Farm loans are loans taken from the banks by the farmers for agriculture requisites and production. In a farm loan waiver scheme, the Centre or the state Government repays the loan to the banks on behalf of the farmers, simply by using public money collected in the form of taxes.

When there is a poor monsoon or natural calamity, farmers cannot repay their loans. The political party uses this problem during election time and promise loan waiver in their manifesto.

So, whenever there is a lethal combination of Drought, farmer suicides, and political uncertainty in India the topic of Farm loan waiver becomes the battlefield between oppositions as 60% of the Indian population mostly bank on farming Income.

A loan waiver benefits individual farmers but on the other hand, it can gobble India’s growing economy and banking sector.

Impacts

- The loan waivers not only impact the banking sector but also impact the state’s finances. Banks don’t lose money in such waivers as they are fully compensated by the state exchequer, who bears the burden.

- The farm loans are transferred from the assets side of banks’ balance sheets to the liabilities side of the government’s books as part of the waivers.

- The loan goes out of the books of the bank and gets replaced by a bond issued by the state government. But for the state government, this is a debt obligation that has to be serviced by paying interest on these bonds.

- States typically stagger loan re-payments over four to five years. This puts pressure on bank’s books, forcing them to put a lending squeeze.

- Banks might gain in the short run as their loan book gets lighter and they get rid of some non-performing assets. But such waivers anticipation in future can damage credit culture.

Problem with the Agriculture Sector

Indian Agriculture sector has been facing several issues such as fragmented land holding, depleting water table, deteriorating soil quality, rising input costs, low productivity along with high dependence on monsoon.

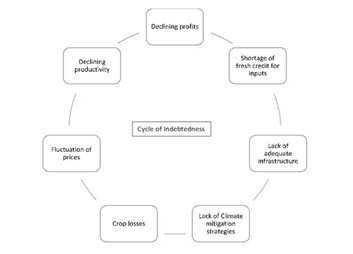

The vagaries of the nature often lead to poor outputs forcing farmers to depend heavily on credits. That is when the vicious circle of loans and indebtedness begins.

Benefits of farm Loan waivers

- In India, agriculture is highly dependent on monsoons. Farmers take heavy loans for crop production. If the crop fails due to lack of rains or insufficient market demand, farmers get trapped in debt and it leads to Farmer suicides. Thus to overcome this government waives farm loans.

- Many farmers are leaving farming due to better money making alternatives. If this situation continues, there will be serious food scarcity. To prevent this situation, the government needs to gain the trust of farmers. Thus Farm loan waiver seems the only option.

- Many farmers borrow money from moneylenders at high-interest rates and get trapped in a never ending cycle of debt. Farm loan waivers help to divert these farmers to borrow money from banks instead of money lenders.

Drawbacks of farm loan waiver

- Loan waiver sends a negative signal to the markets. Honest farmers, some of whom take more loans to repay earlier one, or use their saving to repay loans, feel cheated. It disrupts credit discipline. Farmers to turn into wilful defaulters due to the next loan waiver scheme, which is bad for economy.

- The focus of such schemes is on small and marginal farmers. This ignores the dominant role of moneylenders and informal credit sources in the rural economy. The farmers who take loans from such sources are not benefitted from such schemes.

- It increases the fiscal deficit of the state as the gross expenditure of state government exceeds the gross revenue which in turn causes low credit ranking for the state and so the cost of borrowing increases for the state.

- Rich farmers to take loan even if there is no need, in the hope of the next loan waiver scheme. This impacts the farmers who are genuinely in need of loans.

- Loan waiver is a relief only for one season, with the farmers going back to distress in the next season if the monsoon fails.

- Loan waivers not only increase the fiscal deficit and interest burden of the states but also limit its ability to undertake productive capital expenditure in the agriculture sector. It affects the long term growth in the sector.

- Providing loan waive in some states encourage farmers from other states to demand loan waiver even if they don’t need them.

- Loan waivers are just a tool for politicians to gain vote banks in all elections and prevent them from coming up with the long lasting solution.

Election event and farm loan waivers

Governments – both at the central and state level – have written off loans.

Between 2014 and 2018, loan waivers were announced in 11 states, by both BJP and Congress administrations, at a total cost of more than a trillion rupees.

In the current election also, political parties started promising of farm loan waiver in their manifesto.

Earlier, this year, the promise of a loan waiver helped the Congress defeat the BJP in state elections in Chhattisgarh, Rajasthan and Madhya Pradesh in December.

Farm loan waivers a nightmare for Banking Industry

India’s first farm loan waiver was nearly three decades ago in early 1990. From 2016 to 2018 six state governments have declared farm loan waivers of upto Rs1, 19,000 cr.

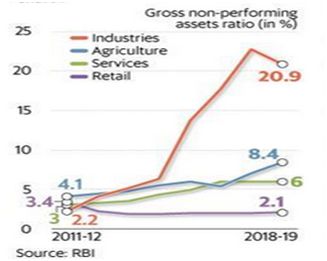

Repeated occurrences of loan waivers hurt the credit culture in the country. Public sector banks are the worst affected because of their high exposure to agriculture and farm loans.

Constant occurrence of such populist actions leads to risks of impaired credit discipline and weak risk-reward for banks and reduced credit availability for borrowers.

Also Read : 15 ways to perform banking stock analysis

Farm loan waivers affect credit-off take and induce further stress on banks. The farm sector nonperforming assets (NPAs) account for 16% of the bank’s advances under the priority sector lending as of October 2018.

Further announcement of farm loan waivers by selected governments can only worsen the situation of already beleaguered banks.

Take the case of the State Bank of India (SBI), the country’s largest lender. Its NPAs stood at 6.4% before June 2017 when farm-loan waivers were announced in UP and Maharashtra. By September 2018, this rose to 11.4%, according to a report by Macquarie Research.

After the farm loan waiver in 2012, the drop in bank’s agricultural bad loans or NPAs has rose up sharply once again.

Key Takeaways

- If you are an investor in bank stocks, you may have to worry, as waivers may add to the already elevated non-performing assets of banks.

- Farm loan waivers by government may appear to have benefitted the cause temporarily but is not a solution to mitigate agrarian distress.

- Demand for loan waivers arises because income of farmers is not increasing at a reasonable rate.

- Government has to focus on improving farmer’s income rather than use it in Political manifesto.

In order to get the updates on Financial Markets visit https://stockedge.com/