The recent fall in the Indian market benchmark, Nifty is mainly due to the Indian rupees depreciating, crude oil prices increasing, and the Indian finance sector. Many people asked me if there is any other investment asset available in which they could invest as a hedging tool against the losses made in the equity market. Well, investing in commodities is one of the safe vehicles when the equity markets are volatile.

In this article let us discuss why investors should invest in commodities and how can they invest in it when the equity markets are volatile.

Four reasons for investing in Commodities:

1. Protection from Rupee’s depreciation

Dollars and gold prices have an inverse relationship, which means whenever the dollar weakens, prices of international gold prices increase. Similarly, the Indian rupee also has an inverse relationship with gold prices. Whenever the Indian rupee weakens, the gold prices increase.

This situation can currently be seen in the Indian markets. The dollar against the Indian rupee has reached an all-time high of Rs 72.65 per dollar and the gold prices have increased by 3.5% that is Rs 31,850 per 10 gram. As the Indian economy is showing weakness the NSE and BSE stock prices are also falling. Therefore in this condition, it is better to invest in commodities than equities.

2. Hedge against event risk

Certain events such as economic crisis, natural disasters, wars, etc can depreciate the value of the investor’s assets. This is known as “event risk”. These event risks have a negative effect on the prices of financial assets such as bonds and stocks. But these event risks, on the other hand, increases the prices of certain commodities.

Learn from Experts: Fundamental Analysis Of Commodities

For example:

Brent which is an international benchmark for oil prices has crossed $80 this week, the highest price since November 2014. The main reason for the rise in the prices of crude oil is that the Organization of the Petroleum Exporting Countries (OPEC) which is the third-largest producer of crude oil has little capacity in order to make up for an expected shortfall in Iranian exports. Because of the increase in the price of Brent, the crude oil prices have increased and the equity markets are falling. In this situation, commodities act as hedging against losses made in the equity markets.

Source: CNBC

3. Liquidity

When the equity markets are volatile, one can invest in Commodity futures, as it offers higher liquidity compared to other financial assets like real estate. It is easy to buy and sell commodities. One can liquidate his position whenever required.

4. High Returns

Commodities can experience huge swings in prices when the markets are volatile. For example wars in the oil-producing countries can shoot up the prices of crude oil. Investors can take advantage of these huge swings in prices and make gains out of it.

Suggested Read: Types of Commodities You Should Consider Investing In

How to invest in commodities

1. Futures

One of the popular ways of investing in commodities is through the futures contract. The futures contract is an agreement to buy and sell a specific quantity of a commodity at a specific price. On every category of commodity, futures are available. You can have a Detailed Understanding of Derivative Market to have idea on derivatives and its benefits and uses.

2. In the form of shares

Many traders trade in the stocks of companies related to a commodity. For example, those who want to do investing in commodities like oil can invest in refineries, drillers or other diversified oil companies.

3. Mutual Funds

Mutual Funds cannot directly invest in commodities, but they can invest in stocks of the companies related to that commodity. A brisk understanding on How To Invest In Mutual Fund Scheme will help you acquire more knowledge on mutual funds.

4. Index Funds

Index Mutual funds invest in commodity futures contracts and commodity-linked investment derivatives and thus providing more exposure to the direct trading of commodity

5. Exchange Traded Funds

Commodity Exchange Traded Fund allows investors to directly participate in commodity and invest directly in future contracts.

Different steps to investing in Commodity Market

The steps to invest in the commodity market are as follow:

1. Determination of how much money you want to invest

First, determine how much money you to invest in commodities. Investing in commodities is one of the safest to invest in as compared to other classes of investment.

2. Open a trading account

One has to take help of the broker in order to trade in commodities. A trading account will help the trader to deposit the money and buy and sell commodities.

3. Deposit money in your account

After opening the trading account, one can deposit money in that account and start trading.

Best commodities to invest in:

1. Copper

As the economy of India has become more industrialized, there is a rise in the demand for copper. India is pouring huge resources in building new airports, construction and industrial equipment, and other transportation systems which require copper as raw material.

2. Crude oil

As we have discussed above, the prices of crude oil are rising due to the laws of demand and supply and tensions in the Middle East. There are many products made from petroleum like medicines, plastics, cosmetics, and so on. The prices of crude have reached an all time high because of the shortage of production in the Middle East.

3. Gold

There is an inverse relationship between the prices of gold and equity market. Whenever the equity market falls down, there is a rise in the price of gold. Therefore one can invest in gold as a hedging instrument against equity market.

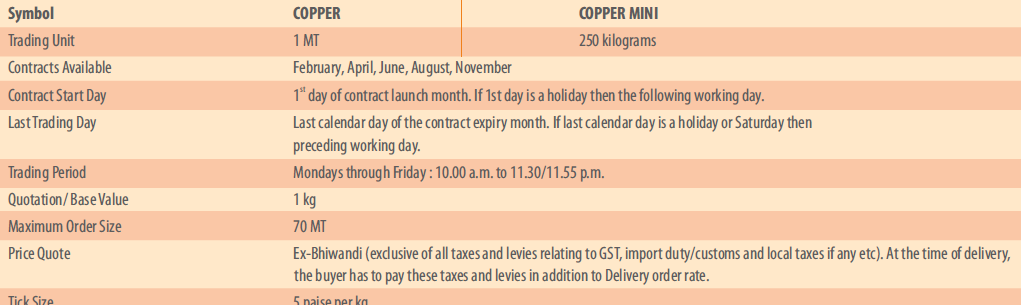

Investing in Copper

Copper prices are based on the international spot prices. The prices are affected by the events such as the construction of new production facility, unexpected mine or plant disaster or industry restricting. The investment in copper can be made through futures and options contracts. Details of the contract:

Source: MCX

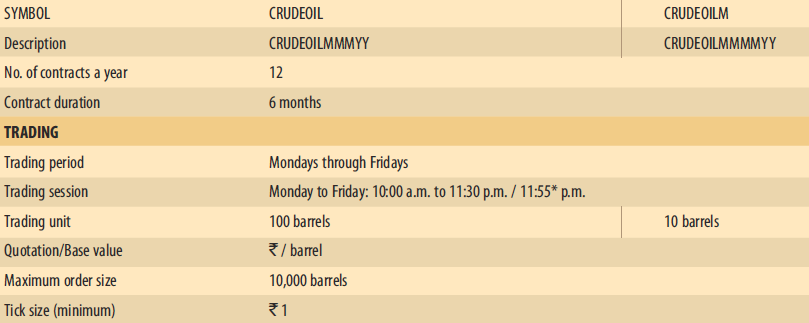

Investing in Crude oil

The prices of the crude oil are based on the international prices. These prices are affected by the economic factors such as industrial growth, inflation, recession, and global financial crises. One can invest in crude oil through options and futures contract.The details of contract:

Source: MCX

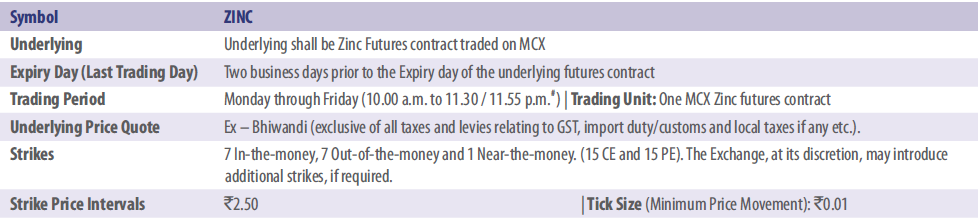

Investing in Zinc

Zinc prices in India are fixed based on the rates of the international spot market or LME (London metal exchange), and INR–USD exchange rates. Economic events, such as national industrial growth, global financial crisis, recession, and inflation, affect zinc prices. In India, you can invest in zinc through zinc options and futures contracts. The details of the contract:

Source: MCX

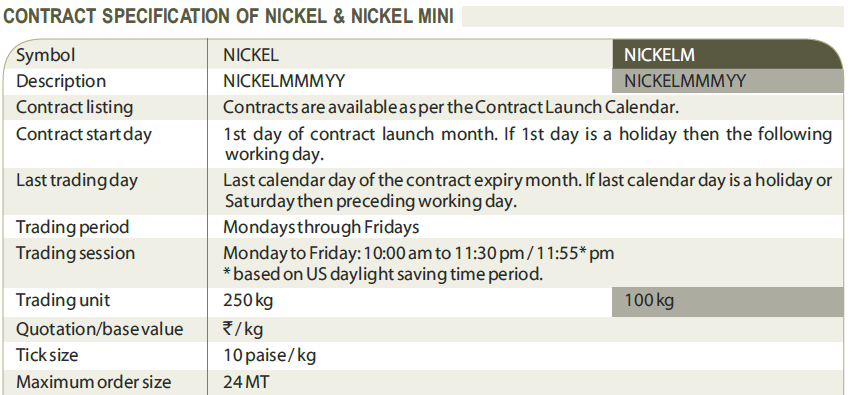

Investing in Nickel

Nickel prices are based on international prices and US dollar and Indian rupee exchange rates. Economic factors which affect the prices of Nickel are same as the economic factors of other commodities. Nickel is one of the important raw material for battery makers. One can invest in Nickel through futures and options contract. Details of the contract:

Source: MCX

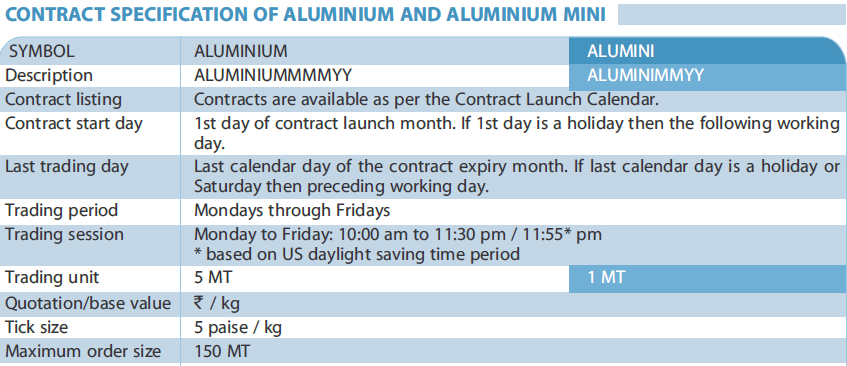

Investing in Aluminium

Aluminum prices are based on the international spot prices and also on the exchange rate of dollar and Indian rupee. The prices are affected by the events such as the construction of a new production facility, unexpected mine or plant disaster or industry restriction. The investment in aluminium can be made through futures and options contracts. Details of the contract:

Source: MCX

Frequently Asked Questions

Are commodities a good investment?

Whether commodities purchased in the form of futures contracts, ETFs ( or options, it is considered a better investment as compared to the real estate sector. Commodity investments tend to generate more liquidity, owing to the seasonality and unpredictability in prices

How do I start investing in commodities?

The first step towards investing in the commodity market in India is opening an account with a exchange registered broker.

How can I learn to invest in commodities?

You can learn about commodity by taking our course like Commodity Markets Made Easy in which you will undergo training in various aspects of commodity market starting from very basics to how commodity markets function, to technical and fundamental analysis.

Which commodity is best for investing?

You can invest in commodities like gold, crude oil and other which act like hedging tools

Bottomline

As discussed above, the commodity is one of the safest investment vehicle a trader can invest in when the equity markets are too volatile. They can also use commodities as a hedging tool. As commodities are liquid, they can be bought and sold easily and they can also generate high returns when the markets are volatile due to huge swings in the prices.

Get Commodity trading training from market experts on our platform to enhance your skill!

In order to get the latest updates on Financial Markets visit Stockedge

I always was concerned in this topic and stock still am, appreciate it for posting.