What is Capital Market?

Capital markets, commonly referred to as the stock markets, have been in existence for centuries. The British East India Company was the first company to invite the public to buy shares in the company, marking a significant milestone in the history of what capital markets are today.

Since then, over the years, markets have gone through tremendous changes. The way the market works, the asset classes it encompasses, the framework of the exchanges, and everything else related to what capital markets entail have been evolving over time. The changes have been brought in gradually according to the convenience of the investors and market participants. Also in order to prevent market participants to take undue advantage of the information in order to gain monetary benefits, the Securities Regulatory bodies over the world have surveillance methods for mitigation of such acts.

If you wish to become an active participant in the markets, having rudimentary knowledge is of critical importance.

Elearnmarkets today will tell you how the Indian Capital Market works. We will discuss the functions of the stock market and who are the intermediaries. Then we will move on to the structure of the capital markets in India and finally recognize the role of the Securities Exchange Board of India (SEBI) in our stock market scenario.

Functions of Capital Market

While from a broader perspective, Capital Markets is viewed as a market of financial assets with long or infinite maturity, it actually plays a very important role in mobilizing resources and allocating them to productive channels. So it can be said that the process of economic growth of a country is facilitated by the Capital Markets. The important functions and significance of the markets have been discussed below: –

1. Economic Growth:

Capital Markets help to accelerate the process of economic growth. It reflects the general condition of the economy. The capital Market helps in the proper allocation of resources from the people who have surplus capital to the people who are in need of capital. So, we can say that it helps in the expansion of industry and trade of both public and private sectors leading to balanced economic growth in the country.

Learn the basics of Stock Markets from Stock Markets Made Easy Course

2. Promotes Saving Habits:

After the development of Capital Markets, the taxation system, and the banking institutions provide facilities and provisions to the investors to save more. In the absence of Capital Markets, they might have invested in unproductive assets like land or gold or might have indulged in unnecessary spending.

3. Stable and Systematic Security Prices:

Apart from the mobilization of funds, Capital Markets help to stabilize the prices of stocks. Reduction in speculative activities and providing capital to borrowers at a lower interest rate help in the stabilization of the security prices.

4. Availability of Funds:

Investments are made in Capital Markets on a continuous basis. Both the buyers and sellers interact and trade their capital and assets through an online platform. Stock Exchanges like NSE and BSE provide the platform for this and thus the transactions in the capital market become easy.

Types of Capital Market:

The capital market is mainly categorized into:

Primary Market

The primary market mainly deals with new securities that are issued in the stock market for the first time. Thus it is also known as the new issue market. The main function of the primary market is to facilitate the transfer of the newly issued shared from the companies to the public. The main investors in this type of market are financial institutions, banks, HNIs, etc.

Secondary Market

It is the market where the trading of the securities actually takes place, thus it is also referred to as the stock market. Here the buying and selling of securities take place, The existing investors sell the securities and new investors by the securities.

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.”- Seth Klarman

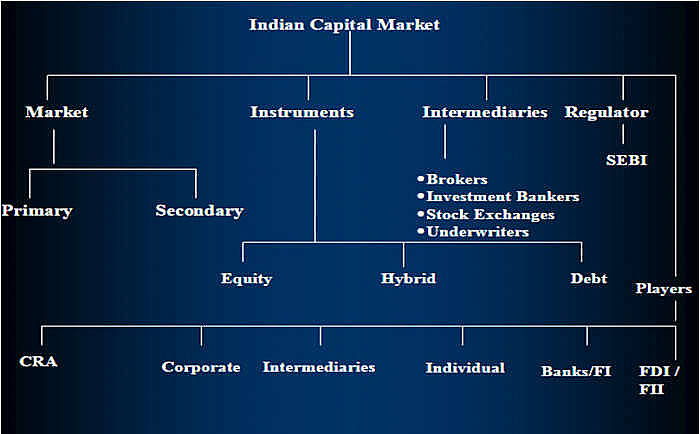

Structure of Capital Market

The following is the structure of Indian Capital Market:

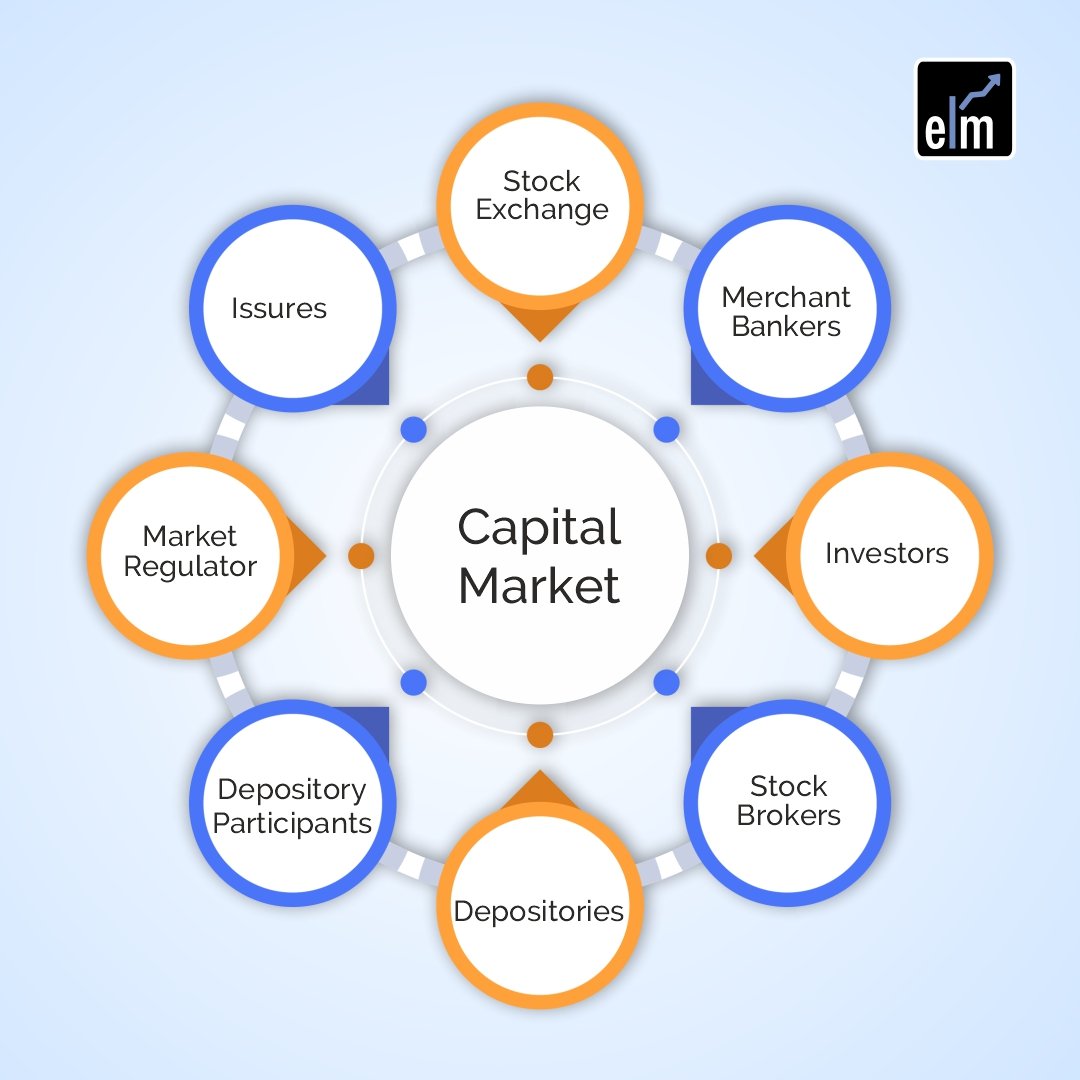

Constituents of Capital Market

The constituents of Indian capital market are as follows:

Capital Market Instruments

There are mainly two types of instruments that are traded in the capital market, which are:

- Stocks: Stocks are sold and bought over a stock exchange, They represent ownership in the company and the buyer of the share is referred as the shareholder.

- Bonds: The debt securities which are traded in the capital market are known as the bonds. Companies issue bonds for in order to raise capital for the expansion of the business and growth.

Features of Indian Capital Market:

Here are the features of the Capital Market:

1. Serves as a link between Savers and Investment Opportunities:

The capital market serves as a crucial link between the saving and investment process as it transfers money from savers to entrepreneurial borrowers.

2. Long-term Investment:

It helps investors to invest their hard-earned money in long-term investments.

3. Helps in Capital formation:

The capital market offers opportunities for those investors who have a surplus amount of money and want to park their money in some type of investment and also take the benefit of the power of compounding.

4. Helps Intermediaries:

While transferring shares and money from one investor to another, it takes help from intermediaries like brokers, banks, etc. thus helping them in conducting their business.

5. Rules and Regulations:

The capital markets operate under the regulation and rules of the Government thus making it a safe place to trade.

Example of Capital Market:

Suppose a company says ABC requires capital for expanding its business, so it plans to raise the required fund from the public by issuing new securities in the primary market.

After issuing the new securities, the people who are interesting in buying those shares after doing research of the company, buy those shares through the Initial Public Offering (IPO) process.

After the initial buying, it sharts trading in the secondarily market, where the existing buyers and sellers start trading that security.

Capital Market Intermediaries

Financial Intermediaries are the organizations that help in the transfer or channeling of funds from those who have surplus funds to those who are in need of it. They act as a middleman in connecting the surplus parties to the deficit ones. A classic example can be a bank that accumulates bank deposits and uses them to provide bank loans.

The main Financial Intermediaries of India include:

- Stock Exchanges: These include the NSE (National Stock Exchange), BSE (Bombay Stock Exchange), MCX (Multi Commodity Exchange), etc

- Banks

- Insurance Companies

- Pension Funds

- Mutual Funds

Difference between Capital Market and Money Market

We have provided you the answer to this question in the table below:

Role of SEBI in Capital Market

The Securities Exchange Board of India (SEBI) regulates the functions of the Securities Market in India. It was set up in 1988 but didn’t have any legal status until May 1992, when it was granted powers to legally enforce its control over the financial market intermediaries. With the bloom of the scale of actions in the financial markets, there were a lot of malpractices taking place. Practices like a false issue, delay in delivery, violation of rules and regulations of stock exchanges are on a rise. In order to curb these malpractices, the Govt. of India decided to set up a regulatory body known as the Securities Exchange Board of India (SEBI).

The roles and objectives of SEBI are elaborate and have been described as below:

- Regulation of the activities of the stock market

- Protecting the Rights of Investors

- Ensuring the safety of the investments.

- To prevent malpractices and fraudulent activities.

- To develop a code of conduct for the intermediaries such as brokers, mutual fund sellers etc.

Recent Developments in the Indian Capital Market

The Indian Capital Markets have been going through various developments over the years and the most significant of them have been listed below: –

1. New Measures of Risk Management: Investments in Capital Markets are exposed to various risks. Though some are systematic risks, others happen as a result of unsystematic market activities.

- Measures to reduce Price Volatility: Volatility is the fluctuation of price movements. It is the rate of up or down movement of the stock price. Volatility is regarded as a negative factor for the markets as it represents uncertainty and risk. After the introduction of Index futures trading in 2000, there was a relative reduction in the volatility of the prices.

- Circuit Breakers: Circuit breakers were introduced to reduce large sell-offs and panic selling. Sometimes it is also called a “collar”. If an Index or a particular stock rises or falls a certain percentage of 10%, 15% or 20%, trading is halted by the exchange in that stock or index for a certain period of time to curb the panic and check for market manipulations.

2. Investor Awareness Campaign: To make the markets more secure for the investors, SEBI introduced the Investor Awareness Campaign by making an official site for this.

3. Investigations: In case of any violation of the rules and regulations of the SEBI Act 1992, the investigation is carried out by SEBI.

4. T + 2 Settlement Cycle: Currently in the Indian Capital market, the settlement cycle is in the “T+2” cycle. Here, ‘T’ means the trading day, and the ‘T+2’ settlement means the settlement and delivery of the shares takes place on the 2nd trading day after the trade takes place

5. Ban on Insider Trading: Individuals possessing confidential information of a particular company can use the information to unethically profit from the stock markets. SEBI has made it clear and mandatory to restrict all kinds of insider trading in the Indian Capital Markets.

Learn more about similar concepts in our trading classes now!

Frequently Asked Questions

What is the difference between Money Market and Capital Market?

The money market trades usually in the short term debt whereas the capital market trades in both stocks and bonds. Together the capital market and the money market are comprised of the financial market.

What are capital market instruments?

The capital market instruments include equity shares, debentures, bonds, preference shares, etc. The main instruments that are traded in the money market are T-bills, commercial paper, and certificates of deposit.

How can I start learning about the capital market?

You can start learning about the capital market through the various courses available on our platform like Basics of Financial markets. You can also read our blogs and watch videos on our Youtube channel related to this subject.

Bottomline

With the ever-changing regulations laid by SEBI and omnipresent opportunities, understanding capital markets can sometimes become as complex as solving a Rubik’s cube.

To construct a multi-storeyed building, the base has to be made as sturdy as possible. Similarly, to eventually become successful in the bourses, one needs to understand the basic concepts from its very roots.

After all, who doesn’t aspire to be the next Charlier Munger or Warren Buffet of their generation? Let us all start walking on the path which will lead us closer to our goal.

Thanks. very simple and well discribed can be understand easly by the beginer what is excatly the stock trading is all about.

Thank you Moorthy for your valuable opinion. We are glad that you found this useful.

Well described for a novice like me. Sir, we all have heard about the trial of former Mckinsey chief Rajat Gupta in the US, as well as the Galleon hedge fund founder Raj Rajaratnam name, for insider trading. But in India, insider trading is not a criminal act and more importantly nobody has ever been jailed for it. Then how safe are the retail investors in India?

Wonderful and straight to the point.

By reading all this information it clears that the capital market has huge scope and it is easily understandable by the people who interested

thanks well defined in simple language?

Sir plzzz explain working process of financial intermediaries institutions

Financial Intermediaries are institutions that act as middlemen between two parties in a financial transaction.

Let us understand this with the help of the following examples:

Bank: Individuals having surplus funds deposit their surplus funds as savings in a bank, the bank, in turn, lends these funds in the form of capital to companies, other individuals who are in need of it.The parties (borrowers) receiving the capital from the bank pay an interest on such funds to the banks.A portion of this interest is then paid to the individuals who have deposited their funds(lenders) with the bank.The remaining portion is the bank’s profit.

Mutual Funds: The mutual fund manager connects the individual shareholder with the company by purchasing stocks of a company that he expects will outperform the market.In this way, the mutual fund manager provides the individual shareholder with assets(i.e shares of the companies), the companies with capital and the overall market with liquidity.

Stock Brokers : Stock Brokers bring together buyers and sellers of securities thereby bringing in liquidity in the securities market.

Insurance Companies : Insurance companies collect premium from the individuals and provide them policy benefits to them.

There are several other financial intermediaries apart from the ones discussed above.

To learn more about the role of various financial intermediaries you may do: NSE Academy Certified Capital Market Professional(E-NCCMP)

Happy Learning!

Great article with a precise content indeed. Thank you for sharing.

Financial market is a market in which people trade financial securities commodities and their tangible item of value at low transaction cost and at price that reflect supply and demand. Some of the major functions of financial market are as follows:

1.Borrowing and lending

2.Risk Sharing

Hi,

Thank you for Reading!

Keep Reading!

Shared! This is AWESOME stuff! Thank you!

What’s Happening i’m new to this, I stumbled upon this I’ve discovered It absolutely helpful and it has aided me out loads. I am hoping to contribute & help other customers like its aided me. Good job.

Nice

Hi,

Thank you for reading our blog!

Keep Reading!

Basic concepts of the Indian capital markets have been very explicitly explained…And if Simone is really interested in developing his long term career or specific goals in the share markets, these basic comments will be of immense importance to him ..Also the other peripheral things belonging to Indian equity market have been very beautifully crafted…..great work….cheers..

Hi,

Thank you for reading our blog!!

Keep Reading!

Nice

Hi,

Thank you for Reading!

Keep Reading