Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

- It’s really important to be aware of factors influencing the returns on any asset.

- Markets have a rule that higher is your age lesser should be your investment in equities as you need to invest more in risk-free assets like bonds, PPF, FD, Debt Funds, and Liquid Funds.

- But if your age is less than more should be your investments in risky assets like stocks, Equity mutual funds, Income funds, etc.

- Thus make your investment decision based on your age, and if you prefer to invest in stock markets, then follow the rule laid out by Warren Buffet: Invest when others are fearful and exit when others are greedy.

- In this manner, invest some in risky assets, some in debt and bonds, and some in fixed assets like gold and real estate to diversify your risk.

The answer to the above question should be clear- “No”- simply because having entire savings in a single asset class is too much risk.

It is risky because equity shares markets are subject to great swings.

While historically equity shares as an asset class has given higher returns compared to other asset classes, but we have also seen people lose huge sums in equity markets.

For, example stock markets crashed by around 50% during the financial crisis of 2008-09. If you had a goal maturing around that period and were invested in equity shares investments for that goal, you would have lost significant capital.

| Table of Contents |

|---|

| What is Diversification? |

| Thumb Rules for Asset Allocation |

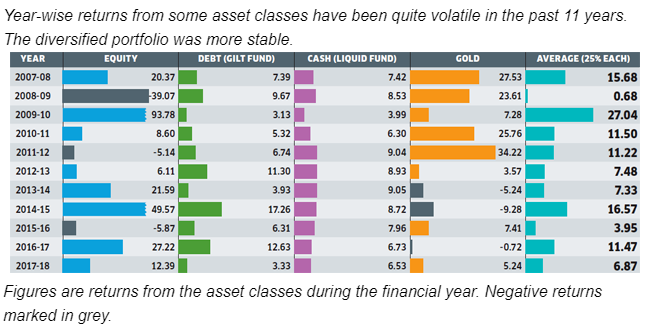

A diversified portfolio is a savior in adverse times

However, if you had a diversified portfolio of equity shares, debt, cash (liquid fund), and gold, the portfolio would have given an average return of 0.68%.

This is because of superior returns from gold and stable returns from debt and liquid funds.

The situations changed the next year, while equities rose 90%; other asset classes gave lower returns.

The diversified portfolio, however, gave 27% returns.

You can educate yourself about the markets and investment instruments you are investing in to make a better judgment about how to remain invested at any point in time.

What is Diversification ?

Diversification is spreading your investments in more than one asset class to minimize the risk of capital loss.

One can think of investing entirely in safe instruments like PPF, NSCs, FD, Government Bonds, etc. for diversification.

Diversifying will help us to strike a balance between risks we take and the returns we want from our portfolio.

Learn to become your own portfio manager in just 2 hours by Market Experts

Though there are thumb rules, the asset allocation should be based on individual needs

Thumb Rules for Asset Allocation

1. Investor’s Age:

Age is a significant factor in deciding asset allocation.

The ‘100 minus your age’ is a commonly used equity allocation thumb rule.

It means younger investors should have higher equity allocation (eg, investors aged 25 and 35 should have equity allocation of 75% and 65% respectively), while older people should have lower equity allocation.

Younger people have a long investment horizon and can ride out the volatility of the stock markets while aiming for higher returns by investing for a longer duration.

While older people need money for retirement; thus, a vast corpus cannot be invested into risky instruments as they want safe and steady returns to tide over their daily needs.

2. Risk Appetite:

Risk appetite is a willingness to bear risks.

It is necessary to know about risk and the types of investment.

Equity shares markets can go down rapidly in a short period of time but also can recover pretty well as we have seen.

Although debt funds give lower returns, it is necessary in our portfolio because of the stability it provides.

For creating an emergency corpus of 3-6 months’ expenses, one should remain invested in liquid funds and FD. Liquid investments will help us out during an emergency like a medical emergency or a loss of a job.

3. Duration:

How much time we have towards our goal is also significant.

You should know how much and where to save for various financial goals.

For e.g.- If any goal is under 3 years, it is advisable to stay out of equity investment unless you are reasonably certain about the stock markets because any fall can bring the value of your investment down.

But, if you have a longer duration say more than 10-15 years, it is more likely equity will give you higher returns.

4. Nature of investment instruments:

It is really important to understand the nature of the assets we are investing in.

Say for equity, even if we invested the day before the financial crisis of 2008-09 or dot-com bust or any major crisis—Our investment would first fall by 50%, and in the next ten years or so, it would still have tripled our money.

If we panic and opt out after the fall, we may lose out on such gains.

Again FD, Liquid investments, and gold would have given us money to tide over difficult times like 2008-2009.

In case you want to get practical hands on the stock market, you can download our StockEdge app.

Happy Learning!