Bonus and stock split are two well-known corporate actions undertaken by publicly listed companies to boost the number of shares traded. Investors usually get confused between these two terms.

Read this blog to understand the difference between these corporate actions and why companies take corporate action and how they impact shareholders.

| Table of Contents |

|---|

| What is Bonus Issue? |

| What is Stock Split? |

| Difference between Bonus issue & Stock Split |

| Bottomline |

What is Bonus Issue?

Bonus Issue also known as capitalization issue, offers additional shares to the existing shareholders without any cost. Companies with low cash balances may issue bonus shares rather than cash dividends as a method of providing regular income to their shareholders. There is just an extra financial impact as shares are funded via reserves.

Issuing bonus shares increases the number of shares which leads to a decrease in the stock price of the company in proportion to the bonus ratio, which makes the stock attractive for retail investors who hesitate to invest in companies that are fundamentally strong but are available at a higher rate.

Price per share, Earnings per share (EPS) or, book value per share (BVPS) falls as the number of shares goes up. A bonus issue is taken positively as a sign of good health of the company. When bonus shares are issued the price of the shares falls proportionately but the company value remains the same.

For example; In 2018 Infosys Ltd. declared a 1:1 bonus, pre bonus no. of outstanding shares were 2,184,127,091 with a face value of 5/share, post-bonus no. of shares were 4,368,254,182 with a face value of 5/share. Issuing a bonus is the same as making a narrow slice of a cake. The total size of the cake does not change by how many times you cut it.

Pros and Cons of a Bonus Issue:

Pros:

- Bonus issues result in a price reduction of the stock. But this can be beneficial as the market reach of the stock increases. If a stock is valued at Rs.1000, after a bonus issue, the price will come down making it easier for people with low capital to buy higher quantities of these shares.

- Bonus share issues are essentially the capitalization of profits. Such a step always enhances a company’s creditworthiness. Making the company more attractive to investors all around.

- As a shareholder, you get more shares, which in turn means more possible dividend payments in the future.

Cons:

- Speculation and overall market sentiment changes leading to more volatility in the prices of the stock.

- The Issuance of Bonus shares is a lengthy process and requires a lot of regulatory approvals from various authorities.

What is a Stock Split?

A stock split is the action taken in which a company divides its existing shares into multiple shares to boost the liquidity of shares. Split is usually taken when the stock price is high, making it pricey for investors to acquire. It brings down the share price since the number of shares increases but the value of the stocks remains the same. The only thing that gets divided is face value. The primary motive is to make share affordable to retail investors.

Learn from Market Experts – Basics of trading & Investing in Stock Market

For example; In 2018, Britannia Industries split their stocks in the ratio of 1:2, which means every 100 shares held by existing shareholders will have 200 shares. It split the share with the face value of Rs. 2/share to Re. 1/share. Pre-split shares were 25 crores shares of face value Rs.2, post-split it was 50 crores equity shares of face value Re.1 each.

Pros and Cons of a Stock Split:

Pros:

- The main advantage of a split is that it reduces the price of a share making it more affordable for investors.

- The number of shares traded increases, making the ownership base wider.

Cons:

- Increases speculation in the markets. This leads to higher volatility in the prices of the stock.

- Stock splits are an expensive and tedious process. The legalities behind it and regulatory approvals required are immense.

What is a Reverse Stock Split?

A reverse stock split is just the opposite of a stock split. In this case, the number of outstanding shares of the company reduces. This corporate action results in an increase in the price of the stock.

You may think that a share price increase is good for the company but the increase due to a reverse split is mainly an accounting trick.

Here the market capitalization of the company remains the same. Basically, the company simply cancels all outstanding shares and distributes new shares in direct proportion to what you owned earlier.

For instance, in a 1 is to 5 reverse split, you would now own 1 share for every 5 shares you owned. If you owned 1,500 shares, for example, then you would end up with 300 shares.

Companies usually do reverse stock splits to prevent the stock price from falling too much. It should not be looked at as a sign of strength, but in reality, it indicates weakness in the company’s financials.

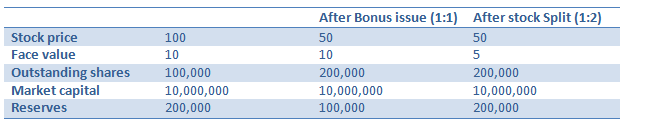

Difference between Bonus issue & Stock Split

A bonus issue is an additional share given to existing shareholders while a stock split is the same share divided into two or more as per the split ratio. Bonus shares are benefiting to existing shareholders while both existing shareholders and potential investors can benefit from the stock split.

In bonus and stock split, fundamentals of the company are not going to change, the issued share capital remains the same, the revenue remains the same, and the profit remains the same too, the only thing which will be affected is the face value and reserves capital.

Also Read : How do Corporate Actions affect the Share Market

If the company goes for a stock split from the face value of 10 to the face value of 5. The number of stocks will get double and the price will get adjusted, whereas in bonus face value remains the same but the price will get adjusted in proportion to the bonus ratio.

Frequently Asked Questions

What is the purpose of the stock split?

In order to boost the liquidity of shares, the company takes up the stock split action where existing shares of the company are divided into multiple shares.

How is stock splits good for investors?

Stock split leads to a decrease in the share prices, making it more affordable to investors for investing. So, as a result, it increases the liquidity in the stock.

Why would a company do a reverse stock split?

Companies usually do a reverse stock split in order to prevent the share price to go very low. As under reverse stock split number of outstanding shares decreases which lead to an increase in the price of stocks.

What is the use of issuing bonus shares?

The main use of issuing bonus shares is to capitalize the free reserves in the event of no new investment avenues for the company. It also increases the liquidity in the share as the number of shares increases

What kind of companies issue bonus shares?

Companies that have high reserves and no new avenue for investment issues bonus shares

Are bonus shares a good sign to an investor?

yes, the issue of a bonus share is a good sign for the investor as it reflects the good health of the company. As bonus shares lead to a decrease in the share price and an increase in the number of shares but value of the company remains the same.

Key Takeaways:

- Bonus issues and stock splits are corporate actions primarily undertaken to prevent share prices from rising too high.

- Reverse Stock splits are undertaken to prevent the share price of a company from falling too much.

- Though the number of outstanding shares increases and the price per share falls, the market capitalization (and the value of the company) does not change.

- Bonus issues and stock splits help make shares more affordable to small investors and provides greater marketability and liquidity in the market.

good info

Hi,

We are glad that you liked our post.

Thank you for Reading!