Are you trying to develop your long-term wealth and looking for a dependable and safe investment option? The Public Provident Fund (PPF) Scheme is the only place to look! This well-liked program, supported by the Indian government, provides a special blend of long-term security, tax advantages, and assured profits.

We’ll go deep into the world of PPF in this blog, going over its salient characteristics, advantages, and qualifying requirements. In addition, we’ll walk you through the investing process and address some of the most common queries you may have regarding this effective instrument for accumulating money.

Table of Contents

What is the Public Provident Fund (PPF) Scheme?

The Indian government supports a long-term savings plan called the Public Provident Fund (PPF) Scheme. With its alluring interest rates, tax advantages, and assured returns on investment, it’s no wonder that those looking to build safe, long-term wealth choose it.

The Public Provident Fund Scheme (PPF Account) is a popular government scheme introduced by the Ministry of Finance, which offers attractive returns (which are completely exempted from tax) along with reasonable safety.

An investor can start with a minimum investment of Rs 500 to a maximum of Rs 1,50,000 in a financial year and can avail of other facilities like withdrawal, loan, and extension of account.

The scheme aims to –

- Mobilize savings by offering investments with decent returns and tax benefits; and

- Encourage the habits of financial planning in the masses by motivating them to build a retirement corpus.

Eligibility for opening PPF Account

- An individual, being an Indian resident and above 18 years can open only one account in his/her name. However, there is no upper age for opening the account.

- A minor can also open a PPF Account, but the maximum limit of Rs 1,50,000 per year applies collectively to the minor and his guardian.

- HUF, NRI and Foreigners cannot open the account.

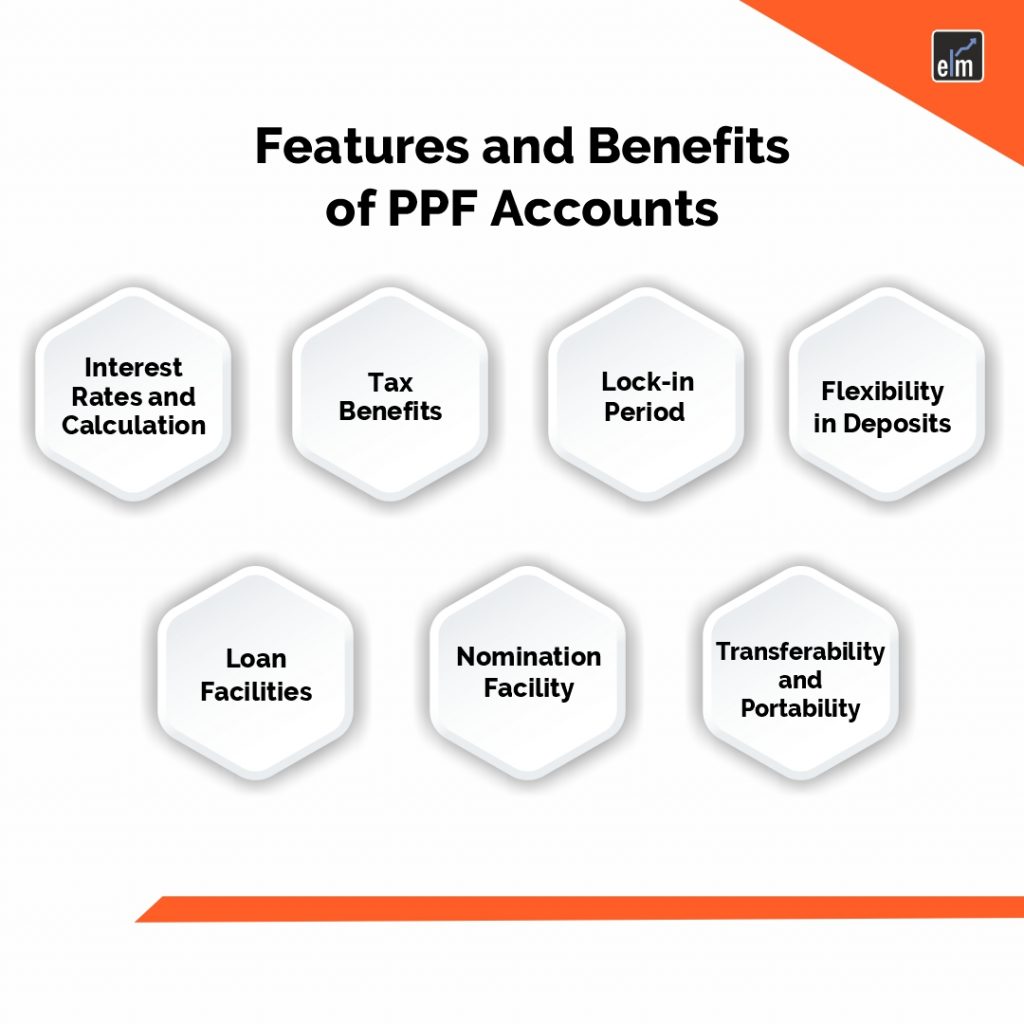

Key Features of PPF Scheme

Some of the key features of PPF schemes are as follows-

1. Tax-Free Rate of Interest

The interest rate is set by the Ministry of Finance on a yearly basis. The current rate is 7.1%. Additionally, the entire interest amount is exempt from tax.

2. Long-term investment

One has to be invested for a time period of 15 years and it helps individual to accumulate a lump sum amount for the retirement.

4. Low investment and opening balance

You have to deposit a minimum of ₹500 yearly to maintain your account. This encourages especially the poor masses to develop a habit of savings. Investments can be made in a lump-sum or on a monthly basis as well.

Moreover, the account under the scheme requires a minimum balance of only ₹100 to be opened.

5. Withdrawal facility

Partial withdrawal option can be availed only from 7th year onwards.

These withdrawals can be done only once a year. Also, the PPF account can only be closed after 15 years, when it matures.

6. Availability of loan

The facility of loan can be availed between the 3rd and 5th financial year of opening the account.

This amount can be a maximum of 25% of the amount at the end of the 2nd year immediately before the year of the loan application.

Also, you can take a second loan before the end of the 6th year, but only if the previous loan has been paid off.

7. Extension of Account

One can extend his/her account in a block period of 5 years after maturity.

Benefits of investing in PPF Scheme

- Tax-free return: Investment in Public Provident fund (PPF) is completely exempted from tax.

- Attractive long-term investment: It helps in fulfilling long-term goals with a deposit period of 15 years and lock in period of 7 years.Moreover, it offers effective return as compared to bank FDs and the interest rate is also compounded annually.

- Easy accessibility:The account can be opened at post offices, public banks or selected private banks. Moreover, you can open the account online as well.

- Lower risk: There is a very low risk of default since it is government backed.

- Suitable for retirement planning: It is suitable for building a retirement corpus due to features like long-term tenure, tax-free return, compounding benefit and a better interest rate vis-a-vis bank FD.

- No attachment: PPF funds can’t be attached under court order or laid claim to by creditors.

How to open a PPF Account?

As mentioned before, we can open this account offline (via a post office, a nationalized bank or some private banks) or online.

The following KYC documents are required to open a PPF account –

- Identity proof

- Residence proof

- PAN and Aadhar card

- 2 passport-size photographs

- Pay-in slip (available at any post office or banks)

- Nomination form

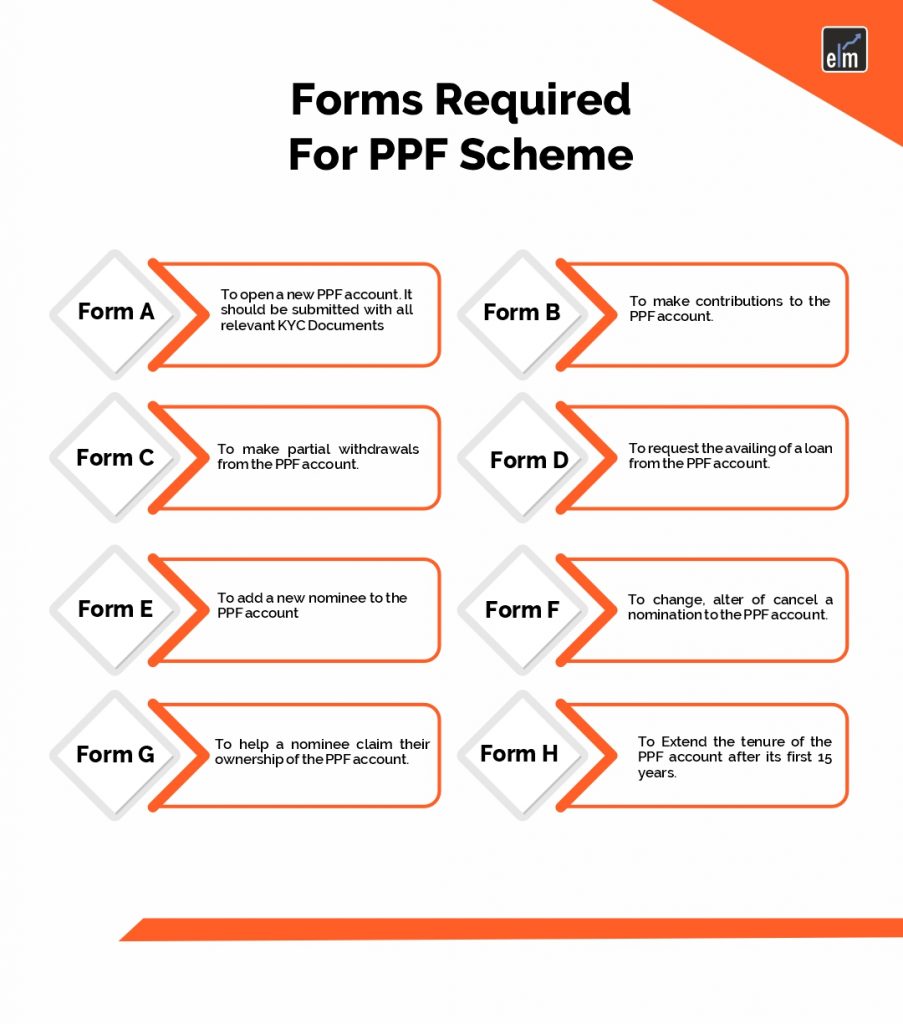

Forms for PPF Account

There are various forms from A to H pertaining to PPF account, which are issued for some specific purpose.

How to calculate PPF interest?

A PPF calculator is a free tool offered online and it’s a great tool for those investing in Public Provident Fund scheme.

It is often seen on the website of bank, post-office or third party service providers.

How to renew the PPF account?

The account holder has an option to extend the tenure beyond 15 years and it can be extended to a 5-year block with or without further investment.

- Without fresh investment: The account holder will continue to earn interest on the accrued sum after the maturity. Moreover, the individual is free to withdraw the sum freely once, every financial year.

- With fresh investment: The additional investment made will be added to the overall fund and the interest calculation will be made on the total funds. But the individual is restricted to withdraw a maximum of 60% of the funds held at the start of each 5-year period of extension.

How to withdraw PPF amount?

An individual cannot close the PPF account before maturity i.e. 15 years. You cannot withdraw the funds before maturity even though the account becomes inactive. The account can be closed and the entire sum can be withdrawn along with the interest accrued on completion of 15 years.

There is an option of partial withdrawal of funds from the 7th year but however, the amount to be withdrawn is lower of –

a.50% of the overall balance at the end of the fourth year, counting from the year of withdrawal or

b.50% of the total balance at the end of the year, before the year of withdrawal. However, withdrawals are to be made only once in a financial year.

Frequently Asked Questions (FAQs)

How to apply for this scheme through SBI?

You can apply for PPF by filling up Form A and then submit it to thebranch of any bank that offers this facility, with the documents mentioned above. You need to mention the name of the branch where you wish to open PPF account in Form A.

Can somebody maintain more than 1 PPF account under his/her name?

No, an individual can maintain only one PPF Account except in cases where the account is opened on behalf of a minor.

What are the minimum and maximum amounts that can be maintained under this scheme?

The minimum amount to be maintained is Rs. 500 per annum and the maximum amount is Rs. 1.50,000 per annum.

Is there is any penalty when someone fails to deposit any amount in one or more financial years?

Yes, there is. A penalty of Rs. 50 is levied per year.

For Market Updates, Visit StockEge

Dont you think that the PPF is not remaining to be a wise investment any more ? They plan to check the rate every quarter which would most probably yield in reduction of rates across long term(already 8.1%). Its becoming less and less attractive each passing day.

Nice article !!!

Hi,

Thank you for your feedback.

keep Reading!