The media are now acknowledged as significant influencers in financial markets. Impact of the media is not unknown to us. There are numerous traders who don’t understand fundamental or technical analysis and simply rely on the news to make investment decisions. For such investors, it’s important to read the news correctly. When they misread information, the media fails to create the desired effect.

For a better understanding of technical analysis and financial markets, you may consider this course: NSE Academy Certified Technical Analysis

Intraday Trading refers to buying and selling or selling and buying of securities on the same trading day before the market closes. For intraday investors, of all factors, impact of the media is the highest; one event can change the dynamic of the stock/market for the day. Media adds to the effectiveness of the stock market through increasing distribution of information amongst investors.

Several studies indicate that news relevance, news volume an expert’s opinion on Twitter seem to fluctuate the indices, positively and affect trading. Impact of the media depends on the time of reporting of the news as well as its ability to facilitate transmission to investors. Many times the media manipulate news, generate fake news reports and exaggerate a public comment. This can prove to be dangerous in intraday trading if one is not careful in reading it.

Also read: How To Use Twitter For Market News

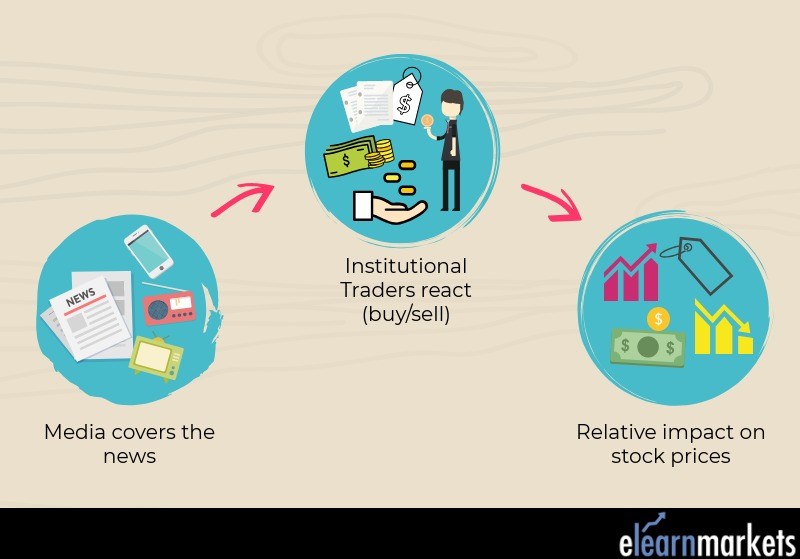

Impact of the Media, Institutional Traders, and Stock Prices

Institutional traders are involved in buying and selling securities for a group/institution. They control a substantial amount of monetary assets and can exert a significant impact on financial markets. They typically trade in high numbers and thus, can impact the stock prices, considerably.

Through the years, it’s seen that intensive coverage on corporate news can provoke a massive reaction in the market and impact of the media on stock prices can be seen. Institutional traders always keep an eye on the most recent news, read and analyze it in depth and make decisions based on that. So impact of the media is seen on stock prices, through institutional traders.

If the stock price changes massively, it has an impact on the support and resistance on that particular day, and this information facilitates intraday trading as traders can take necessary action immediately.

You have got a great opportunity to learn how to select right stocks for intraday trading.

Publicizing financial stability reports (FSR)

The International Monetary Fund (IMF) publishes the Global FSR, which is a semi-annual document that assesses the stability of global financial markets. It focuses on the consequences of economic and financial imbalances. It incorporates current scenarios that would risk stability in financial markets all over the world. Similarly, the Central Bank (in this case, Reserve Bank of India (RBI)) too publishes a report, which contains data on national parameters that would impact the country’s financial performance.

So there’s no doubt that publication of this report impacts industries and acts as valuable input for investment decision-making, and impact of the media here is immense. For intraday trading, the analysis of this report is very important as it consists of all factors essential to a successful trade.

You may also read: Quarterly results & stock market

Do newspapers predict future trends?

Fluctuations in stock prices are caused by supply and demand. This relationship is knotted into the kind of news reports that comes out at any moment.

For instance, a negative piece of news would usually indicate people to sell. Economic/Political uncertainty, poor financial reports, etc. would increase selling pressure and decrease the stock prices and vice versa with positive news.

People react after reading the newspapers, and their reaction may form the basis of a trend. Every day before the market opens, people are aware of what kind of trade they want to do and handle it thereon. News plays a critical role in deciding the stock’s future. So yes, information in the newspapers may give clues indicating future market trends. The impact of the media is really strong here. The market always incorporates future expectations into these stock prices, thereby predicting some trend.

Publicity can make or break the stock

Public’s confidence in the company determines the value of a share. Good publicity upholds a brand image and capitalizes on it. It is vital to the success of a company. In a big crisis when the company loses competence, and stocks are taking a huge hit, impact of the media can revive the status of the stock and avoid panic. Publicity is important to both internal and external parties.

Organic publicity is one of the purest forms that can promote optimism in the market; word-of-mouth holds much more credibility than the word of a company’s promoter. This spreads positive sentiments and may increase stock prices.

Publicity is possible today due to the prevalent media forums. The effectiveness and impact of the media here are very essential for the publicity to gain widespread attention.

To facilitate intraday trading, impact of the media can be seen only if they are active in distribution and take immediate notice of any publicity stunt that happened.

Read, also: 8 Facts you should know about Financial Media

In conclusion

Impact of the media can be seen in an investor’s life, especially ones involved in intraday trading. It has the ability to create a massive impact on the market. Impact of the media is evident in trading behavior. It instigates stock prices, can determine future trends and can impact a company’s reputation, and hence its financial position. One needs to know what aspect of the media to trust and to analyze it well to use in trading.

To Understand more about similar concepts, join our share market academy now!

This blog content is useful for beginners like me who wants knowledge about Indian Stock Market and intraday. Thank you so much for this

Hi,

We really appreciated that you liked our blog.

Keep Reading!