate is pre-decided, an investor cannot participate in the volatility of gold prices.

Tips For Investing In Gold

As we have learned, what are the different options to buy gold in India? This section will discuss a few tips when investing in gold. So, let us start:

- For investors wishing to participate in the volatility in the prices of gold, buying physical gold or bullion is a great option. While owning physical gold requires an initial investment and storage costs, people might find it more comfortable than investing in paper gold.

- Having said that, jewellery is not really the best option for buying physical gold. Bars and coins have better market acceptability and standardization.

- If you are an aggressive investor and understand the ways of working of futures and options, there can be no better gold investment alternative than trading gold futures and options. They are an efficient and profitable way of participating in the gold price movement.

- For a beginner investor, mutual funds and ETFs are the safest and the easiest way to invest in gold. These are passive investments which require less monitoring from the investor’s side.

- If you are completely risk-averse, sovereign gold bonds might be right for you. Bonds which are issued by the Government of India, sovereign gold bonds are the safest of all the options.

- Keep a long-term perspective while investing in gold. As we have shown you, historically, gold prices have gone up. Hence, in the long run, this trend is likely to continue. If you have a shorter time horizon, you might look at other modes of investment.

- Always buy/sell gold through a reputable dealer – be it physical gold or paper gold. Using a well-regulated broker/dealer is always recommended.

Conclusion

Gold is an ideal option for bringing diversification to a portfolio. An allotment of 10-15% in gold is ideal for building up your portfolio and protecting it from market fluctuation.

It is possible to build up a large corpus of gold by investing a little every month. Make the right use of all the investment options and create your own mix.

So, we have learned that gold is a precious metal and is a very important asset class that helps us to diversify our portfolio. If you liked reading this module, we have also designed many other interesting modules at ELM School. Do read them all to gather knowledge, skill and expertise in the financial markets.