Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

Key Takeaways

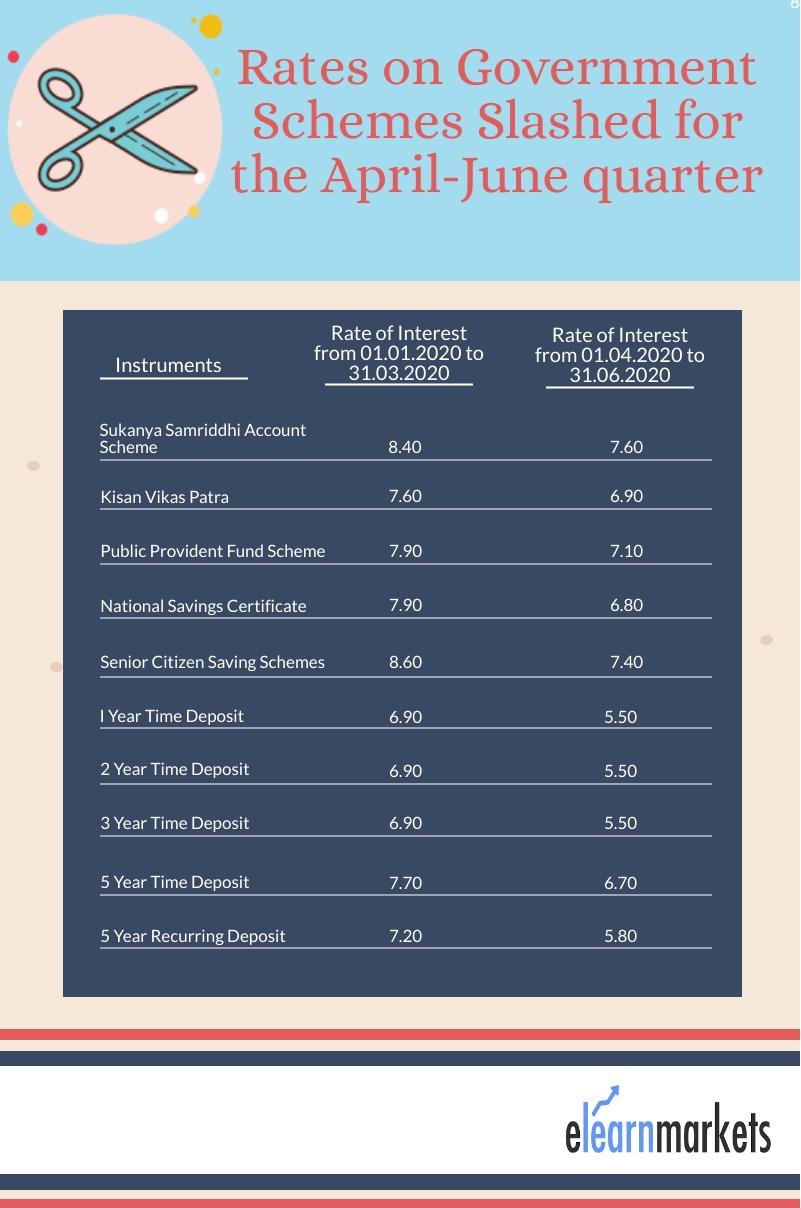

- Following the economic downturn due to COVID-19, the Government has announced a fall in the interest rates of various small savings schemes.

- The Public Provident Fund and the 5-year Recurring Deposits have been affected the most by this decision.

- These rate cuts have major implications for investors who have majorly chosen these schemes to invest their money in.

Following the RBI’s cuts in interest rates to counter the economic crisis, on 1 April, 2020, the government of India announced massive rate cuts on various small savings schemes.

This is the first revision in interest rates made for some of these schemes since 1 July, 2019.

These rates will be applicable for the first quarter of the financial year, from 1 April, 2020 to 30 June, 2020.

Some of the schemes which have been affected include the following –

- The Sukanya Samriddhi Yojana, which previously held an interest rate of 8.4%, has been slashed to 7.6% (compounded annually).

- The interest rate of the Kisan Vikas Patra has been reduced from 7.6% to 6.9% (compounded annually).

- The Public Provident Fund scheme, which previously held a rate of 7.9% (compounded annually), has been reduced to 7.1%. This is the lowest rate this scheme has offered in the last 43 years.

- The National Savings Certificate scheme now has a reduced interest rate of 6.8% (compounded annually), which was previously 7.9%.

- The Senior Citizen Savings Scheme with a previous interest rate of 8.6%, is now on 7.4% (compounded quarterly and paid).

- The interest rates on one, two, and three-year deposits have fallen from 6.9% to 5.5% (compounded quarterly).

- The interest rates on 5-year recurring deposits have seen the highest cut, from 7.2% to 5.8% (compounded quarterly).

Effect of rate cuts on the economy

The interest rates have been driven down at this point so that people are discouraged to deposit their money in these schemes.

When people will stop deposits in these schemes, the burden of the government to pay interest in these schemes will fall, thus leaving more assets for them to deal with the economic downturn.

A cut in the rates of small saving schemes can also encourage retail banks to decrease their deposit rates as they are dealing with the economic losses of the pandemic as well.

Effect of rate cuts on investors:

The people who have already made investments in these schemes can take this as an opportunity to shift to the stock market as a better investment avenue.

This is because the market will remain free from any government interference and will provide higher returns than these schemes at this point.

Investors who haven’t begun investing in the stock market yet, can start with creating an SIP or a Systematic Investment Plan, as it caters to long-term objectives.

Happy Learning!

BOTTOMLINE

Read further on The Economic Times.

Visit blog.elearnmarkets.com to read more blogs.

Check Stockedge to avail Technical and Fundamental scans of Financial Markets.