Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

One out of the many ways to generate revenue from the stock market is through day trading and thus finding a right trade becomes more crucial.

Day trading is a specific trading technique where a trader buys and/or sells a financial instrument multiple times over the course of the day with a motive to profit from small price fluctuations.

| Table of Contents |

|---|

| Market analysis |

| Analyzing pre-market |

| News impact |

| Trading Volume |

| High Liquidity and Volatility |

| Trade stocks near 52- week highs/lows |

| Key Takeaways |

However, day trading is essentially a high-risk investment strategy that requires a great deal of knowledge, a large amount of funds, expertise, proper risk management, discipline, and technique to select the right trade that can generate profit.

One of the most pressing issues faced by traders is to find the right trade among thousands of stocks.

Following are points that may help traders to find potential right trades for the day.

1. Market analysis

A trader should have an early start to the trading day, and should start his preparation work at least an hour before the start of the markets.

He should utilize this time to analyze any latest macro or micro news flow, international markets, geo- political happenings, crude and currency movements, reading news and views that may have an impact on any particular stock (right trade) or sector on that day.

This provides him with a fair bit of idea where the market may head and which sectors and companies can he place his bet upon.

2. Analyzing pre-market

Traders should keep a close eye on pre-market session to guess the strength and sentiment of the market. Pre- market session should be analyzed:

(i) to determine bullish or bearish sentiment of the Nifty or Sensex index,

(ii) opening gap or gap down of individual stocks (especially top 5 gappers) and

(iii) pre- market volume data strength of any stock(most actively traded).

It is generally seen that stocks with a higher opening gap up combined with a strong volume have a huge demand and likewise stocks with a big gap down with strong volume are likely to have a bearish sentiment during the day.

Attention should also be paid to the amount of upward or downward momentum being built in a particular stock indicating how the stock will perform as this emphasis on which one is right trade to invest.

Learn about stocks in detail with Stock Market Made Easy Course by Market Experts

Proper analysis of pre-market may influence traders in specific stock picks and help them to streamline their trading strategies ahead of the curve.

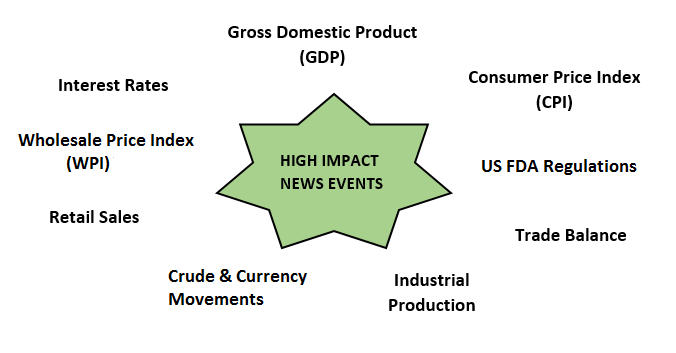

3. News impact

Day traders should always find right trade in stocks that are moving and showing volatility. And one way to find such stocks is to look at names in the news.

News has a direct impact on the stock, thus impacting the price of the stock in question.

Stocks can make big intraday moves, in either direction, based on earnings reports, order data, upgrades/downgrades, product announcements, FDA announcements, economic data releases, geopolitical issues and other macro and company-related news.

4. Trading Volume

The volume of stock traded measures how many times it has been bought and sold in a given time period, usually within a single trading day. A stock with high degree of volume suggests higher interest in the stock- either positive or negative.

An increase in a stock’s volume is often an indicator of a price jump, either up or down.

Stocks with high volume provide increased liquidity and significant price movement which is essential for successful day trading.

5. High Liquidity and Volatility

Liquid stocks provide traders with the opportunity to trade numerous times a day and exploit minute price movements in the stocks.

Such stocks provide tight spreads and low slippage thus allowing traders to easily enter and exit the stocks at a good price.

Volatility measures how much price of a stock will fluctuate over a given time. Trading the most volatile stock is an efficient way of trading as they offer more profit potential.

The more the price fluctuates, the more opportunity there is for traders to profit from intraday movement. All these make volatile stocks preferable over range bound stocks for day trading.

However, traders should look out for volatile stocks in combination with strong volumes, essential for easy entry and exit.

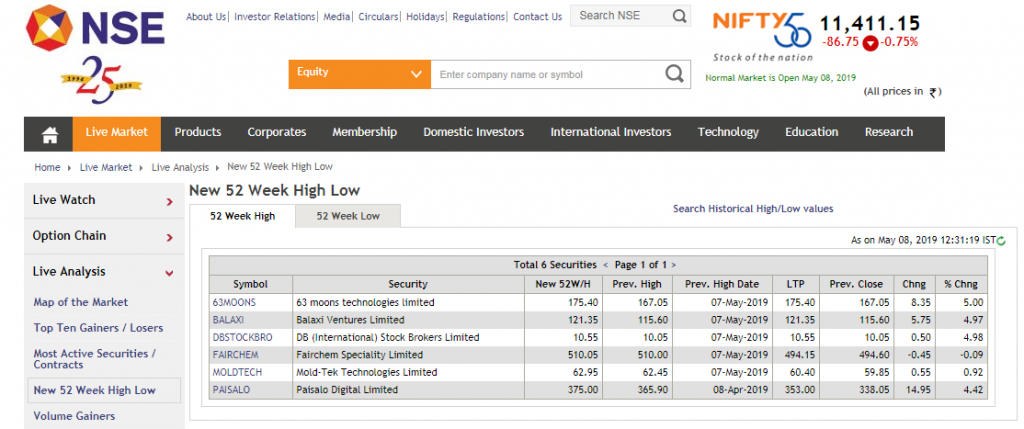

6. Trade stocks near 52- week highs/lows

A 52-week high/low is the highest and lowest price at which a stock has traded during the previous year.

Traders should look out for stocks at or near 52 weeks high/lows, as such stocks see the higher interest and therefore more momentum for daily trading.

Usually, it is seen that if stock price breaks from the 52 week zone (either above or below), the momentum in price is expected to continue in the same direction.

They can also place contrarian trades where 52 week high should be treated as a resistance level and 52 week low as a support zone.

Thus, day traders can choose stocks hovering around 52-week high/low zone and can apply the above strategies to generate profitable trades.

An NBER paper by Samuel P. Fraiberger of World Bank showed that media sentiment is an important predictor of daily stock returns in both emerging and advanced markets.

Therefore, it is important for day traders to review the news headlines periodically.

At the same time they should also be able to comprehend and determine the extent to which the news will impact a particular stock and/or sector.

So, keeping track of the news and their quick comprehension, helps a trader to quickly find a list of potential day trade.

Key Takeaways:

- The first step in trading is figuring out what to trade and the second is to correctly time the market and implement strategies to generate the maximum return.

- Traders should start early. They should conduct a thorough analysis of the market, sectors and stock at the opening.

- They should always choose a stock that well suits their financial position and goals, like the quantum of capital he has, type of investment he wants to make and his risk tolerance etc.

- Trading should be more objective and less subjective. Traders should not get emotionally attached to any stock, whether positive or negative, rather they should focus only on profit and loss and should always adhere to stop loss.

- Traders should be prudent enough to identify the ongoing market trend and should usually prefer strong stocks in an uptrend and weak stocks in a downtrend to lower the potential for loss.

- It is always beneficial to avoid trading when the market fails to establish any clear trend.

Thank you for sharing this informative Blog.

Hi Shikha,

Thank you for Reading!

Keep Reading!

Perfect and Profitable information for DAY TRADING.

Hi,

Thank you for reading our blog!!

Keep Reading!