English: Click here to read this article in English.

तकनीकी विश्लेषण (Technical Analysis) के तहत, कैंडलस्टिक चार्ट किसी सिक्योरिटी की कीमतों में परिवर्तन का विश्लेषण करने के सबसे कुशल तरीकों में से एक है।

कैंडलस्टिक चार्ट्स की लोकप्रियता का एक कारण यह है कि वे बार और लाइन चार्ट्स की तुलना में अधिक आकर्षक हैं।

एक व्यापारी के लिए, कैंडलस्टिक चार्ट की दो सबसे पसंदीदा विशेषताएँ हैं:

- प्रत्येक कैंडलस्टिक एक विशेष अवधि के दौरान व्यापारों की विशिष्ट संख्या के पूरा होने को दर्शाता है।

- इससे यह भी पता चलता है कि उस विशेष अवधि के दौरान अधिक बिक्री का दबाव था या खरीदी का दबाव था।

इस ब्लॉग में, हम कैंडलस्टिक चार्ट और उनका विश्लेषण कैसे करें के बारे में विस्तार से चर्चा करेंगे:

| Table of Contents |

|---|

| कैंडलस्टिक्स चार्ट का उद्गम |

| कैंडलस्टिक्स चार्ट का निर्माण |

| कैंडलस्टिक चार्ट पर पैटर्न की व्याख्या करना |

| कैंडलस्टिक चार्ट का विश्लेषण करते समय तीन मान्य ताएँ |

| महत्वपूर्ण सीख |

कैंडलस्टिक्स चार्ट का उद्गम:

जापानी कैंडलस्टिक चार्ट भविष्य के मूल्य उतार-चढ़ाव का विश्लेषण करने के लिए इस्तेमाल की जाने वाली सबसे पुरानी प्रकार की चार्टिंग तकनीक है।

1700 के दशक में, कैंडलस्टिक चार्ट के शुरुआती रूपों का इस्तेमाल चावल की कीमतों का अनुमान लगाने के लिए किया गया था।

1750 में, मुनेहिसा होमा के नाम से एक जापानी व्यापारी ने अपने कैंडलस्टिक विश्लेषण का इस्तेमाल सकाता में चावल के आदान-प्रदान में व्यापार करने के लिए करना शुरू किया।

कैंडलस्टिक चार्ट का निर्माण:

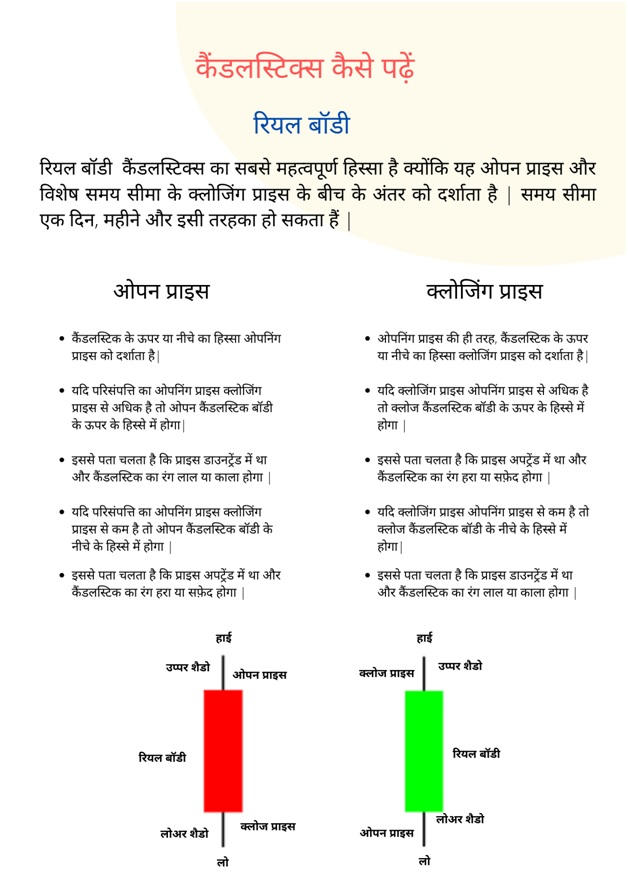

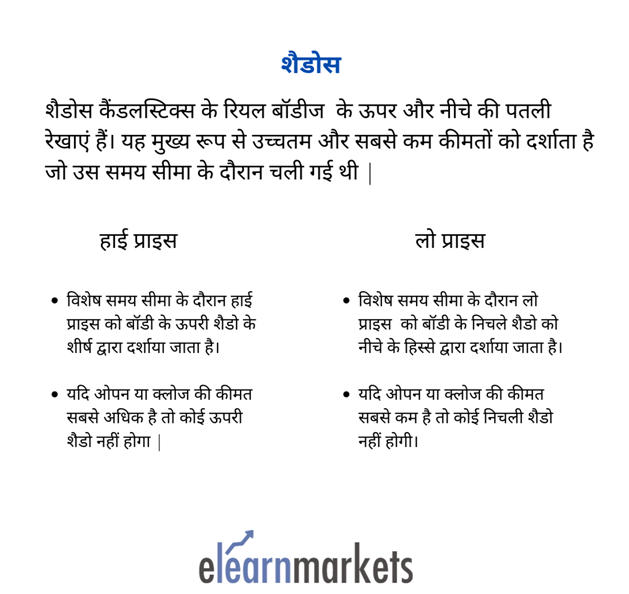

प्रत्येक कैंडलस्टिक मुख्य रूप से रियल बॉडी और विक्स से बना होता है जिसे शड़ौस या टेल्स के रूप में भी जाना जाता है:

कैंडलस्टिक चार्ट पर पैटर्न की व्याख्या करना:

जैसा कि कैंडलस्टिक्स अधिक आकर्षक होती हैं, व्यापारी ऐसी कैंडलस्टिक पैटर्न की तलाश करता है जो निरंतरता या उलट-फेर हो सकती हो।

इन कैंडलस्टिक पैटर्न को मंदी और तेजी वाली कैंडलस्टिक पैटर्न में भी वर्गीकृत किया जा सकता है।

मार्केट एक्सपर्ट्स से कैंडलस्टिक विश्लेषण की मूल बातें सीखें

कैंडलस्टिक पैटर्न एक एकल कैंडलस्टिक पैटर्न हो सकता है या दो-तीन कैंडलस्टिक्स को मिलाकर बनाया जा सकता है।

इस तरह के कैंडलस्टिक पैटर्न के कुछ उदाहरण हैं:

एकल कैंडलस्टिक पैटर्न का उदाहरण:

कई कैंडलस्टिक पैटर्न्स कई कैंडल्स द्वारा बनाई जाती है।

कई कैंडलस्टिक पैटर्न का उदाहरण:

o बुलिश एंगलफ़ींग

o बीयरिश एंगलफ़ींग

- हारामी

o बुलिश हारामी

o बीयरिश हारामी

- पियर्सिंग पैटर्न

- डार्क क्लाउड कवर

- मॉर्निंग स्टार

- इवनिंग स्टार

कैंडलस्टिक चार्ट का विश्लेषण करते समय तीन मान्य ताएँ:

1. एक को ताकत खरीदनी चाहिए और कमजोरी को बेचना चाहिए:

शक्ति आमतौर पर एक तेजी (हरे) कैंडल द्वारा दर्शायी जाती है जबकि कमजोरी एक मंदी (लाल) कैंडल द्वारा दर्शायी जाती है।

आम तौर पर हरे रंग की कैंडल के दिन खरीदना चाहिए और लाल कैंडल के दिन बेचना चाहिए।

2. एक को पैटर्न के साथ लचीला होना चाहिए:

बाजार की स्थितियों के कारण पैटर्न में मामूली बदलाव हो सकते हैं।

इसलिए, चार्ट पर इन कैंडलस्टिक पैटर्न का विश्लेषण करते समय थोड़ा फ्लेक्सिबल होना चाहिए।

3. एक को पूर्व प्रवृत्ति की तलाश करनी चाहिए:

अगर आप तेजी से कैंडलस्टिक पैटर्न की तलाश कर रहे हैं तो पूर्व प्रवृत्ति मंदी होनी चाहिए और इसी तरह, अगर आप एक मंदी के पैटर्न की तलाश कर रहे हैं तो पूर्व प्रवृत्ति तेज होनी चाहिए।

महत्वपूर्ण सीख:

- कैंडलस्टिक चार्ट एक प्रकार के तकनीकी चार्ट हैं जो बार चार्ट या लाइन चार्ट के समान मूल्य के उतार-चढ़ाव का विश्लेषण करते हैं।

- प्रत्येक कैंडलस्टिक मुख्य रूप से वास्तविक शरीर और विक्स से बना होता है जिसे छाया या पूंछ के रूप में भी जाना जाता है:

- संपत्ति का शुरुआती मूल्य> समापन मूल्य = ओपन कैंडलस्टिक बॉडी के शीर्ष पर होगा।

- संपत्ति का समापन मूल्य> प्रारंभिक मूल्य = क्लोज कैंडलस्टिक बॉडी के शीर्ष पर होगा।

- जैसा कि कैंडलस्टिक्स अधिक आकर्षक होती हैं, व्यापारी ऐसी कैंडलस्टिक पैटर्न की तलाश करता है जो निरंतरता या उलट-फेर हो सकती हो।

Great content! Super high-quality! Keep it up! 🙂

Hello there, I discovered your web site via Google while searching for a related topic, your web site came up, it appears good. I have bookmarked it in my google bookmarks.

काफी अच्छी जानकारी प्रदान की है आपने | धन्यवाद

Thanks allot

Nice artical

Hi,

We are glad that you liked our blog post.

Thank you for Reading!

Hi can learn more about candles analysis

Hi,

You can check our course on CANDLESTICKS MADE EASY to learn more about candlesticks

Keep Reading!

Nice👍😊

Hi,

We really appreciated that you liked our blog.

Keep Reading!