We have often faced a situation where we decided to make a long term investment but were struggling as to where to invest?

Sometimes we are aware of the various instruments available for investment like Property, Fixed Deposits and Stocks which help in our Financial planning and wealth management , but we are still confused about which one to choose.

So let’s find out which are the factors that needs to be considered while going for a long term investment in any of these.

We need to note that every form of investment comes with its own set of pros and cons which are suitable for different types of investors.

| Table of Contents |

|---|

| Fixed Deposits |

| Property |

| Equity |

| Differnce between FD, Property and Equity |

| Key Takeaways |

Fixed Deposits:

First thing that comes to our mind when we talk about any investment is Fixed Deposit which is definitely the safest mode of long term investment.

From a very long time it has remained the safest and the most popular mode of investment.

FDs are the secured mode of investment as it carries a fixed interest rate attached to it.

One has the option to choose the frequency of payout of the interest income and the tenure of the deposit.

However, it carries a lock in period i.e one has to keep the money invested for a particular tenure which also helps to develop the habit of saving.

FDs are generally not liquid due to its lock in period.

However, during emergency situations one can break their FDs.

But the banks charge a small amount as penalty for prematurely breaking FDs.

FDs can also be used to raise a loan.

Banks often grant loans against up to 90% of the FD amount, while the customer continues to earn interest on the FD amount.

Companies also raise FD when they want to raise some funds; they also have a lock in period.

These kinds of FD’s are known as Corporate Fixed Deposits .

Property:

Property on the other hand is more popular with the cash rich investors.

Since, it requires huge capital, majority of the investors who have a chunk of huge capital are more interested on investing into any property.

Property investments are a bit risky as compared to the FDs as the prices and returns vary according to the area or location.

However, loss of capital generally does not happen.

Property returns are generally more than that of FD. One can also earn monthly rental income from the property they own.

Liquidity remains the biggest drawback of investing in property as during emergency one cannot easily sell off its property investment.

However, if at all a buyer is available the selling price can be much lower than the actual market price due to its illiquid nature.

Cost is also a big factor involved in property investment as it carries high cost factors like registration fees, agreement fees, local authority fees etc.

These all factors make it a tedious and time taking to invest into a property.

Just like FDs, loans can be also be raised by keeping the property as a collateral to the banks.

Learn from Experts – Stock Market Made Easy

Equity:

Equity investments are gaining ground as the awareness about the instrument is rising.

With the growing financial literacy in India, more investors are investing into the stocks due to its potential for higher returns along with liquidity and simpler implementation.

Stocks are the riskiest instrument available among the others, as it carries a potential threat of capital loss also.

But if done with proper research and discipline, it can give the best returns out of the three.

The Return on Investments in Equity is generally in the form of dividends and capital appreciation.

Thus, as we all know that with higher risks comes a higher return.

One should never consider equity to generate guaranteed returns.

Equity is the most liquid form of investment as it can be liquidated whenever we want (during market hours) and withdraw the funds.

Costs are also minimal in case of equity as compared to that of property.

To select in which long term investment you should invest in, download Kredent Money App

It generally forms a small part of the total investment value in the form of brokerages, STT charges, GST etc.

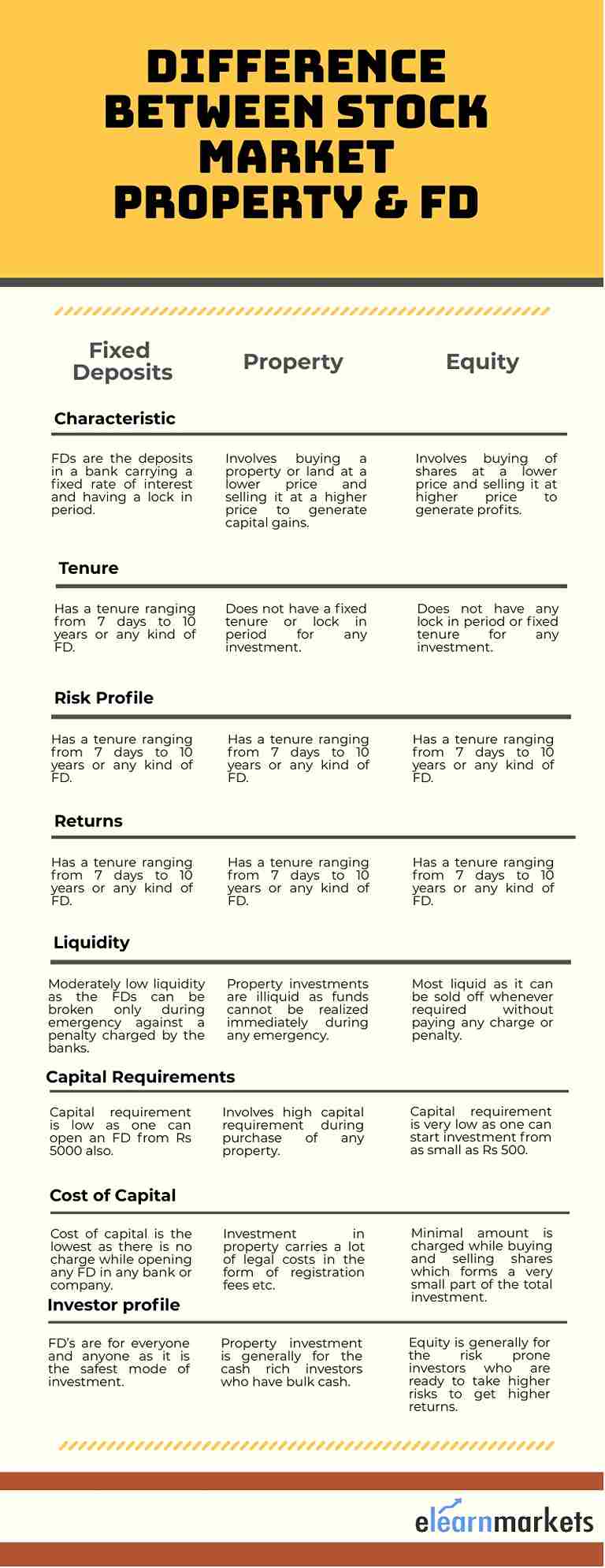

Difference between FD, Property and Stock Market

Key Takeaways:

One can say that for long term investments, equity is the most desirable, if someone has the risk appetite to bear the high market volatility.

With higher liquidity, low costs and ease of investment process involved, equity has much more to offer if done properly.

FDs can be considered for those who are risk averse and are satisfied with lower returns attached. However, liquidity might be an issue with the FDs.

Property is generally for those who have huge amount of free cash to be invested but it is illiquid and can’t be liquidated in a day or two.

Property carries a huge cost component and it is also a tedious process to complete the transaction. Liquidity is not present at all in property investments.

Equity has the highest potential to give returns to its shareholders in the long term due to its higher inflation beating returns, lower costs, low capital requirements, high liquidity and user friendly process compared to the other two instruments.

Also, hop in to learn our capital market courses online.

Very nice article.

Hi,

Thank you for reading!

Keep Reading!

whoah this blog is magnificent i love reading your articles. Keep up the good work! You know, lots of people are looking around for this info, you could help them greatly.