The nifty P/E ratio works the same as individual stocks’ Price to Earnings Ratio. It measures the average P/E ratio of the Nifty 50 companies. It is one of the simple but very helpful buy/sell indicators for all investors who believe in buying good companies at throwaway prices.

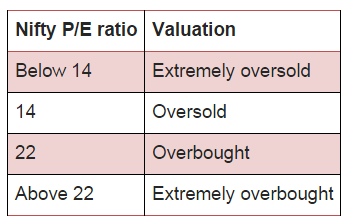

Nifty is considered in the overbought zone when Nifty P/E is trading at or above 22, and anything below 14 is considered undervalued.

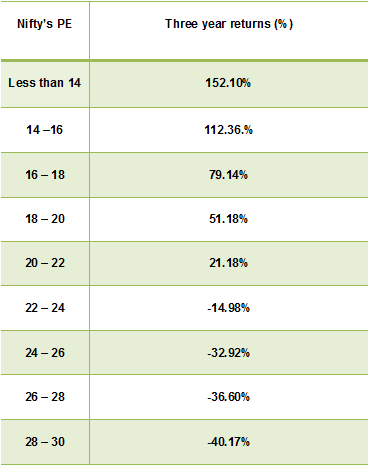

Professor Sanjay Bakshi, a renowned value Investor said – “Recent research done by my firm shows just how dangerous it is to remain invested in an expensive market. Since NSE started, every time when Nifty’s Price/Earnings ratio exceeded 22, the average return from Indian equities over the subsequent three years became negative”

What is PE Ratio?

Ideally, long-term investors who believe in value investing usually buy stocks when P/E reaches 14 or below and avoid buying when P/E goes above 22.

To determine the P/E value, one must simply divide the current stock price by the earnings per share (EPS).

The current stock price (P) can be found simply by plugging a stock’s ticker symbol into any finance website, and although this concrete value reflects what investors must currently pay for a stock, the EPS is slightly more nebulous figure.

So, what is a good PE ratio for a stock? A “good” P/E ratio isn’t necessarily a high ratio or a low ratio on its own. The market average P/E ratio currently ranges from 20-25, so a higher PE above that could be considered bad, while a lower PE ratio could be considered better.

The two types of EPS metrics factor into the most common types of P/E ratios: the forward P/E and the trailing P/E. A third and less common variation uses the sum of the last two actual quarters and the estimates of the next two quarters.

The forward (or leading) P/E uses future earnings guidance rather than trailing figures. Sometimes called “estimated price to earnings,” this forward-looking indicator is useful for comparing current earnings to future earnings and helps provide a clearer picture of what earnings will look like—without changes and other accounting adjustments.

What is the PE Ratio of Nifty?

The table below gives a brief idea about the P/E-based valuation.

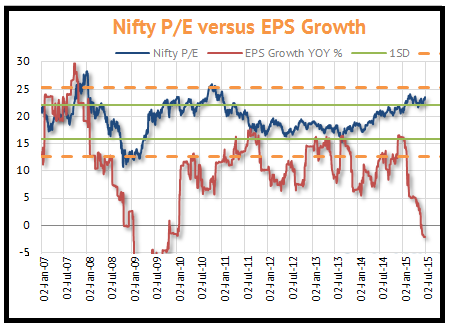

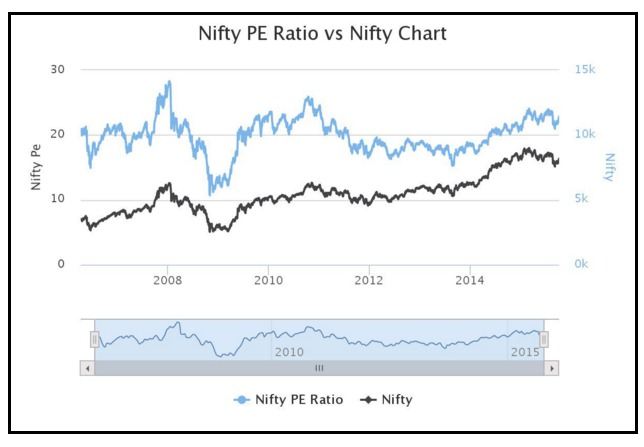

Nifty P/E ratio on 08-10-2015 is trading at 22.71 whereas Nifty closed at 8129.35.

Currently, the market is trading at an extremely overbought area which shows that price is moving at a faster rate with respect to its earning.

Learn about Nifty Intraday Strategy in 2 hours by Market Experts

Previous two times when Nifty crossed P/E of 22, the earnings growth was strong, following the trend of P/E. However, the scenario is not the same this time since earning is coming down while P/E is still heading up i.e contradictory.

Also Read: A quick introduction to the term index and its concepts

This shows the market has moved up just in the hope of optimism, but the reality is completely different.

History says that whenever Nifty goes above 22 P/E, the market sees a correction. It would be important to see what happens this time?

It is usually seen that most of the money comes into mutual funds when Nifty is in the overbought zone and very few people invest in the oversold region.

Though in reality, it should be opposite, thus reflecting the psychology of herding mentality.

Bottomline

However, with the huge optimism built on the Modi government, the market has already rallied much. Let’s see, whether the government will be able to deliver the result and if so, then the market may continue to rally further.

Feel free to give your feedback by writing in the comment box below.

In order to get the latest updates on Financial Markets visit StockEdge

Happy Investing!

A well-written writeup on Nifty P/E ratio which plays a key role in determining the overall valuations of the stock market.

Thanks Aamir!

I totally agree with you.