Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

The Securities and Exchange Board of India (SEBI)- Regulator of the financial markets in India that was established on 12th April 1988.

It was initially established as a non-statutory body, i.e. it had no control over anything but later in 1992, it was declared an autonomous body with statutory powers. he

This regulatory authority plays an important role in regulating the securities market of India. Thereby it is important to know the purpose and objective of the same.

Thus, In this blog, we will discuss why this regulatory body was formed and what are the roles, functions, and objectives of this regulatory authority:

Why was SEBI formed?

At the end of the 1970s and during the 1980s, capital markets were emerging as the new sensation among individuals in India. Many malpractices started taking place such as unofficial self-styled merchant bankers, unofficial private placements, rigging of prices, non-adherence of provisions of the Companies Act, violation of rules and regulations of stock exchanges, delay in delivery of shares, price rigging, etc.

Due to these malpractices, people started losing confidence in the stock market. The government felt a sudden need to set up an authority to regulate the working and reduce these malpractices. As a result, the Government came up with the establishment of SEBI.

Role of SEBI

This regulatory authority acts as a watchdog for all the capital market participants. Its main purpose is to provide such an environment for financial market enthusiasts that facilitate the efficient and smooth working of the securities market. SEBI also plays an important role in the economy.

To make this happen, it ensures that the three main participants of the financial market are taken care of, i.e. issuers of securities, investors, and financial intermediaries.

1. Issuers of securities

These are entities in the corporate field that raise funds from various sources in the market. This organization makes sure that they get a healthy and transparent environment for their needs.

2. Investor

Investors are the ones who keep the markets active. This regulatory authority is responsible for maintaining an environment that is free from malpractices to restore the confidence of the general public who invest their hard-earned money in the markets.

3. Financial Intermediaries

These are the people who act as middlemen between the issuers and investors. They make financial transactions smooth and safe.

Functions of SEBI

The main primary three functions are-

- Protective Function

- Regulatory Function

- Development Function

1. Protective Functions

As the name suggests, these functions are performed by SEBI to protect the interest of investors and other financial participants.

It includes-

- Checking price rigging

- Prevent insider trading

- Promote fair practices

- Create awareness among investors

- Prohibit fraudulent and unfair trade practices

2. Regulatory Functions

These functions are basically performed to keep a check on the functioning of the business in the financial markets.

These functions include-

- Designing guidelines and code of conduct for the proper functioning of financial intermediaries and corporate.

- Regulation of takeover of companies

- Conducting inquiries and audit of exchanges

- Registration of brokers, sub-brokers, merchant bankers etc.

- Levying of fees

- Performing and exercising powers

- Register and regulate credit rating agency

3. Development Functions

This regulatory authority performs certain development functions also that include but are not limited to

- Imparting training to intermediaries

- Promotion of fair trading and reduction of malpractices

- Carry out research work

- Encouraging self-regulating organizations

- Buy-sell mutual funds directly from AMC through a broker

What are the Objectives of SEBI?

The objectives of the Stock Exchange Board of India are:

1. Protection to the investors

The primary objective of SEBI is to protect the interest of people in the stock market and provide a healthy environment for them.

2. Prevention of malpractices

This was the reason why SEBI was formed. Among the main objectives, preventing malpractices is one of them.

3. Fair and proper functioning

SEBI is responsible for the orderly functioning of the capital markets and keeps a close check over the activities of the financial intermediaries such as brokers, sub-brokers, etc.

Organizational Structure:

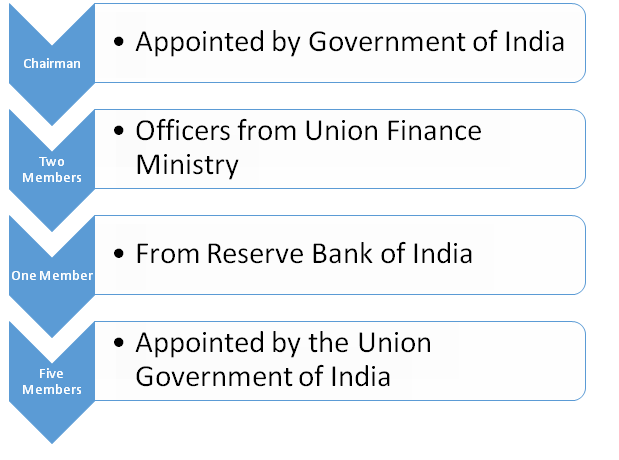

The SEBI Board consists of nine members-

- One Chairman appointed by the Government of India

- Two members are officers from the Union Finance Ministry

- One member from the Reserve Bank of India

- Five members appointed by the Union Government of India

SEBI has the power to regulate and approve any laws related to stock exchange functions.

It has the power to access the books of records and accounts for all the stock exchanges, and it can arrange for periodical checks and returns into the workings of the stock exchanges.

It can also conduct hearings and pass judgments if there are any malpractices detected on the stock exchanges.

When it comes to company treatment, it has the power to list and delist companies from any stock exchange in the country.

It has the power to completely regulate all aspects of insider trading and announce penalties and expulsions if a company is caught doing something unethical.

It can also make companies list their shares in more than one stock exchange if they see that it will be beneficial to investors.

The role of SEBI and stock exchanges in investor protection is to draft legal rules to ensure the protection of the general public.

The scope of SEBI also extends to regulating the registration of brokers and other middlemen who will deal with investors in the market.

Mutual Funds and SEBI:

Mutual funds are managed by Asset Management Companies (AMC), which have to be approved by SEBI. A Custodian registered with SEBI holds the securities of various schemes of the fund. The trustees of the AMC monitor the performance of the mutual fund and ensure that it works in compliance with SEBI Regulations.

Recently, a self-regulation agency for mutual funds has been set up called the Association of Mutual Funds of India (AMFI). AMFI focuses on developing the Indian mutual fund industry in a professional and ethical manner.

AMFI aims to enhance the operational standards in all areas with a view to protect and promote mutual funds and their stakeholders.

SEBI has also made a few policies and laid down guidelines for mutual funds in order to safeguard the interests of the investors.

These guidelines have been laid to bring uniformity in the working of the similar mutual funds’ scheme which will help the investors to make their investment decisions more clearly.

To bring uniformity in the functionality of the similar mutual fund scheme, SEBI has categorized mutual funds into the five broad categories:

They are:

Equity Schemes

Debt Schemes

Hybrid Schemes

Solution Oriented Schemes

Other Schemes

Other SEBI guidelines for Mutual Funds are as follows:

- SEBI has reclassified large, mid and small-cap companies as follows:

| Market Capitalization | Description |

| Large-cap company | 1st to 100th company in terms of full market capitalization. |

| Mid-cap company | 101st to 250th company in terms of full market capitalization. |

| Small-cap company | 251st company onwards in terms of full market capitalization |

- There is a lock-in period specified for solution-oriented schemes

- Permission of only one scheme in each category, except for Index Funds/ Exchange Traded Funds (ETF), Sectoral/Thematic Funds and Funds of Funds.

New SEBI Guidelines Effective from 1st September 2021

Stock Exchange Board of India has announced that from September 1, 2021, there will a tectonic shift in India’s stock market i.e. the new intra-day trading margin rules of the Securities and Exchange Board of India started with full force.

In 2020, Sebi introduced the new margin rules for day traders under which it was necessary for the stockbrokers to collect minimum margins on leverage-based trade upfront as against the earlier practice of collecting it at the end of the day.

| Phases | Effective from | % of Peak Margins |

|---|---|---|

| Phase 1 | December 2020 | 25% of Peak Margins |

| Phase 2 | March 2021 | 50% of Peak Margins |

| Phase 3 | June 2021 | 75% of Peak Margins |

| Phase 4 | September 2021 | 100% of Peak Margins |

The main objective of SEBI in this whole exercise of peak margin system was for reducing speculation in the market so that retail investors do not end up incurring losses in volatile markets. The protests made by bodies like ANMI are that the volumes will reduce in the intraday market, but we did not see that when the rules became effective.

From the trader’s perspective, they should be prepared for paying up margins upfront for any position in the market. For the brokers, this will surely reduce the risk of open positions as they would be covered by margins for peak risk.

Also, the shares bought today cannot be sold tomorrow and the funds from today cannot be used tomorrow.

Explore the world of SEBI and master it with our NSE Capital Market Course. Elevate your knowledge for success!

Frequently Asked Questions

What is the full form of SEBI?

The full form of SEBI is the Stock Exchange Board of India.

What does SEBI do?

SEBI protect the interests of investors in securities and promotes the development and regulate the securities market

What is SEBI and its function?

SEBI regulates the functioning of the stock market, mutual funds, etc. and also protects the interests of the investors.

What is the role of SEBI in the Indian financial system?

SEBI’s main role in the Indian financial system is to regulate that the Indian stock markets in an orderly manner. SEBI was formed to protect the interests of investors and traders in the Indian stock market.

What are the duties of SEBI?

The main duty of SEBI is to regulate the Indian Capital markets. It monitors and regulates the stock market and protects the interests of the investors by enforcing certain rules and regulations.

It’s not 12th April, 2018. It’s 1988.

Hi Waseem!

Thank you! We have made the changes!

Happy Reading!

useful informations

Hi Vijith,

Thank You!

Keep Reading!!

Hello dear this is great knowledge for me to prepare my examination

Thanks dear

Hi Neelam,

Thank you for Reading!

Keep Reading!

It helps me a lot. .. today is my exam and SEBI is one of my topic …ty for this

Hi Sakshi,

Thank you for your feedback.

Keep Reading!

Thank you so much.

Hi,

Thank you for Reading!

Keep Reading!

Dear Author,

Thank you for writing this article, it is very informative and useful. As per my experience there is a vital difference between educated and being financial educated. The article written by you will make people financial educated.

Regards,

Abhishek

U really doing great work and hats off to your team, really guys your team doing treamoundeous job.

NICE INFORMATION. AND THANK YOU SO MUCH.

Nice n crisp information. Thank you very much.

Hi,

We are glad that you liked our blog post.

Thank you for Reading!

Thank u so much for writing this article. It hlps me a lot, monday is my exam and SEBI is my one of the toppic once again thank u so much dear

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

u are doing good job.nice

Hi,

Thank you for Reading!

Keep Reading

keep posting. bookmarked this site. thanks so much

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Excellently explained

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Tq super record

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Tnqqq

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!